Zero knowledge proofs enhance accounting security by enabling one party to prove the accuracy of financial data without revealing sensitive information. Traditional double-entry bookkeeping ensures accuracy through paired debit and credit entries across accounts, maintaining a transparent audit trail. Explore how integrating zero knowledge proofs with double-entry bookkeeping can revolutionize financial privacy and verification.

Why it is important

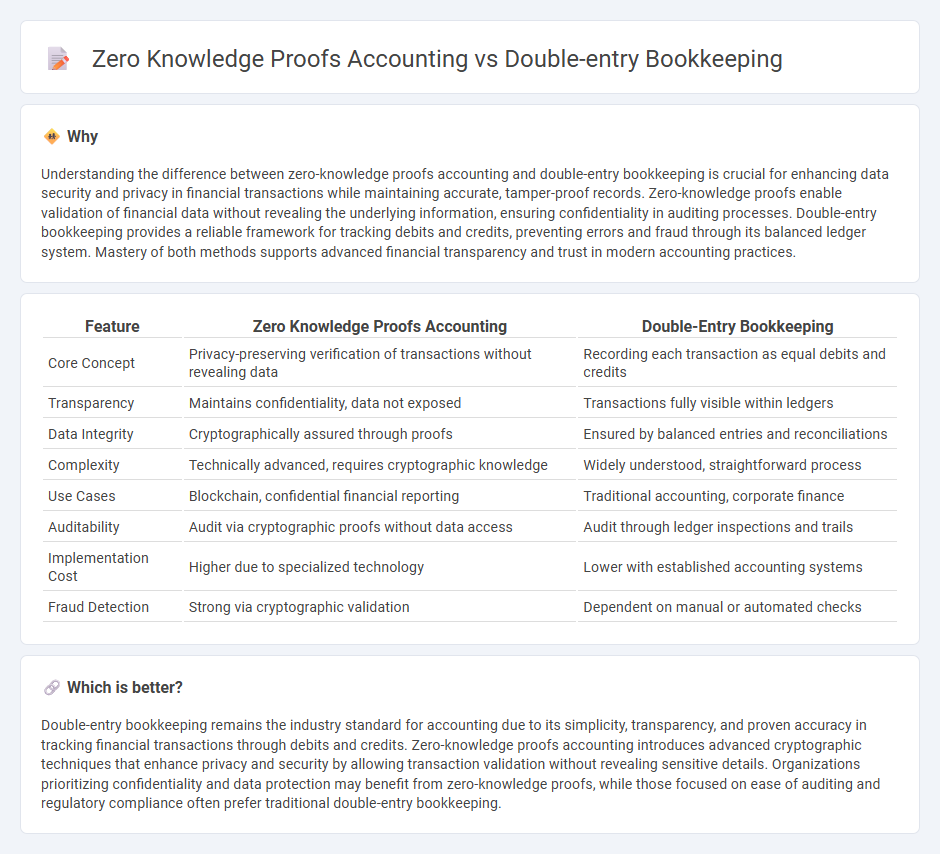

Understanding the difference between zero-knowledge proofs accounting and double-entry bookkeeping is crucial for enhancing data security and privacy in financial transactions while maintaining accurate, tamper-proof records. Zero-knowledge proofs enable validation of financial data without revealing the underlying information, ensuring confidentiality in auditing processes. Double-entry bookkeeping provides a reliable framework for tracking debits and credits, preventing errors and fraud through its balanced ledger system. Mastery of both methods supports advanced financial transparency and trust in modern accounting practices.

Comparison Table

| Feature | Zero Knowledge Proofs Accounting | Double-Entry Bookkeeping |

|---|---|---|

| Core Concept | Privacy-preserving verification of transactions without revealing data | Recording each transaction as equal debits and credits |

| Transparency | Maintains confidentiality, data not exposed | Transactions fully visible within ledgers |

| Data Integrity | Cryptographically assured through proofs | Ensured by balanced entries and reconciliations |

| Complexity | Technically advanced, requires cryptographic knowledge | Widely understood, straightforward process |

| Use Cases | Blockchain, confidential financial reporting | Traditional accounting, corporate finance |

| Auditability | Audit via cryptographic proofs without data access | Audit through ledger inspections and trails |

| Implementation Cost | Higher due to specialized technology | Lower with established accounting systems |

| Fraud Detection | Strong via cryptographic validation | Dependent on manual or automated checks |

Which is better?

Double-entry bookkeeping remains the industry standard for accounting due to its simplicity, transparency, and proven accuracy in tracking financial transactions through debits and credits. Zero-knowledge proofs accounting introduces advanced cryptographic techniques that enhance privacy and security by allowing transaction validation without revealing sensitive details. Organizations prioritizing confidentiality and data protection may benefit from zero-knowledge proofs, while those focused on ease of auditing and regulatory compliance often prefer traditional double-entry bookkeeping.

Connection

Zero knowledge proofs enhance accounting by enabling secure verification of financial transactions without revealing sensitive details, complementing the integrity of double-entry bookkeeping systems. Double-entry bookkeeping records each transaction as both a debit and a credit, ensuring accuracy and traceability, while zero knowledge proofs provide cryptographic assurance of transaction validity. Integrating zero knowledge proofs with double-entry bookkeeping strengthens auditability and privacy in financial reporting.

Key Terms

Debit and Credit Balancing

Double-entry bookkeeping ensures financial accuracy by maintaining equal debit and credit balances in accounting ledgers, providing a transparent trail for auditing and error detection. Zero-knowledge proofs (ZKPs) offer an advanced cryptographic method to validate accounting data integrity without revealing sensitive financial details, enhancing privacy and security. Explore how integrating double-entry bookkeeping with zero-knowledge proofs can revolutionize secure and transparent financial reporting.

Ledger Integrity

Double-entry bookkeeping maintains ledger integrity by recording every transaction with equal debit and credit entries, ensuring accuracy and preventing errors or fraud. Zero-knowledge proofs (ZKPs) enhance ledger integrity by allowing verification of transactions without revealing sensitive data, thereby increasing privacy and security within the accounting system. Explore how these methods redefine ledger integrity and transform modern accounting practices.

Privacy-preserving Verification

Double-entry bookkeeping is a traditional accounting method ensuring accuracy through reciprocal ledger entries, but it often exposes sensitive financial data. Zero knowledge proofs accounting enables privacy-preserving verification by allowing one party to prove the validity of transactions without revealing underlying details, enhancing confidentiality in audits and compliance. Discover how zero knowledge proofs transform secure financial verification and protect business privacy.

Source and External Links

What is Double-Entry Bookkeeping? - Double-entry bookkeeping is a method where every transaction is entered twice, using debits and credits in at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced with each transaction.

Double-Entry Accounting: What It Is and Why It Matters - It is a bookkeeping system that records every transaction as both a debit and a credit to different accounts, offering a fuller financial picture by tracking assets, liabilities, equity, revenue, and expenses.

What Is Double-Entry Bookkeeping? A Simple Guide for ... - The system requires that total debits equal total credits for every transaction and maintains the balance of the accounting equation, using five main account types: assets, liabilities, equity, income, and expenses.

dowidth.com

dowidth.com