Microtransaction accounting involves recording numerous small payments, often for individual digital goods or services, requiring precise tracking of each transaction's revenue recognition. Subscription accounting focuses on recurring revenue from periodic billing cycles, emphasizing deferred revenue management and subscription lifecycle analysis. Explore our detailed comparison to understand how each method impacts financial reporting and cash flow management.

Why it is important

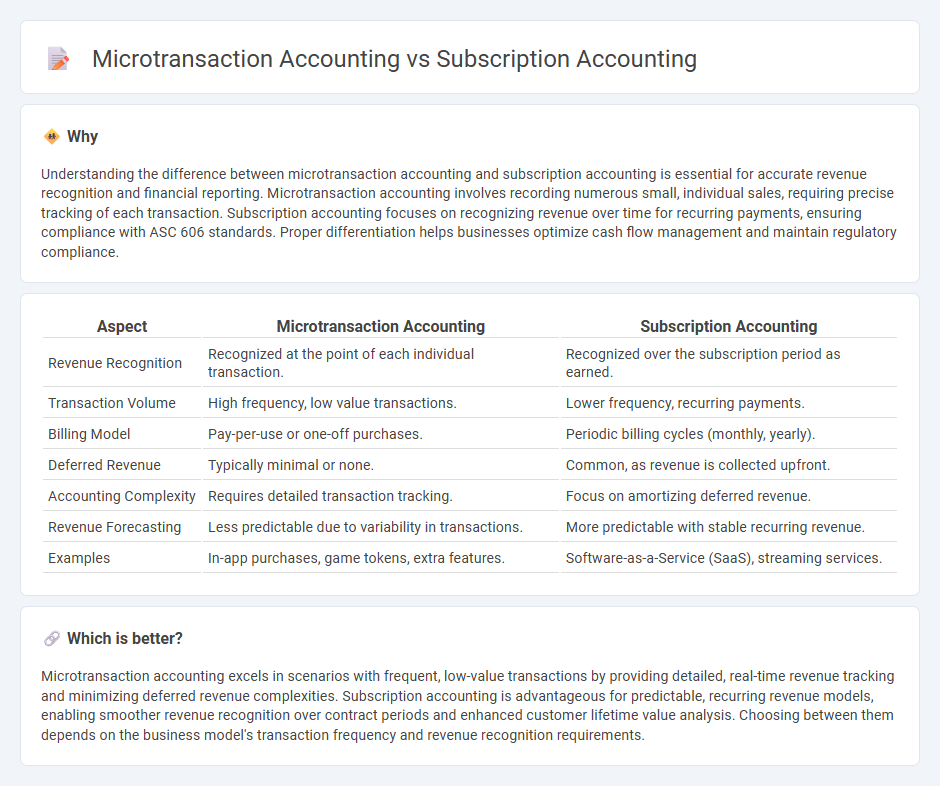

Understanding the difference between microtransaction accounting and subscription accounting is essential for accurate revenue recognition and financial reporting. Microtransaction accounting involves recording numerous small, individual sales, requiring precise tracking of each transaction. Subscription accounting focuses on recognizing revenue over time for recurring payments, ensuring compliance with ASC 606 standards. Proper differentiation helps businesses optimize cash flow management and maintain regulatory compliance.

Comparison Table

| Aspect | Microtransaction Accounting | Subscription Accounting |

|---|---|---|

| Revenue Recognition | Recognized at the point of each individual transaction. | Recognized over the subscription period as earned. |

| Transaction Volume | High frequency, low value transactions. | Lower frequency, recurring payments. |

| Billing Model | Pay-per-use or one-off purchases. | Periodic billing cycles (monthly, yearly). |

| Deferred Revenue | Typically minimal or none. | Common, as revenue is collected upfront. |

| Accounting Complexity | Requires detailed transaction tracking. | Focus on amortizing deferred revenue. |

| Revenue Forecasting | Less predictable due to variability in transactions. | More predictable with stable recurring revenue. |

| Examples | In-app purchases, game tokens, extra features. | Software-as-a-Service (SaaS), streaming services. |

Which is better?

Microtransaction accounting excels in scenarios with frequent, low-value transactions by providing detailed, real-time revenue tracking and minimizing deferred revenue complexities. Subscription accounting is advantageous for predictable, recurring revenue models, enabling smoother revenue recognition over contract periods and enhanced customer lifetime value analysis. Choosing between them depends on the business model's transaction frequency and revenue recognition requirements.

Connection

Microtransaction accounting and subscription accounting share a fundamental connection in revenue recognition principles, focusing on accurately recording small, frequent transactions versus periodic, recurring payments. Both methods require detailed tracking of customer payments and the allocation of revenue over the service delivery period to comply with standards such as ASC 606 and IFRS 15. Efficient integration of these accounting types improves financial reporting accuracy for businesses offering both one-time small purchases and continuous subscription services.

Key Terms

Revenue Recognition

Subscription accounting records revenue evenly over contract periods, matching recurring fees to delivery of services under ASC 606 standards. Microtransaction accounting recognizes revenue immediately upon each transaction, reflecting real-time sales data and customer purchases. Explore more to understand how these models impact financial reporting and compliance strategies.

Deferred Revenue

Deferred revenue in subscription accounting represents prepaid fees for ongoing services recognized as income over time, matching service delivery periods accurately. Microtransaction accounting records smaller, often one-time purchases with immediate revenue recognition, reflecting real-time consumption by users. Explore deeper into revenue recognition strategies and compliance to optimize financial reporting for your business.

Performance Obligation

Subscription accounting recognizes revenue as the service is delivered over the subscription period, aligning with the fulfillment of performance obligations continuously. Microtransaction accounting records revenue at the point of each individual transaction, reflecting distinct performance obligations per purchase. Explore the detailed distinctions in recognizing performance obligations for optimized financial reporting and compliance.

Source and External Links

Subscription Revenue Recognition Guide - Subscription accounting involves recognizing subscription fees as deferred revenue (a liability) when received, then recognizing portions as earned revenue in each billing period as services are delivered, typically using accrual accounting for accuracy in subscription business models.

Revenue recognition for subscription billing - Subscription accounting ensures that revenue is recognized only when performance obligations are fulfilled over the subscription term, distinguishing accrued revenue from deferred revenue, and thus maintaining accurate, real-time financial records for subscription businesses.

Subscription accounting explained - Subscription accounting focuses on managing the complexities of recurring payments, deferred revenue, and accurate revenue recognition, often involving manual or automated processes to reconcile balances, track discounts, and handle fiscal period accounting efficiently.

dowidth.com

dowidth.com