Sustainability ledger integrates environmental, social, and governance (ESG) data directly into financial accounting systems, enabling comprehensive tracking of a company's sustainable performance alongside traditional financial metrics. Non-financial reporting focuses on disclosing qualitative and quantitative ESG information without embedding it into formal accounting ledgers, often guided by frameworks like the Global Reporting Initiative (GRI) or Sustainability Accounting Standards Board (SASB). Explore how these two approaches shape corporate transparency and accountability in sustainable business practices.

Why it is important

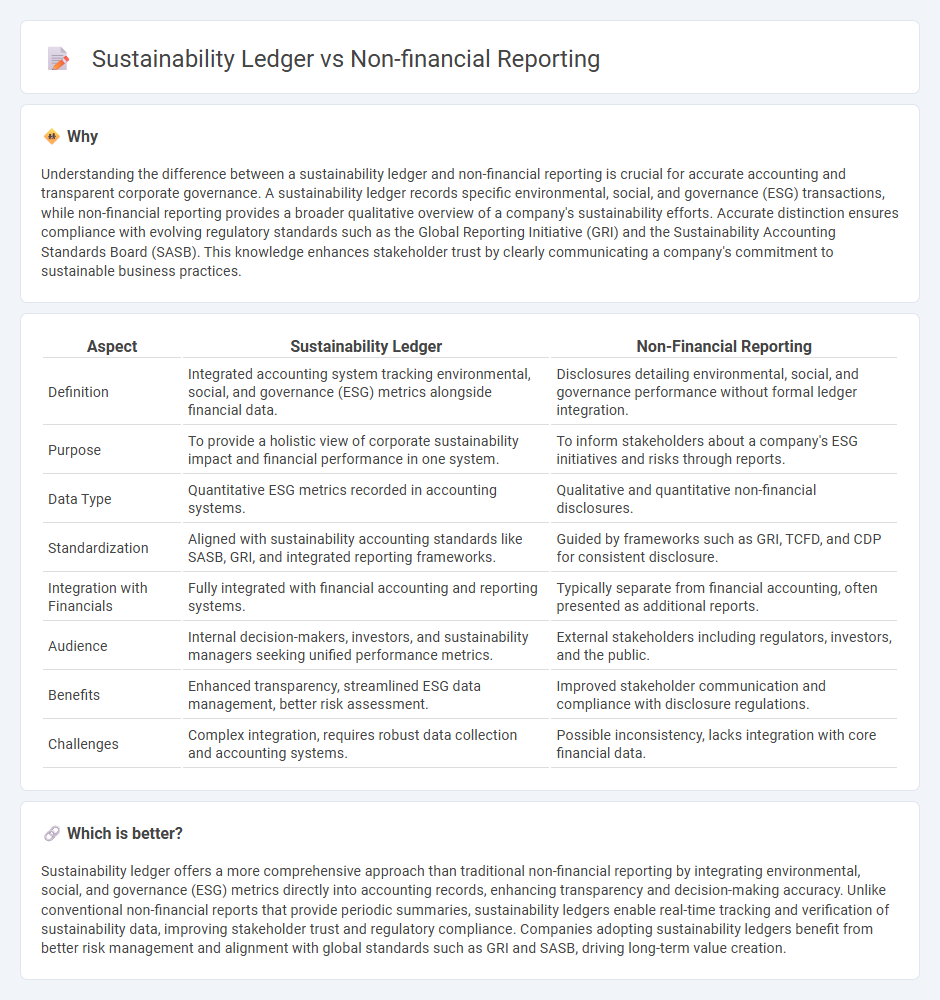

Understanding the difference between a sustainability ledger and non-financial reporting is crucial for accurate accounting and transparent corporate governance. A sustainability ledger records specific environmental, social, and governance (ESG) transactions, while non-financial reporting provides a broader qualitative overview of a company's sustainability efforts. Accurate distinction ensures compliance with evolving regulatory standards such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). This knowledge enhances stakeholder trust by clearly communicating a company's commitment to sustainable business practices.

