Environmental Social Governance (ESG) accounting focuses on quantifying and integrating environmental, social, and governance factors into financial decision-making frameworks, offering stakeholders measurable and comparable data. Corporate Social Responsibility (CSR) reporting presents qualitative narratives about a company's ethical practices and community engagement, often emphasizing voluntary initiatives and values-driven commitments. Explore the distinctions between ESG accounting and CSR reporting to understand their unique impacts on sustainable business strategies.

Why it is important

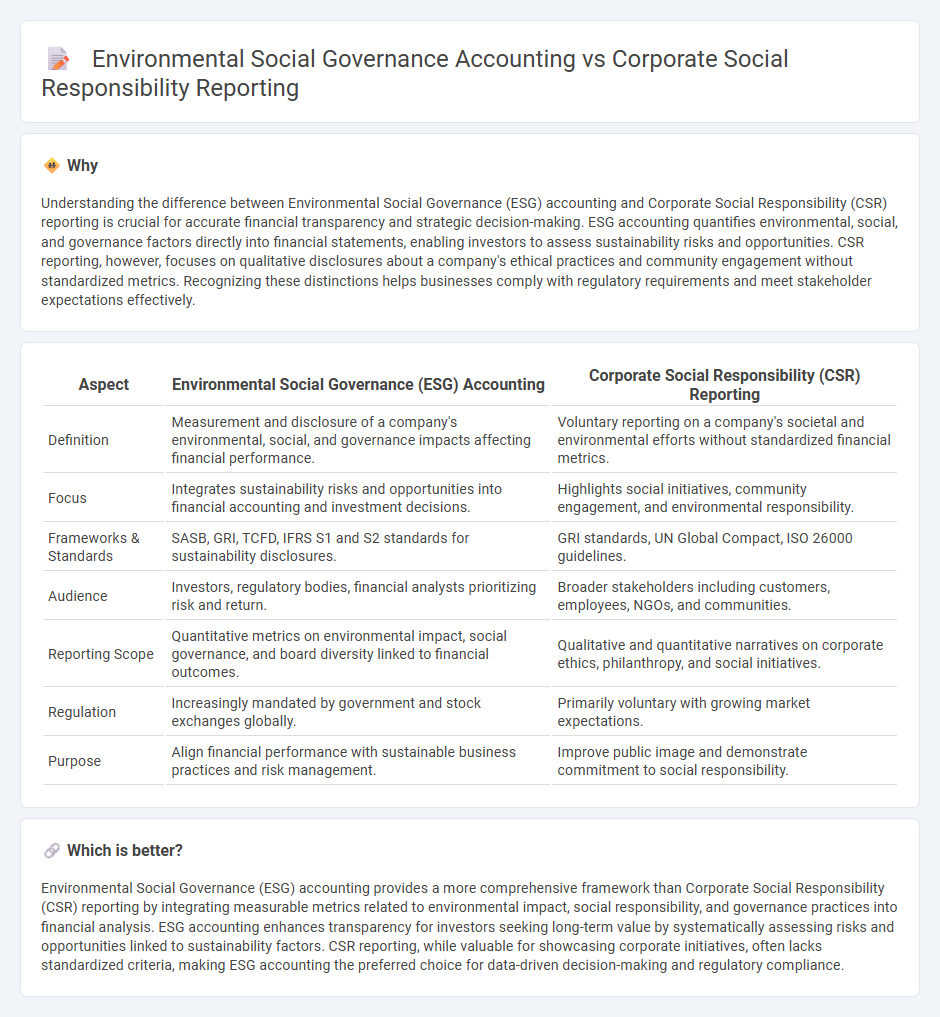

Understanding the difference between Environmental Social Governance (ESG) accounting and Corporate Social Responsibility (CSR) reporting is crucial for accurate financial transparency and strategic decision-making. ESG accounting quantifies environmental, social, and governance factors directly into financial statements, enabling investors to assess sustainability risks and opportunities. CSR reporting, however, focuses on qualitative disclosures about a company's ethical practices and community engagement without standardized metrics. Recognizing these distinctions helps businesses comply with regulatory requirements and meet stakeholder expectations effectively.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Corporate Social Responsibility (CSR) Reporting |

