Accounting for embedded finance reconciliation involves matching transactions within integrated financial services platforms, ensuring accurate tracking of funds across various embedded payment solutions. Payment gateway reconciliation focuses on verifying and aligning transaction records processed through third-party gateways to prevent discrepancies and detect errors or fraud. Explore detailed methodologies and best practices to optimize reconciliation processes in financial operations.

Why it is important

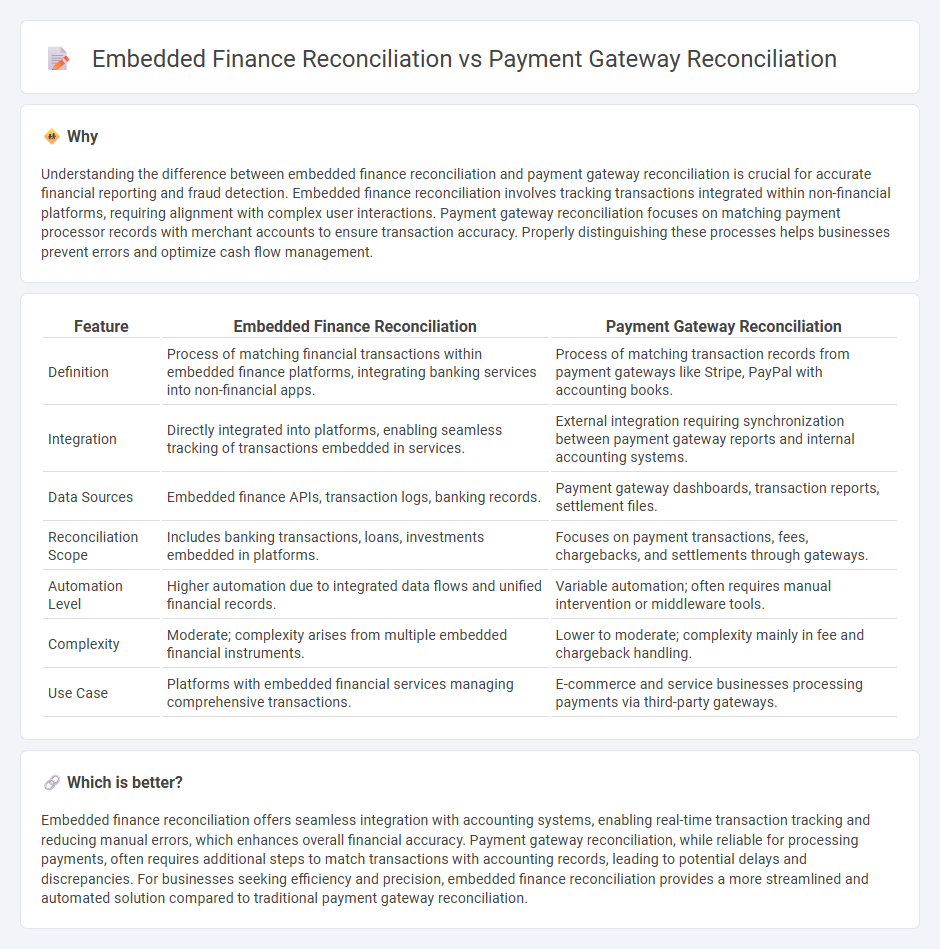

Understanding the difference between embedded finance reconciliation and payment gateway reconciliation is crucial for accurate financial reporting and fraud detection. Embedded finance reconciliation involves tracking transactions integrated within non-financial platforms, requiring alignment with complex user interactions. Payment gateway reconciliation focuses on matching payment processor records with merchant accounts to ensure transaction accuracy. Properly distinguishing these processes helps businesses prevent errors and optimize cash flow management.

