Blockchain bookkeeping offers enhanced transparency and immutability by recording transactions on a decentralized ledger, reducing the risk of fraud. Outsourced bookkeeping provides cost-effective access to professional accounting services, ensuring accurate financial records without the need to maintain in-house staff. Discover how each approach can transform your accounting processes and improve financial management.

Why it is important

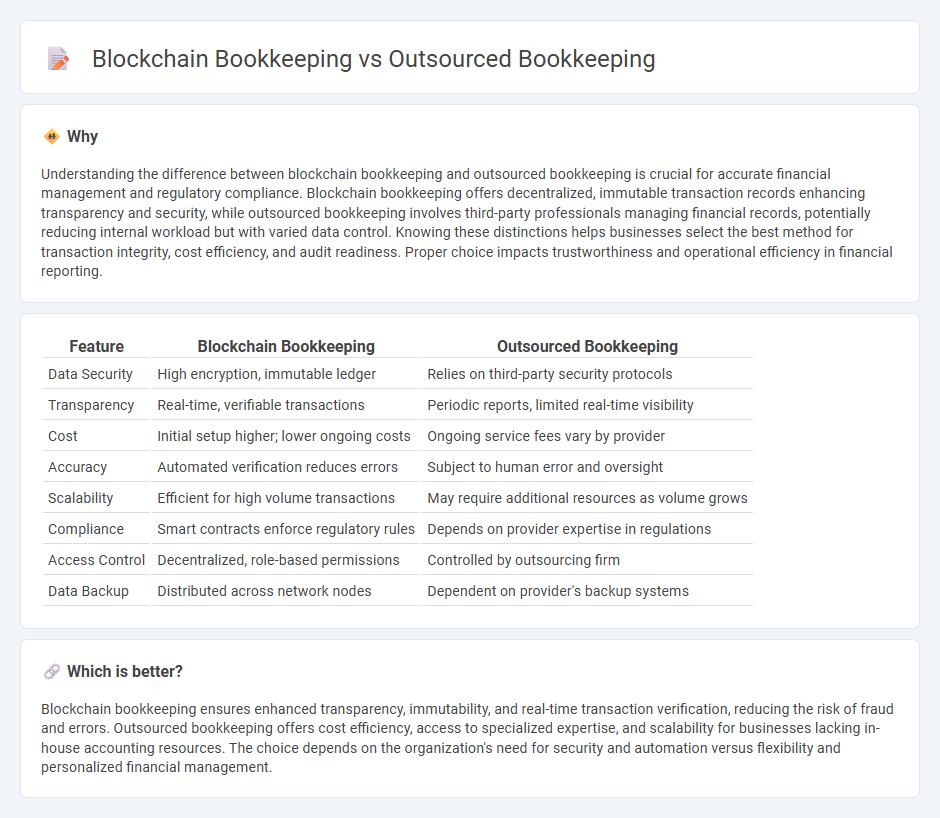

Understanding the difference between blockchain bookkeeping and outsourced bookkeeping is crucial for accurate financial management and regulatory compliance. Blockchain bookkeeping offers decentralized, immutable transaction records enhancing transparency and security, while outsourced bookkeeping involves third-party professionals managing financial records, potentially reducing internal workload but with varied data control. Knowing these distinctions helps businesses select the best method for transaction integrity, cost efficiency, and audit readiness. Proper choice impacts trustworthiness and operational efficiency in financial reporting.

Comparison Table

| Feature | Blockchain Bookkeeping | Outsourced Bookkeeping |

|---|---|---|

| Data Security | High encryption, immutable ledger | Relies on third-party security protocols |

| Transparency | Real-time, verifiable transactions | Periodic reports, limited real-time visibility |

| Cost | Initial setup higher; lower ongoing costs | Ongoing service fees vary by provider |

| Accuracy | Automated verification reduces errors | Subject to human error and oversight |

| Scalability | Efficient for high volume transactions | May require additional resources as volume grows |

| Compliance | Smart contracts enforce regulatory rules | Depends on provider expertise in regulations |

| Access Control | Decentralized, role-based permissions | Controlled by outsourcing firm |

| Data Backup | Distributed across network nodes | Dependent on provider's backup systems |

Which is better?

Blockchain bookkeeping ensures enhanced transparency, immutability, and real-time transaction verification, reducing the risk of fraud and errors. Outsourced bookkeeping offers cost efficiency, access to specialized expertise, and scalability for businesses lacking in-house accounting resources. The choice depends on the organization's need for security and automation versus flexibility and personalized financial management.

Connection

Blockchain bookkeeping enhances outsourced bookkeeping by providing an immutable, transparent ledger that increases accuracy and accountability in financial records. Outsourced bookkeeping firms leverage blockchain technology to streamline transaction verification, reduce errors, and improve audit trails. This integration fosters trust between clients and providers while optimizing the efficiency of financial data management.

Key Terms

Third-party service provider

Outsourced bookkeeping relies on specialized third-party service providers to manage financial records, offering cost efficiency and access to expert knowledge without the need for in-house staff. Blockchain bookkeeping utilizes decentralized, tamper-proof ledgers that enhance transparency and security, reducing reliance on third-party intermediaries. Explore how these approaches differ in control, cost, and innovation to optimize your financial management strategies.

Decentralized ledger

Outsourced bookkeeping relies on third-party accountants to record and manage financial transactions, while blockchain bookkeeping uses a decentralized ledger that enhances transparency and security by storing data across multiple nodes. The decentralized ledger in blockchain bookkeeping reduces the risk of fraud and errors by enabling real-time verification and immutability of records. Discover how decentralized ledger technology revolutionizes financial record-keeping and its impact on accuracy and trust.

Real-time transparency

Outsourced bookkeeping often suffers from delays and limited visibility, whereas blockchain bookkeeping ensures real-time transparency through immutable, decentralized ledgers accessible to all authorized parties. This decentralized technology eliminates discrepancies and enhances trust by providing instantaneous updates and audit trails. Discover how blockchain bookkeeping can revolutionize financial transparency for your business.

Source and External Links

Outsourced Bookkeeping: Key Benefits and How They Work - Solvo - Outsourced bookkeeping involves hiring an independent bookkeeper or a service team to handle financial tasks like transaction recording, bank reconciliations, payroll, and tax prep remotely, offering cost savings, expert knowledge, and scalable solutions with regular financial reporting and secure data access.

A Comprehensive Overview of Outsourced Bookkeeping Services - Outsourced bookkeeping means delegating part or all of your business's financial recordkeeping to a third-party provider, which can save money and time while improving financial expertise, efficiency, and compliance.

Monthly Outsourced Bookkeeping & Accounting Services - Outsourced bookkeeping services often include a dedicated team of certified experts who manage your books using tools like QuickBooks, provide detailed financial insights, and support accounting functions such as sales tax and accounts receivable/payable to ensure accurate, audit-ready financial data.

dowidth.com

dowidth.com