|---|---|---|

| Definition | Measurement and disclosure of a company's environmental, social, and governance impacts affecting financial performance. | Voluntary reporting on a company's societal and environmental efforts without standardized financial metrics. |

| Focus | Integrates sustainability risks and opportunities into financial accounting and investment decisions. | Highlights social initiatives, community engagement, and environmental responsibility. |

| Frameworks & Standards | SASB, GRI, TCFD, IFRS S1 and S2 standards for sustainability disclosures. | GRI standards, UN Global Compact, ISO 26000 guidelines. |

| Audience | Investors, regulatory bodies, financial analysts prioritizing risk and return. | Broader stakeholders including customers, employees, NGOs, and communities. |

| Reporting Scope | Quantitative metrics on environmental impact, social governance, and board diversity linked to financial outcomes. | Qualitative and quantitative narratives on corporate ethics, philanthropy, and social initiatives. |

| Regulation | Increasingly mandated by government and stock exchanges globally. | Primarily voluntary with growing market expectations. |

| Purpose | Align financial performance with sustainable business practices and risk management. | Improve public image and demonstrate commitment to social responsibility. |

Which is better?

Environmental Social Governance (ESG) accounting provides a more comprehensive framework than Corporate Social Responsibility (CSR) reporting by integrating measurable metrics related to environmental impact, social responsibility, and governance practices into financial analysis. ESG accounting enhances transparency for investors seeking long-term value by systematically assessing risks and opportunities linked to sustainability factors. CSR reporting, while valuable for showcasing corporate initiatives, often lacks standardized criteria, making ESG accounting the preferred choice for data-driven decision-making and regulatory compliance.

Connection

Environmental Social Governance (ESG) accounting and Corporate Social Responsibility (CSR) reporting are interconnected through their shared focus on evaluating and disclosing a company's ethical, environmental, and social impacts. ESG accounting integrates non-financial metrics such as carbon emissions, labor practices, and corporate governance into financial assessments, enhancing transparency for investors. CSR reporting complements this by providing detailed narratives and quantitative data on corporate initiatives that promote sustainability and social responsibility, thereby strengthening stakeholder trust and regulatory compliance.

Key Terms

Sustainability Reporting

Corporate social responsibility (CSR) reporting emphasizes a company's voluntary commitments to social and environmental initiatives, often highlighting community impact, ethical practices, and philanthropy. Environmental, Social, and Governance (ESG) accounting integrates sustainability metrics into financial analysis, focusing on measurable performance indicators that influence long-term corporate value and risk management. Discover how these frameworks shape sustainability reporting and drive corporate accountability.

Stakeholder Engagement

Corporate social responsibility (CSR) reporting emphasizes transparent communication with stakeholders about a company's ethical practices and community impact, fostering trust and accountability. Environmental, Social, and Governance (ESG) accounting integrates financial metrics related to sustainability and governance, providing investors with data-driven insights on risk management and long-term value creation. Explore how strategic stakeholder engagement drives both CSR and ESG frameworks for enhanced corporate performance.

Materiality Assessment

Corporate social responsibility (CSR) reporting emphasizes a company's ethical impact and community engagement, often highlighting qualitative outcomes, while Environmental Social Governance (ESG) accounting centers on quantifiable metrics tied to financial performance and risk management. Materiality assessment in CSR tends to prioritize stakeholder concerns and social impact, whereas ESG emphasizes data-driven identification of issues critical to long-term value creation and investor decision-making. Explore further to understand how integrating these approaches enhances comprehensive sustainability strategies.

Source and External Links

How do you structure a Corporate Responsibility Report? - Corporate social responsibility (CSR) reports are annual documents outlining a company's sustainability efforts, detailing ESG goals and progress, providing transparency, managing risks, boosting investor confidence, and ensuring regulatory compliance under frameworks like CSRD and TCFD.

Pursuing Accountability: CSR Reporting Strategies & ... - CSR reporting documents a company's environmental, social, ethical, or economic impacts; it is voluntary in the U.S. but increasingly important for demonstrating commitment and providing investors with material ESG risk information.

Corporate Responsibility Report: Everything You Need to ... - A strong CSR report builds trust and loyalty by transparently communicating measurable environmental and social responsibility efforts, differentiating it from impact reports that focus on specific initiatives.

dowidth.com

dowidth.com