Blockchain reconciliation leverages distributed ledger technology to automate and secure transaction verification, significantly reducing errors and processing time compared to manual reconciliation methods reliant on human input. It provides enhanced transparency, real-time data synchronization, and immutable audit trails that streamline accounting workflows. Explore the advantages of blockchain reconciliation over traditional processes to optimize your financial operations.

Why it is important

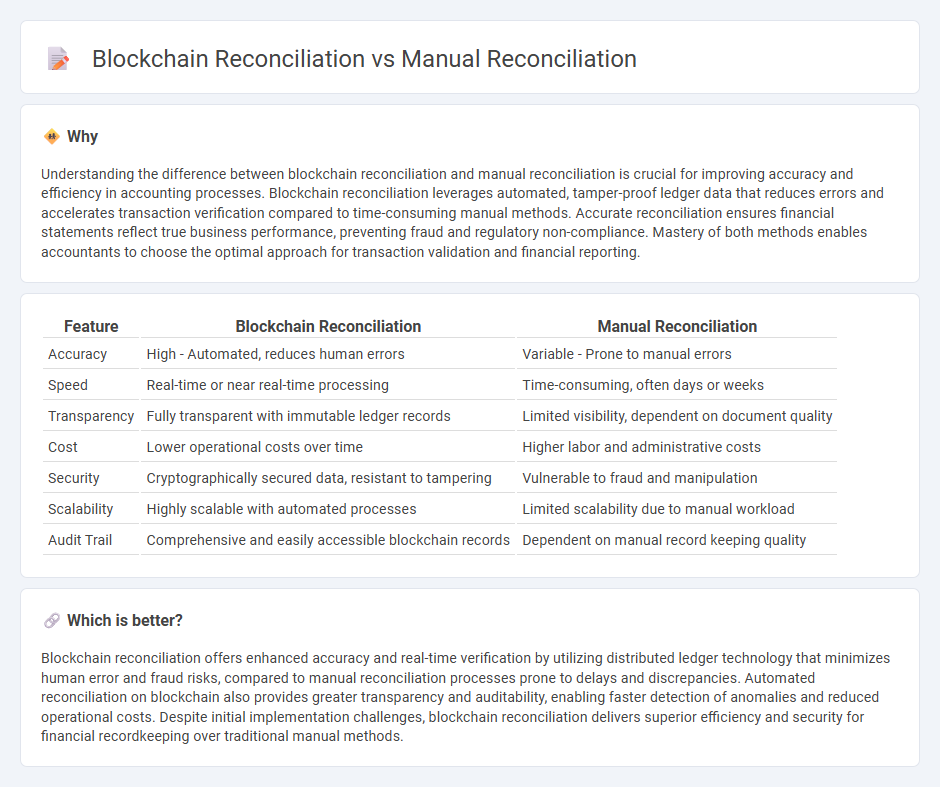

Understanding the difference between blockchain reconciliation and manual reconciliation is crucial for improving accuracy and efficiency in accounting processes. Blockchain reconciliation leverages automated, tamper-proof ledger data that reduces errors and accelerates transaction verification compared to time-consuming manual methods. Accurate reconciliation ensures financial statements reflect true business performance, preventing fraud and regulatory non-compliance. Mastery of both methods enables accountants to choose the optimal approach for transaction validation and financial reporting.

Comparison Table

| Feature | Blockchain Reconciliation | Manual Reconciliation |

|---|---|---|

| Accuracy | High - Automated, reduces human errors | Variable - Prone to manual errors |

| Speed | Real-time or near real-time processing | Time-consuming, often days or weeks |

| Transparency | Fully transparent with immutable ledger records | Limited visibility, dependent on document quality |

| Cost | Lower operational costs over time | Higher labor and administrative costs |

| Security | Cryptographically secured data, resistant to tampering | Vulnerable to fraud and manipulation |

| Scalability | Highly scalable with automated processes | Limited scalability due to manual workload |

| Audit Trail | Comprehensive and easily accessible blockchain records | Dependent on manual record keeping quality |

Which is better?

Blockchain reconciliation offers enhanced accuracy and real-time verification by utilizing distributed ledger technology that minimizes human error and fraud risks, compared to manual reconciliation processes prone to delays and discrepancies. Automated reconciliation on blockchain also provides greater transparency and auditability, enabling faster detection of anomalies and reduced operational costs. Despite initial implementation challenges, blockchain reconciliation delivers superior efficiency and security for financial recordkeeping over traditional manual methods.

Connection

Blockchain reconciliation automates the verification of transactions by creating immutable, timestamped records, reducing errors common in manual reconciliation processes. Manual reconciliation requires human intervention to compare financial records, which is time-consuming and prone to discrepancies. Integrating blockchain technology enhances transparency and accuracy, minimizing the need for extensive manual audits in accounting.

Key Terms

Human Error

Manual reconciliation processes are highly prone to human error due to data entry mistakes, oversight, and delays, impacting financial accuracy and operational efficiency. Blockchain reconciliation leverages immutable ledgers and automated smart contracts, significantly reducing the risk of errors by ensuring real-time, transparent, and tamper-proof transaction validation. Discover how adopting blockchain reconciliation can transform your organization's accuracy and trustworthiness in financial operations.

Real-time Verification

Manual reconciliation involves labor-intensive processes that rely on human input to verify and match transactions, often resulting in delays and errors. Blockchain reconciliation enables real-time verification through decentralized ledgers, providing immutable records that automatically validate transactions instantly and transparently. Explore how blockchain technology transforms reconciliation for enhanced accuracy and efficiency.

Immutable Ledger

Manual reconciliation involves human verification of transaction records, which is prone to errors and time delays. Blockchain reconciliation leverages an immutable ledger that records every transaction chronologically and securely, ensuring transparency and tamper-proof audit trails. Explore how blockchain's immutable ledger enhances accuracy and trust in reconciliation processes.

Source and External Links

Why Manual Reconciliation Fails Accounting Teams - Teampay - Manual reconciliation is the process where an accounting professional manually compares general ledger and payable ledger to ensure books are balanced, involving steps like comparing records, identifying payments, and making adjustments, with types including one-step vs. multi-step and bank vs. non-bank reconciliation.

Manual vs. Automated Balance Sheet Reconciliation - DataSnipper - Manual reconciliation involves collecting financial data, verifying it by manual comparison of ledgers and documents, investigating discrepancies, and documenting the process, but is time-consuming and prone to human error compared to automated methods.

Comparing manual and automated payment reconciliation - Payrails - Manual payment reconciliation typically uses spreadsheets to match internal payment records with external payment service provider reports, which is labor-intensive, repetitive, and prone to errors especially for businesses with multiple payment sources.

dowidth.com

dowidth.com