Outcome-based budgeting focuses on allocating resources to achieve specific results by linking expenditures directly to measurable outcomes, enhancing accountability and strategic goal alignment. Performance-based budgeting allocates funds based on the efficiency and effectiveness of services delivered, using quantifiable performance metrics to guide funding decisions. Explore the key differences and applications of these budgeting approaches to optimize financial planning in your organization.

Why it is important

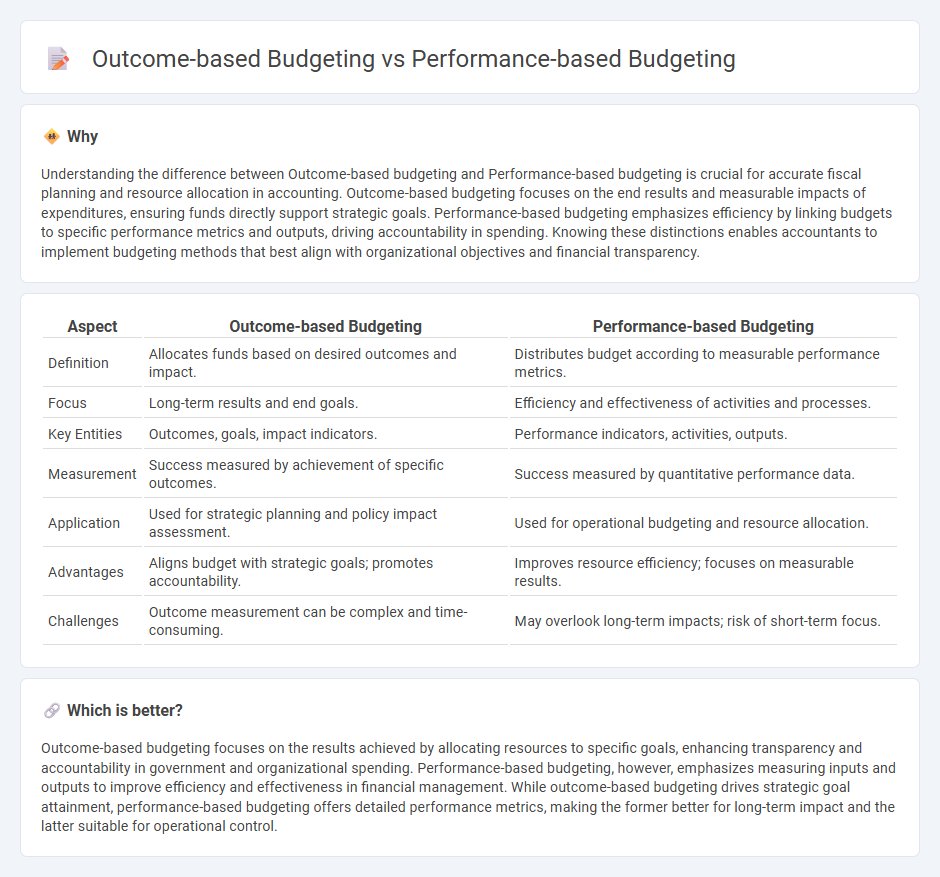

Understanding the difference between Outcome-based budgeting and Performance-based budgeting is crucial for accurate fiscal planning and resource allocation in accounting. Outcome-based budgeting focuses on the end results and measurable impacts of expenditures, ensuring funds directly support strategic goals. Performance-based budgeting emphasizes efficiency by linking budgets to specific performance metrics and outputs, driving accountability in spending. Knowing these distinctions enables accountants to implement budgeting methods that best align with organizational objectives and financial transparency.

Comparison Table

| Aspect | Outcome-based Budgeting | Performance-based Budgeting |

|---|---|---|

| Definition | Allocates funds based on desired outcomes and impact. | Distributes budget according to measurable performance metrics. |

| Focus | Long-term results and end goals. | Efficiency and effectiveness of activities and processes. |

| Key Entities | Outcomes, goals, impact indicators. | Performance indicators, activities, outputs. |

| Measurement | Success measured by achievement of specific outcomes. | Success measured by quantitative performance data. |

| Application | Used for strategic planning and policy impact assessment. | Used for operational budgeting and resource allocation. |

| Advantages | Aligns budget with strategic goals; promotes accountability. | Improves resource efficiency; focuses on measurable results. |

| Challenges | Outcome measurement can be complex and time-consuming. | May overlook long-term impacts; risk of short-term focus. |

Which is better?

Outcome-based budgeting focuses on the results achieved by allocating resources to specific goals, enhancing transparency and accountability in government and organizational spending. Performance-based budgeting, however, emphasizes measuring inputs and outputs to improve efficiency and effectiveness in financial management. While outcome-based budgeting drives strategic goal attainment, performance-based budgeting offers detailed performance metrics, making the former better for long-term impact and the latter suitable for operational control.

Connection

Outcome-based budgeting and performance-based budgeting are interconnected through their shared focus on linking financial resources to measurable results and organizational efficiency. Both approaches emphasize establishing clear goals, performance indicators, and continuous monitoring to ensure funds are allocated effectively based on achieved outcomes. This alignment enhances transparency, accountability, and strategic decision-making within public sector accounting frameworks.

Key Terms

Key Performance Indicators (KPIs)

Performance-based budgeting allocates resources based on specific Key Performance Indicators (KPIs) that measure efficiency and outputs within defined programs. Outcome-based budgeting prioritizes achieving long-term results and societal impacts, using KPIs to track progress toward strategic goals rather than mere activity levels. Explore how strategic KPI selection enhances budgeting effectiveness.

Accountability

Performance-based budgeting allocates resources based on specific performance metrics, emphasizing efficiency and cost-effectiveness in government spending. Outcome-based budgeting prioritizes measurable results and long-term impacts, focusing on achieving strategic goals and improving public accountability. Explore how these budgeting approaches enhance transparency and drive responsible fiscal management.

Source and External Links

Performance-Based Budgeting: Everything You Need to Know - This webpage provides an overview of performance-based budgeting, highlighting its focus on allocating resources based on achieving specific, measurable performance goals and outcomes.

Performance-based budgeting - This Wikipedia page explains performance-based budgeting as a method for developing budgets based on the relationship between funding and expected results, focusing on achieving specific objectives.

Performance-Based Budgeting and Reporting - This solution by Neubrain combines cost-based budgeting with performance goals, providing tools for real-time activity monitoring and strategic prioritization.

dowidth.com

dowidth.com