Blockchain bookkeeping offers decentralized, immutable transaction records enhancing transparency and security, while traditional ERP accounting systems provide centralized, integrated financial management with customizable reporting and automation. Blockchain's distributed ledger technology ensures tamper-proof data, making it ideal for audit trails and real-time verification, whereas ERP systems excel in consolidating business processes across departments for comprehensive financial oversight. Explore how these technologies can transform your accounting practices and improve financial accuracy.

Why it is important

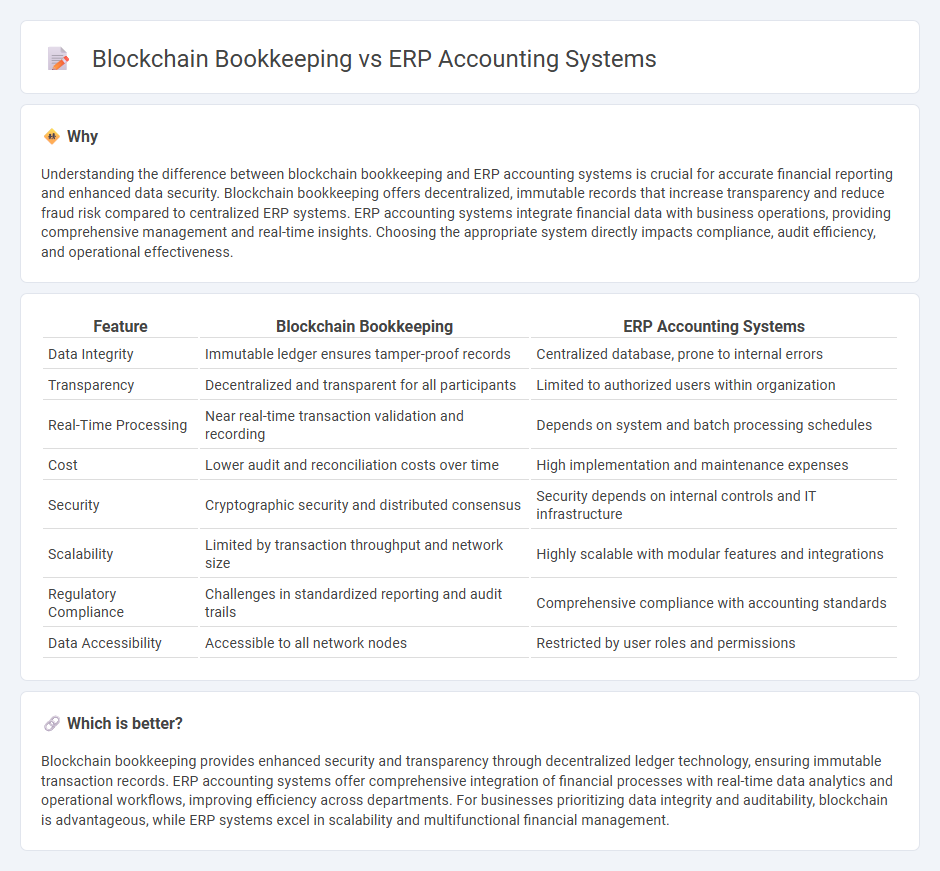

Understanding the difference between blockchain bookkeeping and ERP accounting systems is crucial for accurate financial reporting and enhanced data security. Blockchain bookkeeping offers decentralized, immutable records that increase transparency and reduce fraud risk compared to centralized ERP systems. ERP accounting systems integrate financial data with business operations, providing comprehensive management and real-time insights. Choosing the appropriate system directly impacts compliance, audit efficiency, and operational effectiveness.

Comparison Table

| Feature | Blockchain Bookkeeping | ERP Accounting Systems |

|---|---|---|

| Data Integrity | Immutable ledger ensures tamper-proof records | Centralized database, prone to internal errors |

| Transparency | Decentralized and transparent for all participants | Limited to authorized users within organization |

| Real-Time Processing | Near real-time transaction validation and recording | Depends on system and batch processing schedules |

| Cost | Lower audit and reconciliation costs over time | High implementation and maintenance expenses |

| Security | Cryptographic security and distributed consensus | Security depends on internal controls and IT infrastructure |

| Scalability | Limited by transaction throughput and network size | Highly scalable with modular features and integrations |

| Regulatory Compliance | Challenges in standardized reporting and audit trails | Comprehensive compliance with accounting standards |

| Data Accessibility | Accessible to all network nodes | Restricted by user roles and permissions |

Which is better?

Blockchain bookkeeping provides enhanced security and transparency through decentralized ledger technology, ensuring immutable transaction records. ERP accounting systems offer comprehensive integration of financial processes with real-time data analytics and operational workflows, improving efficiency across departments. For businesses prioritizing data integrity and auditability, blockchain is advantageous, while ERP systems excel in scalability and multifunctional financial management.

Connection

Blockchain bookkeeping enhances ERP accounting systems by providing immutable, transparent transaction records, improving data accuracy and reducing fraud risks. Integrating blockchain with ERP enables real-time synchronization of financial data across departments, streamlining audit processes and ensuring regulatory compliance. This convergence optimizes financial reporting, boosts operational efficiency, and supports more secure, traceable accounting workflows.

Key Terms

Centralization vs. Decentralization

ERP accounting systems centralize financial data within a single, integrated platform, offering streamlined reporting and real-time access for internal stakeholders. In contrast, blockchain bookkeeping decentralizes data across a distributed ledger, enhancing transparency, security, and immutability by eliminating reliance on a central authority. Explore the advantages and challenges of these approaches to determine the best fit for your financial management needs.

Real-time Data Processing

ERP accounting systems offer integrated financial management with real-time data processing across multiple departments, improving accuracy and operational efficiency. Blockchain bookkeeping decentralizes transaction records, providing immutable and transparent ledgers updated in real time, enhancing security and trust. Explore how these technologies transform financial workflows and decision-making in dynamic business environments.

Immutable Ledger

ERP accounting systems rely on centralized databases to manage financial transactions, whereas blockchain bookkeeping employs an immutable ledger that ensures data integrity through cryptographic security and decentralized consensus. Immutable ledgers in blockchain prevent tampering and enable transparent, verifiable records, offering enhanced fraud resistance compared to traditional ERP frameworks. Explore how integrating blockchain's immutable ledger can revolutionize accounting accuracy and transparency.

Source and External Links

ERP for Accounting and Financial Management - Oracle - This ERP system offers integrated capabilities for automating finance and accounting processes, enhancing operational efficiency, and providing real-time analytics for strategic planning and decision-making.

What Is an ERP System in Accounting? - Versapay - ERP systems help companies centralize data, streamline processes, and integrate accounting functions to improve financial management and customer relationships.

Top 10 ERP Systems for Finance and Accounting - This list highlights the top ERP systems effective in supporting finance and accounting functions, including general ledger management and treasury operations.

dowidth.com

dowidth.com