Dark data auditing focuses on uncovering and analyzing hidden or unused data within an organization to enhance financial accuracy and compliance. Enterprise risk management (ERM) systematically identifies and mitigates risks that could impact the organization's financial health and operational efficiency. Discover how integrating dark data auditing with ERM can strengthen overall accounting practices.

Why it is important

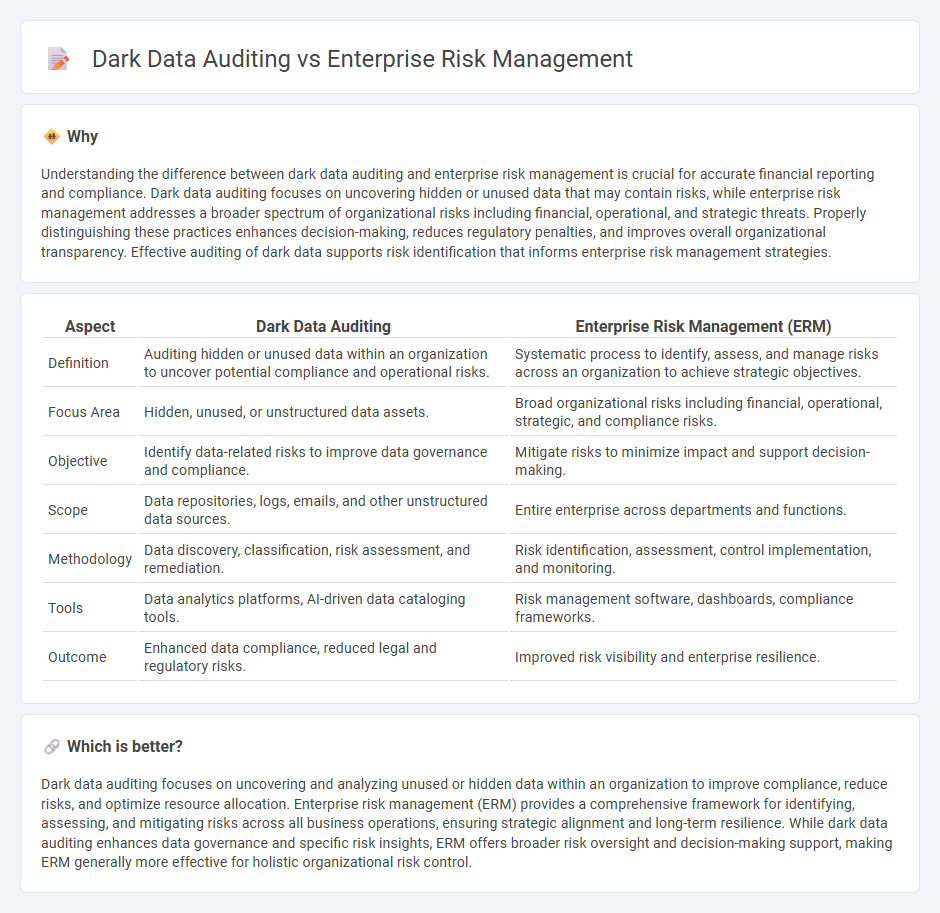

Understanding the difference between dark data auditing and enterprise risk management is crucial for accurate financial reporting and compliance. Dark data auditing focuses on uncovering hidden or unused data that may contain risks, while enterprise risk management addresses a broader spectrum of organizational risks including financial, operational, and strategic threats. Properly distinguishing these practices enhances decision-making, reduces regulatory penalties, and improves overall organizational transparency. Effective auditing of dark data supports risk identification that informs enterprise risk management strategies.

Comparison Table

| Aspect | Dark Data Auditing | Enterprise Risk Management (ERM) |

|---|---|---|

| Definition | Auditing hidden or unused data within an organization to uncover potential compliance and operational risks. | Systematic process to identify, assess, and manage risks across an organization to achieve strategic objectives. |

| Focus Area | Hidden, unused, or unstructured data assets. | Broad organizational risks including financial, operational, strategic, and compliance risks. |

| Objective | Identify data-related risks to improve data governance and compliance. | Mitigate risks to minimize impact and support decision-making. |

| Scope | Data repositories, logs, emails, and other unstructured data sources. | Entire enterprise across departments and functions. |

| Methodology | Data discovery, classification, risk assessment, and remediation. | Risk identification, assessment, control implementation, and monitoring. |

| Tools | Data analytics platforms, AI-driven data cataloging tools. | Risk management software, dashboards, compliance frameworks. |

| Outcome | Enhanced data compliance, reduced legal and regulatory risks. | Improved risk visibility and enterprise resilience. |

Which is better?

Dark data auditing focuses on uncovering and analyzing unused or hidden data within an organization to improve compliance, reduce risks, and optimize resource allocation. Enterprise risk management (ERM) provides a comprehensive framework for identifying, assessing, and mitigating risks across all business operations, ensuring strategic alignment and long-term resilience. While dark data auditing enhances data governance and specific risk insights, ERM offers broader risk oversight and decision-making support, making ERM generally more effective for holistic organizational risk control.

Connection

Dark data auditing enhances Enterprise Risk Management (ERM) by uncovering hidden or unstructured data that may pose unidentified financial, compliance, or operational risks. Integrating dark data insights into ERM frameworks improves risk identification, assessment, and mitigation strategies, ensuring comprehensive oversight of potential vulnerabilities. Organizations leveraging dark data auditing experience strengthened controls and more informed decision-making within their accounting and risk management processes.

Key Terms

**Enterprise risk management:**

Enterprise risk management (ERM) involves identifying, assessing, and mitigating potential risks that could impact an organization's strategic goals, including financial, operational, and compliance risks. ERM frameworks prioritize proactive risk identification, risk appetite definition, and continuous monitoring to safeguard assets and ensure business continuity. Explore in-depth methodologies and benefits of ERM to strengthen your organization's resilience and decision-making processes.

Risk Assessment

Enterprise risk management (ERM) involves a systematic process to identify, assess, and mitigate risks across an organization, ensuring strategic objectives are met. Dark data auditing specifically targets the discovery and evaluation of unused or hidden data that may pose security, compliance, or operational risks often overlooked in broader ERM frameworks. Explore further to understand how integrating dark data auditing enhances comprehensive risk assessment practices.

Internal Controls

Enterprise risk management (ERM) integrates comprehensive internal controls to identify, assess, and mitigate potential business threats, ensuring organizational resilience. Dark data auditing uncovers unstructured or unused data within the enterprise, enhancing control frameworks by addressing hidden risks and compliance gaps. Explore how combining ERM with dark data auditing strengthens internal controls and drives proactive risk management.

Source and External Links

What is Enterprise Risk Management (ERM)? - ERM is a strategic business process that creates a top-down view of all significant risks impacting an organization's objectives, enabling proactive risk management to support strategic success and competitive advantage.

Enterprise risk management (ERM): An overview - ERM involves assessing, prioritizing, and mitigating risks related to a company's goals, aligning internal workflows with risk tolerance, and identifying high-risk events to protect future health and success.

Enterprise risk management - Wikipedia - ERM encompasses methods and processes to identify, assess, and respond to risks and opportunities affecting organizational objectives to protect and create value for stakeholders.

dowidth.com

dowidth.com