Invoice factoring platforms provide businesses with immediate cash by selling outstanding invoices to third-party companies at a discount, improving short-term liquidity and reducing credit risk. Supply chain finance offers extended payment terms through collaboration between buyers, suppliers, and financial institutions, optimizing working capital across the entire supply chain. Explore deeper to understand which financing solution best suits your business needs.

Why it is important

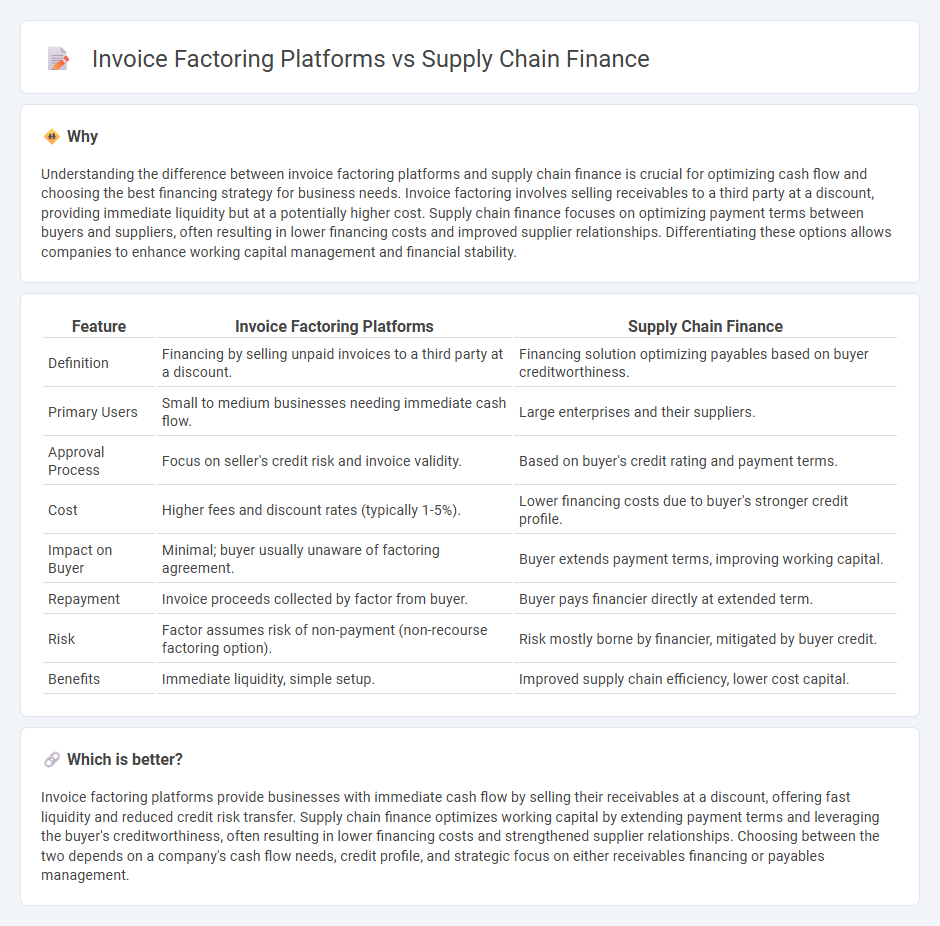

Understanding the difference between invoice factoring platforms and supply chain finance is crucial for optimizing cash flow and choosing the best financing strategy for business needs. Invoice factoring involves selling receivables to a third party at a discount, providing immediate liquidity but at a potentially higher cost. Supply chain finance focuses on optimizing payment terms between buyers and suppliers, often resulting in lower financing costs and improved supplier relationships. Differentiating these options allows companies to enhance working capital management and financial stability.

Comparison Table

| Feature | Invoice Factoring Platforms | Supply Chain Finance |

|---|---|---|

| Definition | Financing by selling unpaid invoices to a third party at a discount. | Financing solution optimizing payables based on buyer creditworthiness. |

| Primary Users | Small to medium businesses needing immediate cash flow. | Large enterprises and their suppliers. |

| Approval Process | Focus on seller's credit risk and invoice validity. | Based on buyer's credit rating and payment terms. |

| Cost | Higher fees and discount rates (typically 1-5%). | Lower financing costs due to buyer's stronger credit profile. |

| Impact on Buyer | Minimal; buyer usually unaware of factoring agreement. | Buyer extends payment terms, improving working capital. |

| Repayment | Invoice proceeds collected by factor from buyer. | Buyer pays financier directly at extended term. |

| Risk | Factor assumes risk of non-payment (non-recourse factoring option). | Risk mostly borne by financier, mitigated by buyer credit. |

| Benefits | Immediate liquidity, simple setup. | Improved supply chain efficiency, lower cost capital. |

Which is better?

Invoice factoring platforms provide businesses with immediate cash flow by selling their receivables at a discount, offering fast liquidity and reduced credit risk transfer. Supply chain finance optimizes working capital by extending payment terms and leveraging the buyer's creditworthiness, often resulting in lower financing costs and strengthened supplier relationships. Choosing between the two depends on a company's cash flow needs, credit profile, and strategic focus on either receivables financing or payables management.

Connection

Invoice factoring platforms and supply chain finance are interconnected through the mechanism of improving cash flow for businesses by converting accounts receivable into immediate working capital. Both solutions leverage technology to optimize payment processes, reduce credit risk, and enhance liquidity within supply chains, enabling suppliers to receive early payments and buyers to extend payment terms. By integrating invoice factoring with supply chain finance programs, companies streamline financial operations, reduce financing costs, and strengthen supplier relationships.

Key Terms

**Supply Chain Finance:**

Supply Chain Finance (SCF) optimizes working capital by facilitating early payments to suppliers through buyer-approved financing, enhancing liquidity and strengthening supplier relationships. SCF platforms leverage technology to integrate buyers, suppliers, and financial institutions, enabling dynamic discounting and extended payment terms without transferring receivables ownership. Explore the benefits of Supply Chain Finance and how it can transform your business cash flow management.

Reverse factoring

Reverse factoring, a subset of supply chain finance, enables suppliers to receive early payments on their invoices through a financing intermediary arranged by the buyer, improving cash flow without increasing the buyer's liabilities. Unlike traditional invoice factoring platforms where suppliers independently sell receivables at a discount, reverse factoring leverages the buyer's stronger credit rating, typically resulting in lower financing costs. Explore the benefits and operational distinctions of reverse factoring to optimize working capital management in your supply chain.

Approved payables

Supply chain finance platforms optimize working capital by allowing buyers to extend payment terms while suppliers receive early payment on approved payables through third-party financing. Invoice factoring platforms provide immediate cash flow by selling outstanding invoices to a factor at a discount, focusing primarily on the supplier's receivables rather than buyer approval. Explore the distinct benefits and operational mechanisms of both supply chain finance and invoice factoring to enhance your financial strategy.

Source and External Links

What is supply chain finance? - Supply chain finance enhances cash flow for companies by allowing suppliers to receive early payments while buyers benefit from longer payment terms.

What is Supply Chain Finance? - Supply chain finance optimizes cash flow by enabling suppliers to access funds earlier and buyers to extend payment terms, often at lower financing rates.

Supply Chain Finance | Mizuho Bank - Mizuho offers a platform for supply chain finance, helping buyers and suppliers improve cash flow and mitigate risks through early financing options.

dowidth.com

dowidth.com