Cryptotax regulations focus on the tax implications of cryptocurrency transactions, emphasizing accurate reporting of gains and losses for compliance with IRS guidelines. GAAP accounting standards prioritize consistent financial reporting and revenue recognition, ensuring transparency and comparability of financial statements. Explore more to understand the distinct approaches and requirements in cryptotax versus GAAP accounting.

Why it is important

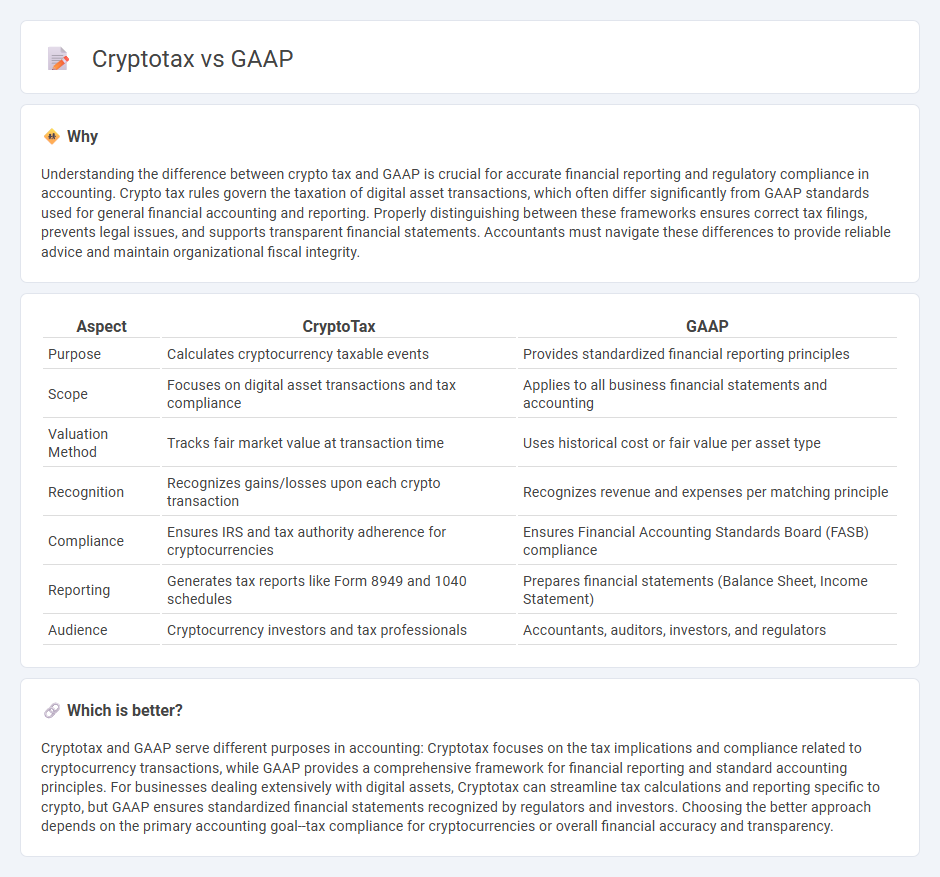

Understanding the difference between crypto tax and GAAP is crucial for accurate financial reporting and regulatory compliance in accounting. Crypto tax rules govern the taxation of digital asset transactions, which often differ significantly from GAAP standards used for general financial accounting and reporting. Properly distinguishing between these frameworks ensures correct tax filings, prevents legal issues, and supports transparent financial statements. Accountants must navigate these differences to provide reliable advice and maintain organizational fiscal integrity.

Comparison Table

| Aspect | CryptoTax | GAAP |

|---|---|---|

| Purpose | Calculates cryptocurrency taxable events | Provides standardized financial reporting principles |

| Scope | Focuses on digital asset transactions and tax compliance | Applies to all business financial statements and accounting |

| Valuation Method | Tracks fair market value at transaction time | Uses historical cost or fair value per asset type |

| Recognition | Recognizes gains/losses upon each crypto transaction | Recognizes revenue and expenses per matching principle |

| Compliance | Ensures IRS and tax authority adherence for cryptocurrencies | Ensures Financial Accounting Standards Board (FASB) compliance |

| Reporting | Generates tax reports like Form 8949 and 1040 schedules | Prepares financial statements (Balance Sheet, Income Statement) |

| Audience | Cryptocurrency investors and tax professionals | Accountants, auditors, investors, and regulators |

Which is better?

Cryptotax and GAAP serve different purposes in accounting: Cryptotax focuses on the tax implications and compliance related to cryptocurrency transactions, while GAAP provides a comprehensive framework for financial reporting and standard accounting principles. For businesses dealing extensively with digital assets, Cryptotax can streamline tax calculations and reporting specific to crypto, but GAAP ensures standardized financial statements recognized by regulators and investors. Choosing the better approach depends on the primary accounting goal--tax compliance for cryptocurrencies or overall financial accuracy and transparency.

Connection

Crypto tax reporting must align with Generally Accepted Accounting Principles (GAAP) to ensure accurate financial statements and regulatory compliance. GAAP provides standardized guidelines for recognizing, measuring, and disclosing cryptocurrency transactions, including valuation and taxable events. Proper integration of crypto tax rules within GAAP frameworks helps businesses maintain transparent records and meet IRS auditing requirements.

Key Terms

Revenue Recognition

GAAP revenue recognition follows the five-step model emphasizing identification of contracts, performance obligations, transaction price, allocation, and satisfaction of obligations to record revenue accurately. Crypto tax revenue recognition often varies by jurisdiction but generally requires recognition of income upon receipt or disposal of cryptocurrency assets, with specific rules for mining, staking, and trading activities. Explore detailed guidelines and compliance strategies to optimize your crypto tax reporting under GAAP principles.

Fair Value Measurement

GAAP mandates Fair Value Measurement following ASC 820, emphasizing market-based inputs for asset valuation, crucial in accurate financial reporting. Crypto taxes often require fair value determination at transaction dates, using spot prices to comply with IRS guidelines, ensuring precise capital gains calculations. Explore detailed comparisons to master fair value intricacies in both GAAP and cryptocurrency tax contexts.

Taxable Event

A taxable event under GAAP occurs when a transaction results in realized gains or losses impacting financial statements, while cryptotax treats events like sales, exchanges, or conversions of cryptocurrency as taxable occurrences. Cryptocurrency tax regulations require meticulous tracking of each transaction to determine tax liabilities, often differing significantly from traditional GAAP accounting rules. Explore more about how these frameworks affect your crypto tax reporting and compliance.

Source and External Links

GAAP: Generally Accepted Accounting Principles | CFI - GAAP is a set of rules and procedures governing corporate accounting and financial reporting in the United States, developed by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB).

GAAP | Wex | US Law | LII / Legal Information Institute - GAAP refers to the standard accounting rules in the United States for preparing, presenting, and reporting financial statements, especially for publicly traded companies.

Generally Accepted Accounting Principles (United States) - GAAP is the accounting standard adopted by the US Securities and Exchange Commission (SEC), which includes basic assumptions, principles, and constraints to ensure consistent financial reporting.

dowidth.com

dowidth.com