Comparison Table

| Aspect | Sustainability Ledger | Non-Financial Reporting |

|---|---|---|

| Definition | Integrated accounting system tracking environmental, social, and governance (ESG) metrics alongside financial data. | Disclosures detailing environmental, social, and governance performance without formal ledger integration. |

| Purpose | To provide a holistic view of corporate sustainability impact and financial performance in one system. | To inform stakeholders about a company's ESG initiatives and risks through reports. |

| Data Type | Quantitative ESG metrics recorded in accounting systems. | Qualitative and quantitative non-financial disclosures. |

| Standardization | Aligned with sustainability accounting standards like SASB, GRI, and integrated reporting frameworks. | Guided by frameworks such as GRI, TCFD, and CDP for consistent disclosure. |

| Integration with Financials | Fully integrated with financial accounting and reporting systems. | Typically separate from financial accounting, often presented as additional reports. |

| Audience | Internal decision-makers, investors, and sustainability managers seeking unified performance metrics. | External stakeholders including regulators, investors, and the public. |

| Benefits | Enhanced transparency, streamlined ESG data management, better risk assessment. | Improved stakeholder communication and compliance with disclosure regulations. |

| Challenges | Complex integration, requires robust data collection and accounting systems. | Possible inconsistency, lacks integration with core financial data. |

Which is better?

Sustainability ledger offers a more comprehensive approach than traditional non-financial reporting by integrating environmental, social, and governance (ESG) metrics directly into accounting records, enhancing transparency and decision-making accuracy. Unlike conventional non-financial reports that provide periodic summaries, sustainability ledgers enable real-time tracking and verification of sustainability data, improving stakeholder trust and regulatory compliance. Companies adopting sustainability ledgers benefit from better risk management and alignment with global standards such as GRI and SASB, driving long-term value creation.

Connection

Sustainability ledgers integrate environmental, social, and governance (ESG) data into traditional accounting systems to support non-financial reporting requirements. These ledgers enable accurate tracking and disclosure of sustainability metrics, aligning with standards such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). By linking financial and non-financial data, businesses enhance transparency, stakeholder trust, and regulatory compliance.

Key Terms

ESG Metrics

Non-financial reporting emphasizes disclosing environmental, social, and governance (ESG) metrics to provide stakeholders with transparent insights into a company's ethical impact and sustainability practices. The sustainability ledger integrates these ESG metrics into a comprehensive, real-time record, enabling dynamic tracking and benchmarking of corporate sustainability performance. Discover how these tools enhance ESG accountability and drive strategic decision-making.

Integrated Reporting

Non-financial reporting encompasses disclosures on environmental, social, and governance (ESG) performance, providing stakeholders with qualitative and quantitative data beyond traditional financial metrics. A sustainability ledger systematically records sustainability-related transactions and impacts, serving as a foundational tool for Integrated Reporting (IR), which combines financial and non-financial information into a cohesive narrative to demonstrate value creation over time. Explore how Integrated Reporting leverages both non-financial reporting and sustainability ledgers for comprehensive corporate transparency.

Double Materiality

Non-financial reporting encompasses the disclosure of environmental, social, and governance (ESG) impacts affecting a company's stakeholders, while a sustainability ledger systematically records these impacts with an emphasis on accountability and traceability. Double Materiality integrates the financial materiality of ESG risks and the impact materiality of a company's activities on society and the environment, serving as a critical framework in both approaches. Explore how Double Materiality shapes transparency and strategic decision-making in corporate sustainability practices.

Source and External Links

Non-financial reporting: responsible, far-sighted management - PwC - Non-financial reporting involves disclosing key themes beyond financial figures that impact an organization, helping stakeholders understand intangible assets and value creation with a focus on corporate responsibility and long-term value, especially relevant for large multinational companies.

A Comprehensive Guide to Non-Financial Reporting - This guide explains the main non-financial reporting standards such as CSRD, ISSB, CDP, and GRI, outlining their scope, focus, applicability, and audit requirements for transparency in sustainability, ESG impacts, tax, and governance disclosures.

Non-financial Reporting Directive - European Parliament - The Non-financial Reporting Directive (NFRD) requires large public-interest companies in the EU to disclose information on social responsibility, human rights, anti-corruption, and diversity to enhance transparency and support sustainable economic and social development.

dowidth.com

dowidth.com