Digital asset taxation involves the complex evaluation of cryptocurrencies and tokens for tax compliance, focusing on capital gains, income recognition, and reporting requirements under evolving regulations. Fiduciary accounting, on the other hand, concerns managing and reporting assets held in trust or estates, ensuring accuracy, transparency, and adherence to legal duties. Explore the differences and implications of these specialized accounting areas to optimize financial strategies.

Why it is important

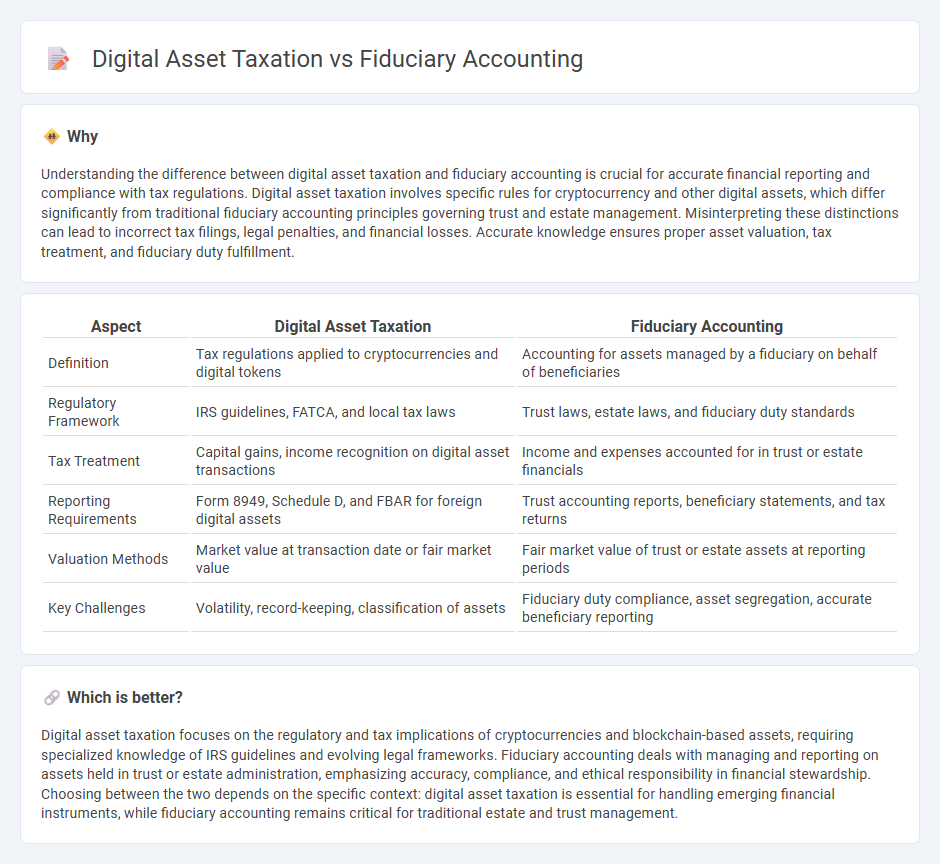

Understanding the difference between digital asset taxation and fiduciary accounting is crucial for accurate financial reporting and compliance with tax regulations. Digital asset taxation involves specific rules for cryptocurrency and other digital assets, which differ significantly from traditional fiduciary accounting principles governing trust and estate management. Misinterpreting these distinctions can lead to incorrect tax filings, legal penalties, and financial losses. Accurate knowledge ensures proper asset valuation, tax treatment, and fiduciary duty fulfillment.

Comparison Table

| Aspect | Digital Asset Taxation | Fiduciary Accounting |

|---|---|---|

| Definition | Tax regulations applied to cryptocurrencies and digital tokens | Accounting for assets managed by a fiduciary on behalf of beneficiaries |

| Regulatory Framework | IRS guidelines, FATCA, and local tax laws | Trust laws, estate laws, and fiduciary duty standards |

| Tax Treatment | Capital gains, income recognition on digital asset transactions | Income and expenses accounted for in trust or estate financials |

| Reporting Requirements | Form 8949, Schedule D, and FBAR for foreign digital assets | Trust accounting reports, beneficiary statements, and tax returns |

| Valuation Methods | Market value at transaction date or fair market value | Fair market value of trust or estate assets at reporting periods |

| Key Challenges | Volatility, record-keeping, classification of assets | Fiduciary duty compliance, asset segregation, accurate beneficiary reporting |

Which is better?

Digital asset taxation focuses on the regulatory and tax implications of cryptocurrencies and blockchain-based assets, requiring specialized knowledge of IRS guidelines and evolving legal frameworks. Fiduciary accounting deals with managing and reporting on assets held in trust or estate administration, emphasizing accuracy, compliance, and ethical responsibility in financial stewardship. Choosing between the two depends on the specific context: digital asset taxation is essential for handling emerging financial instruments, while fiduciary accounting remains critical for traditional estate and trust management.

Connection

Digital asset taxation involves tracking and reporting cryptocurrency and blockchain-based assets for tax purposes, requiring precise valuation and documentation. Fiduciary accounting manages the financial responsibilities of estate or trust assets, ensuring accurate record-keeping and compliance with legal obligations. The connection lies in the need for fiduciaries to accurately report digital asset transactions for tax compliance, integrating blockchain data into fiduciary accounting practices.

Key Terms

**Fiduciary Accounting:**

Fiduciary accounting involves the systematic recording and management of financial activities related to trusts, estates, and guardianships, ensuring accurate tracking of income, expenses, and distributions to beneficiaries. It requires adherence to legal standards and detailed documentation to provide transparency and accountability in fiduciary responsibilities. Explore further to understand how fiduciary accounting principles optimize estate administration and compliance.

Principal and Income

Fiduciary accounting manages the allocation of principal and income within trusts or estates, ensuring accurate categorization and distribution among beneficiaries. Digital asset taxation involves the valuation and reporting of cryptocurrencies and other digital holdings, emphasizing clear distinction between capital gains (principal) and income generated from holdings. Explore the complexities of principal and income treatment in fiduciary contexts and digital asset tax regulations to enhance financial compliance.

Trustee

Trustee responsibilities in fiduciary accounting require precise management and reporting of estate or trust assets to ensure accurate financial records and compliance with legal standards. Digital asset taxation introduces complexity, as trustees must navigate evolving IRS guidelines on cryptocurrencies, tokens, and other digital properties, ensuring proper valuation and tax reporting. Explore how trustees can effectively balance fiduciary duties with digital asset tax obligations to protect beneficiaries and maintain regulatory compliance.

Source and External Links

Fiduciary accounting - AccountingTools - Fiduciary accounting involves recording transactions of a trust or estate and issuing periodic reports on its status, focusing on allocation between income and principal, with annual accounting reports to beneficiaries.

Fiduciary accountings explained | EY - US - Fiduciary accounting is a duty requiring disclosure of all trust or estate activities, protecting both fiduciaries and beneficiaries by ensuring accurate and transparent reporting, often demanded by law or court orders.

What is Fiduciary Accounting and When Might You Need It? - Fiduciary accounting is a detailed report of all activities within a trust or estate during a period, essential for fiduciaries who must act in beneficiaries' best interests and may be required when trustees change or complexities arise.

dowidth.com

dowidth.com