Payroll crypto taxation presents unique challenges due to fluctuating cryptocurrency values and complex regulatory frameworks, requiring meticulous record-keeping for accurate tax compliance. Payroll automation streamlines salary disbursements and tax calculations, significantly reducing errors and administrative efforts. Explore how integrating payroll automation can simplify crypto tax obligations and enhance overall accounting efficiency.

Why it is important

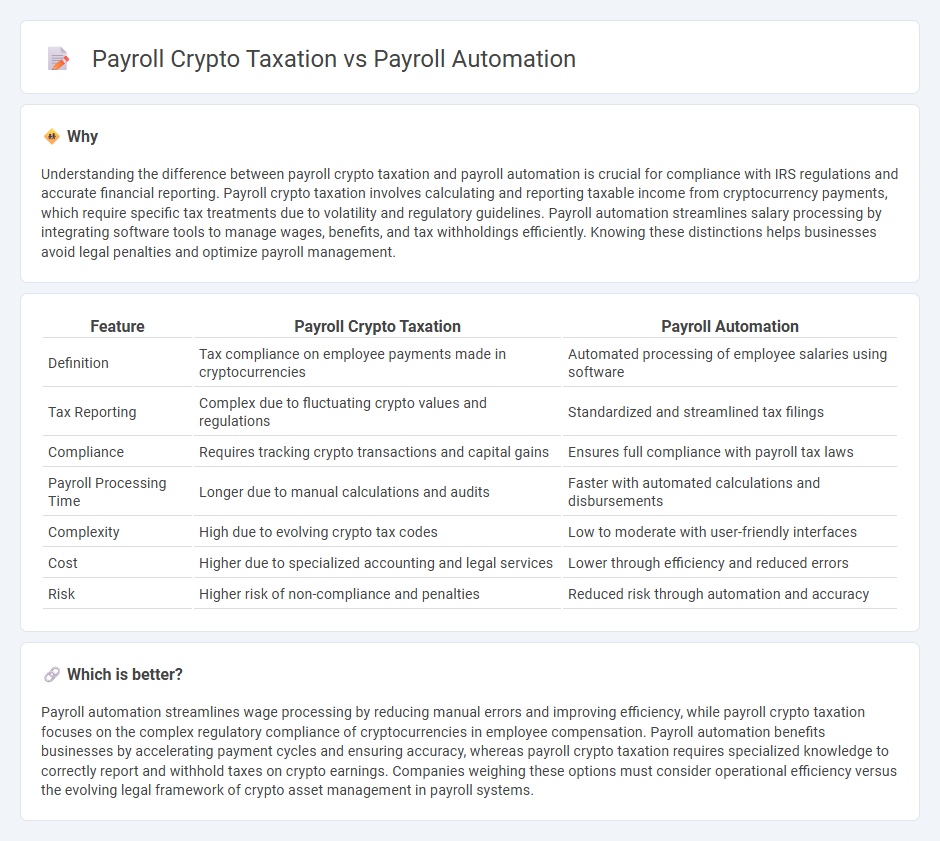

Understanding the difference between payroll crypto taxation and payroll automation is crucial for compliance with IRS regulations and accurate financial reporting. Payroll crypto taxation involves calculating and reporting taxable income from cryptocurrency payments, which require specific tax treatments due to volatility and regulatory guidelines. Payroll automation streamlines salary processing by integrating software tools to manage wages, benefits, and tax withholdings efficiently. Knowing these distinctions helps businesses avoid legal penalties and optimize payroll management.

Comparison Table

| Feature | Payroll Crypto Taxation | Payroll Automation |

|---|---|---|

| Definition | Tax compliance on employee payments made in cryptocurrencies | Automated processing of employee salaries using software |

| Tax Reporting | Complex due to fluctuating crypto values and regulations | Standardized and streamlined tax filings |

| Compliance | Requires tracking crypto transactions and capital gains | Ensures full compliance with payroll tax laws |

| Payroll Processing Time | Longer due to manual calculations and audits | Faster with automated calculations and disbursements |

| Complexity | High due to evolving crypto tax codes | Low to moderate with user-friendly interfaces |

| Cost | Higher due to specialized accounting and legal services | Lower through efficiency and reduced errors |

| Risk | Higher risk of non-compliance and penalties | Reduced risk through automation and accuracy |

Which is better?

Payroll automation streamlines wage processing by reducing manual errors and improving efficiency, while payroll crypto taxation focuses on the complex regulatory compliance of cryptocurrencies in employee compensation. Payroll automation benefits businesses by accelerating payment cycles and ensuring accuracy, whereas payroll crypto taxation requires specialized knowledge to correctly report and withhold taxes on crypto earnings. Companies weighing these options must consider operational efficiency versus the evolving legal framework of crypto asset management in payroll systems.

Connection

Payroll crypto taxation requires precise tracking of cryptocurrency payments to employees, which payroll automation systems can streamline by integrating real-time tax calculations and compliance updates. Automated payroll platforms reduce errors and ensure timely reporting of crypto earnings, adhering to evolving tax regulations. Efficient payroll automation supports accurate tax withholding and reporting, simplifying the complex process of cryptocurrency payroll management.

Key Terms

**Payroll Automation:**

Payroll automation streamlines salary processing by reducing manual errors, enhancing accuracy, and ensuring timely payments through integrated software solutions. It supports compliance with tax regulations by automatically calculating deductions, benefits, and statutory contributions, which minimizes risks associated with human oversight. Explore how payroll automation can transform your business efficiency and compliance strategies.

Direct Deposit

Payroll automation streamlines salary disbursements by integrating direct deposit systems, ensuring timely and accurate payments to employees' bank accounts. In contrast, payroll crypto taxation involves the complexities of tracking and reporting cryptocurrency salary payments, where direct deposit equivalents may require blockchain-based wallets or exchanges. Explore how these processes impact compliance and efficiency in modern payroll systems.

Time Tracking Integration

Payroll automation streamlines wage calculations by integrating advanced time tracking systems that ensure precise employee hours and reduce manual errors. Payroll crypto taxation introduces complexities in time tracking compliance due to the need for accurate conversion rates and transaction timestamps within blockchain systems. Explore detailed insights on optimizing time tracking integration for seamless payroll automation and crypto tax compliance.

Source and External Links

Payroll Automation | How to Automate Your Process - ADP - Automating payroll helps reduce errors, save time and money, and involves steps such as analyzing processes, gathering data, informing third parties, getting stakeholder buy-in, and preparing infrastructure for a smooth transition.

What Is Payroll Automation? How to Automate & Benefits - NetSuite - Payroll automation uses software to speed payroll processing by reducing staff involvement, requiring assessment of payroll needs and selection of software with appropriate features and integration capabilities.

Payroll automation: Benefits, tools, and implementation | HiBob - Automating payroll involves auditing current processes, identifying pain points, choosing a payroll provider based on expertise, growth, complexity, tech integration, ease of use, and cost to streamline tasks like compensation calculation and compliance.

dowidth.com

dowidth.com