ESG reporting focuses on environmental, social, and governance metrics to provide insights into a company's sustainability and ethical impact, while financial reporting centers on quantifying economic performance through standardized financial statements. Both reporting types use data to inform stakeholders, but ESG emphasizes non-financial risks and opportunities relevant to long-term value creation. Discover how integrating ESG and financial reporting can enhance comprehensive corporate transparency.

Why it is important

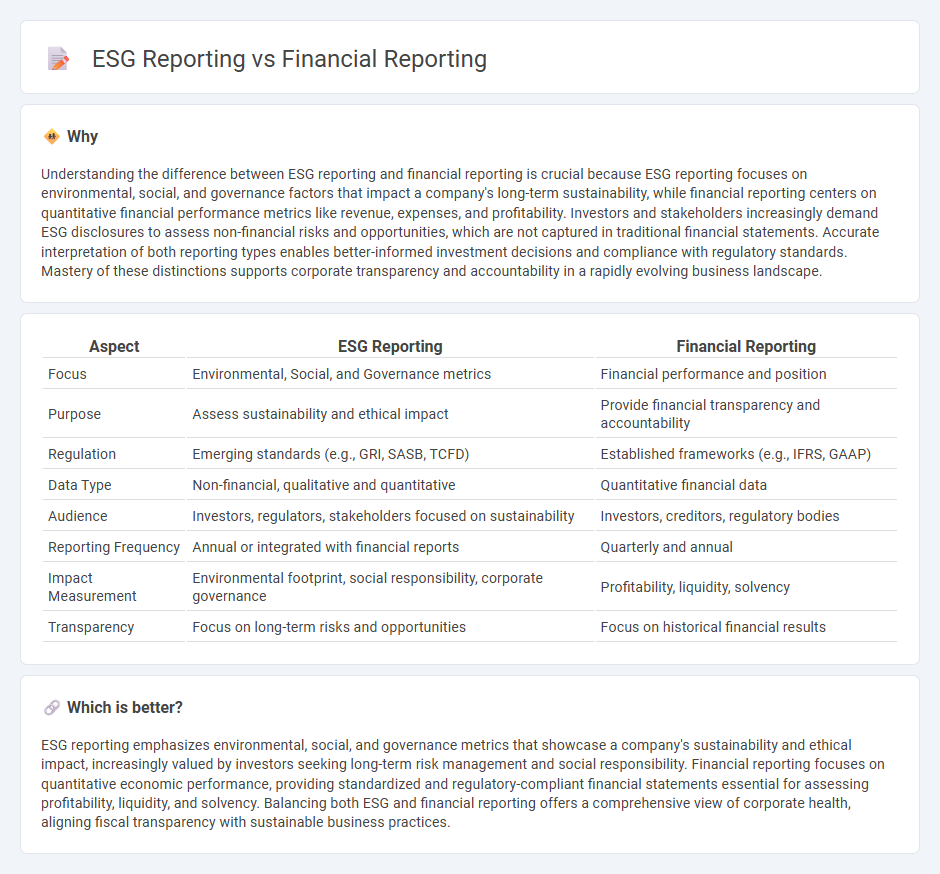

Understanding the difference between ESG reporting and financial reporting is crucial because ESG reporting focuses on environmental, social, and governance factors that impact a company's long-term sustainability, while financial reporting centers on quantitative financial performance metrics like revenue, expenses, and profitability. Investors and stakeholders increasingly demand ESG disclosures to assess non-financial risks and opportunities, which are not captured in traditional financial statements. Accurate interpretation of both reporting types enables better-informed investment decisions and compliance with regulatory standards. Mastery of these distinctions supports corporate transparency and accountability in a rapidly evolving business landscape.

Comparison Table

| Aspect | ESG Reporting | Financial Reporting |

|---|---|---|

| Focus | Environmental, Social, and Governance metrics | Financial performance and position |

| Purpose | Assess sustainability and ethical impact | Provide financial transparency and accountability |

| Regulation | Emerging standards (e.g., GRI, SASB, TCFD) | Established frameworks (e.g., IFRS, GAAP) |

| Data Type | Non-financial, qualitative and quantitative | Quantitative financial data |

| Audience | Investors, regulators, stakeholders focused on sustainability | Investors, creditors, regulatory bodies |

| Reporting Frequency | Annual or integrated with financial reports | Quarterly and annual |

| Impact Measurement | Environmental footprint, social responsibility, corporate governance | Profitability, liquidity, solvency |

| Transparency | Focus on long-term risks and opportunities | Focus on historical financial results |

Which is better?

ESG reporting emphasizes environmental, social, and governance metrics that showcase a company's sustainability and ethical impact, increasingly valued by investors seeking long-term risk management and social responsibility. Financial reporting focuses on quantitative economic performance, providing standardized and regulatory-compliant financial statements essential for assessing profitability, liquidity, and solvency. Balancing both ESG and financial reporting offers a comprehensive view of corporate health, aligning fiscal transparency with sustainable business practices.

Connection

ESG reporting and financial reporting are interconnected through their shared goal of providing stakeholders with a comprehensive view of a company's performance, combining environmental, social, and governance factors with traditional financial metrics. Integrating ESG data into financial reports enhances transparency, risk assessment, and long-term value creation for investors. Firms adopting integrated reporting frameworks align non-financial ESG disclosures with financial statements to support sustainable business practices and regulatory compliance.

Key Terms

**Financial Statements**

Financial statements provide a structured summary of a company's financial performance, including income statements, balance sheets, and cash flow statements, primarily guided by accounting standards like GAAP or IFRS. ESG reporting, by contrast, centers on environmental, social, and governance metrics that reveal a company's sustainability and ethical impact, often aligned with frameworks such as GRI or SASB. Explore in-depth comparisons to understand how financial and ESG disclosures complement each other in corporate transparency.

**Materiality**

Materiality in financial reporting emphasizes information that significantly impacts investors' economic decisions, prioritizing quantitative data such as revenues, expenses, and liabilities. ESG reporting materiality extends to environmental, social, and governance factors that affect long-term business sustainability and stakeholder interests, often incorporating qualitative metrics like carbon footprint, diversity, and ethical practices. Explore detailed differences and best practices to align your reporting strategy effectively.

**Sustainability Metrics**

Financial reporting centers on quantifiable economic data such as revenue, expenses, and profit margins, providing stakeholders with insights into an organization's fiscal health. ESG reporting emphasizes sustainability metrics including carbon footprint, water usage, and social impact indicators, reflecting a company's environmental and societal responsibilities. Explore how integrating sustainability metrics into reporting enhances transparency and drives long-term value creation.

Source and External Links

What Is Financial Reporting & Why Is It Important? - NetSuite - Financial reporting is the process of communicating financial information to internal and external stakeholders through core financial statements and other reports.

What Is Financial Reporting? Definition, Importance, and Types - Financial reporting summarizes a company's performance and includes main financial statements like the balance sheet and income statement.

What is Financial Reporting? - Planful - Financial reporting provides a detailed review of a company's financial data, enabling informed decisions about resource allocation and risk assessment.

dowidth.com

dowidth.com