Comparison Table

| Feature | Embedded Finance Reconciliation | Payment Gateway Reconciliation |

|---|---|---|

| Definition | Process of matching financial transactions within embedded finance platforms, integrating banking services into non-financial apps. | Process of matching transaction records from payment gateways like Stripe, PayPal with accounting books. |

| Integration | Directly integrated into platforms, enabling seamless tracking of transactions embedded in services. | External integration requiring synchronization between payment gateway reports and internal accounting systems. |

| Data Sources | Embedded finance APIs, transaction logs, banking records. | Payment gateway dashboards, transaction reports, settlement files. |

| Reconciliation Scope | Includes banking transactions, loans, investments embedded in platforms. | Focuses on payment transactions, fees, chargebacks, and settlements through gateways. |

| Automation Level | Higher automation due to integrated data flows and unified financial records. | Variable automation; often requires manual intervention or middleware tools. |

| Complexity | Moderate; complexity arises from multiple embedded financial instruments. | Lower to moderate; complexity mainly in fee and chargeback handling. |

| Use Case | Platforms with embedded financial services managing comprehensive transactions. | E-commerce and service businesses processing payments via third-party gateways. |

Which is better?

Embedded finance reconciliation offers seamless integration with accounting systems, enabling real-time transaction tracking and reducing manual errors, which enhances overall financial accuracy. Payment gateway reconciliation, while reliable for processing payments, often requires additional steps to match transactions with accounting records, leading to potential delays and discrepancies. For businesses seeking efficiency and precision, embedded finance reconciliation provides a more streamlined and automated solution compared to traditional payment gateway reconciliation.

Connection

Embedded finance reconciliation and payment gateway reconciliation are interconnected through the seamless integration of financial transactions within digital platforms, ensuring accurate matching of payments and invoices. Both processes rely on real-time data synchronization to identify discrepancies and confirm transaction legitimacy, enhancing financial transparency. Efficient reconciliation in embedded finance streamlines payment gateway operations, reducing errors and improving cash flow management for businesses.

Key Terms

**Payment Gateway Reconciliation:**

Payment gateway reconciliation involves matching transaction records between the payment processor and the merchant's account to ensure accuracy and identify discrepancies such as failed payments or chargebacks. It requires detailed tracking of authorization, capture, settlement, and refund data to maintain financial integrity and comply with regulatory standards. Discover more insights into optimizing payment gateway reconciliation processes for improved financial management.

Transaction Matching

Payment gateway reconciliation centers on matching transaction records between the gateway and merchant accounts to identify discrepancies in payments, fees, and chargebacks, ensuring accurate settlement reporting. Embedded finance reconciliation integrates transaction matching within platforms offering financial services, emphasizing seamless data synchronization between multiple embedded financial products and core banking systems. Discover detailed strategies and tools for optimizing transaction matching in both reconciliation processes.

Settlement Reports

Settlement reports in payment gateway reconciliation provide detailed transaction records, fees, and payout timings essential for accurate financial tracking. Embedded finance reconciliation involves more integrated data flows, combining settlement reports with extended financial services like lending or insurance, requiring comprehensive analysis across multiple channels. Explore how leveraging settlement reports enhances precision in both payment gateway and embedded finance reconciliations.

Source and External Links

Payment gateway reconciliation process for beginners - Payment gateway reconciliation is the process of cross-checking internal payment records with bank statements and ensuring that payments collected via one or more online payment gateways match final settlements in the merchant accounts, involving matching each gateway's transaction records carefully with associated accounts to resolve discrepancies.

Batch Gateway Reconciliation overview - Gateway reconciliation verifies that electronic payment and refund transactions processed in a system match those reported by the payment gateway's settlement report, covering processing, settlement, and post-settlement events such as chargebacks or reversals, to ensure all transactions align between systems.

Payment gateway reconciliation: what you need to know - Payment gateway reconciliation is a complex process that involves matching financial records from different parties after settlements, often complicated by transaction aggregation, fees, and delays; automated reconciliation software can handle these complexities in real-time and improve accuracy and financial analytics.

dowidth.com

dowidth.com