ESG reporting focuses on environmental, social, and governance metrics to assess a company's sustainability and ethical impact, often driven by investor and regulatory demands. Integrated reporting combines financial data with ESG factors to provide a holistic view of an organization's value creation over time. Discover how ESG and integrated reporting shape transparent accounting practices and corporate strategy.

Why it is important

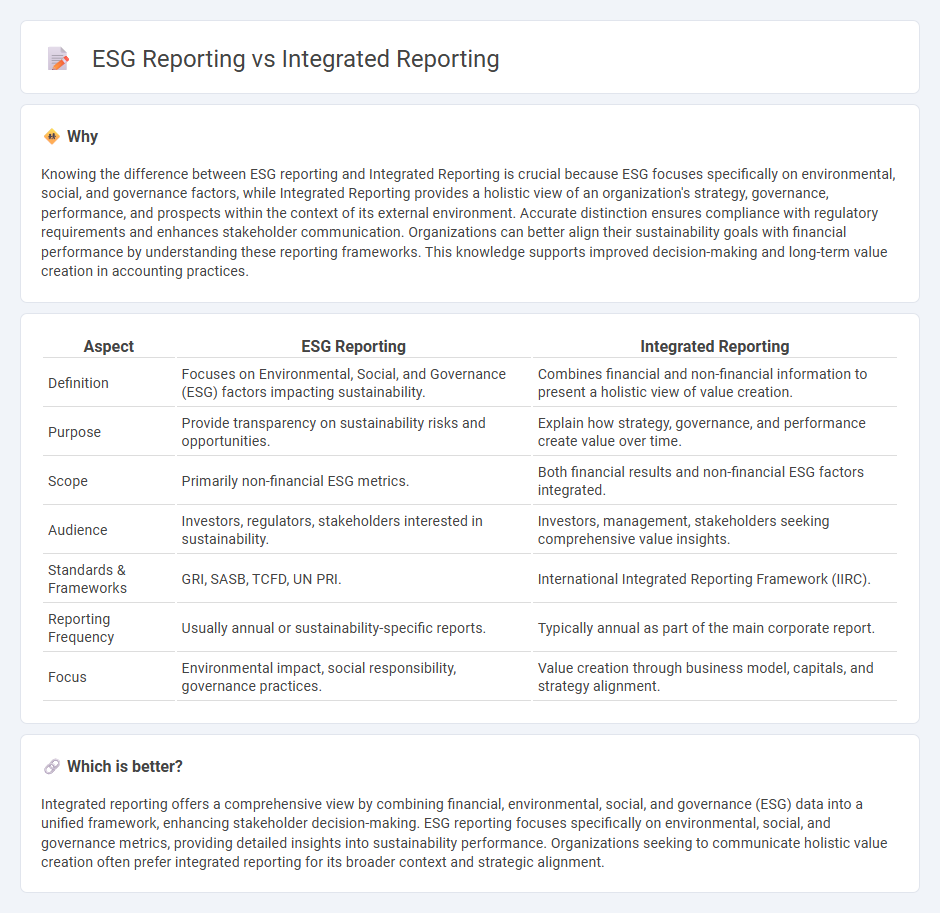

Knowing the difference between ESG reporting and Integrated Reporting is crucial because ESG focuses specifically on environmental, social, and governance factors, while Integrated Reporting provides a holistic view of an organization's strategy, governance, performance, and prospects within the context of its external environment. Accurate distinction ensures compliance with regulatory requirements and enhances stakeholder communication. Organizations can better align their sustainability goals with financial performance by understanding these reporting frameworks. This knowledge supports improved decision-making and long-term value creation in accounting practices.

Comparison Table

| Aspect | ESG Reporting | Integrated Reporting |

|---|---|---|

| Definition | Focuses on Environmental, Social, and Governance (ESG) factors impacting sustainability. | Combines financial and non-financial information to present a holistic view of value creation. |

| Purpose | Provide transparency on sustainability risks and opportunities. | Explain how strategy, governance, and performance create value over time. |

| Scope | Primarily non-financial ESG metrics. | Both financial results and non-financial ESG factors integrated. |

| Audience | Investors, regulators, stakeholders interested in sustainability. | Investors, management, stakeholders seeking comprehensive value insights. |

| Standards & Frameworks | GRI, SASB, TCFD, UN PRI. | International Integrated Reporting Framework (IIRC). |

| Reporting Frequency | Usually annual or sustainability-specific reports. | Typically annual as part of the main corporate report. |

| Focus | Environmental impact, social responsibility, governance practices. | Value creation through business model, capitals, and strategy alignment. |

Which is better?

Integrated reporting offers a comprehensive view by combining financial, environmental, social, and governance (ESG) data into a unified framework, enhancing stakeholder decision-making. ESG reporting focuses specifically on environmental, social, and governance metrics, providing detailed insights into sustainability performance. Organizations seeking to communicate holistic value creation often prefer integrated reporting for its broader context and strategic alignment.

Connection

ESG reporting and Integrated Reporting are connected through their shared focus on providing a comprehensive view of a company's financial performance alongside environmental, social, and governance metrics. Integrated Reporting combines traditional financial statements with ESG data to deliver a holistic account of how sustainability initiatives impact long-term value creation. This integration supports more transparent decision-making by investors and stakeholders seeking to assess both financial outcomes and non-financial performance indicators.

Key Terms

Value Creation

Integrated reporting combines financial, environmental, social, and governance data to provide a holistic view of how a company creates value over time, emphasizing long-term sustainability and strategic impact. ESG reporting focuses specifically on environmental, social, and governance criteria to assess risks and opportunities related to sustainability performance. Explore how integrated reporting and ESG frameworks drive transparent value creation and stakeholder engagement.

Sustainability

Integrated reporting combines financial, environmental, social, and governance (ESG) data to provide a holistic view of a company's sustainable value creation over time. ESG reporting specifically targets environmental, social, and governance factors, offering detailed insights into sustainability practices and risks without the financial context. Explore our comprehensive guide to understand how these reporting frameworks drive sustainability performance and stakeholder engagement.

Stakeholder Communication

Integrated reporting combines financial and non-financial information, providing a holistic view of an organization's value creation for stakeholders. ESG reporting concentrates specifically on environmental, social, and governance metrics, offering detailed data on sustainability performance and risks. Explore how these reporting frameworks enhance stakeholder communication and drive corporate transparency.

Source and External Links

Integrated reporting - Wikipedia - Integrated reporting is a concise communication that explains how an organization's strategy, governance, performance, and prospects create value over time, combining financial and other relevant information to aid long-term decision making primarily for providers of financial capital.

What is Integrated Reporting? - ESG - Integrated reporting is a process that produces a periodic report showing an organization's full view by including financial and non-financial factors such as ESG issues, highlighting how governance and strategy shape sustainable long-term value creation.

Integrated Reporting - The IFRS Foundation describes integrated reporting as an evolution in corporate reporting focused on conciseness, strategic relevance, future orientation, and communicating how value is created or eroded over short, medium, and long terms through integrated thinking and reporting frameworks.

dowidth.com

dowidth.com