Cryptotax regulations are rapidly evolving, affecting how businesses determine their tax obligations related to cryptocurrency transactions. Nexus determination, which establishes tax jurisdiction based on business presence, becomes increasingly complex as digital assets blur traditional geographic boundaries. Explore the intricacies of cryptotax vs nexus to ensure compliance and optimize tax strategy.

Why it is important

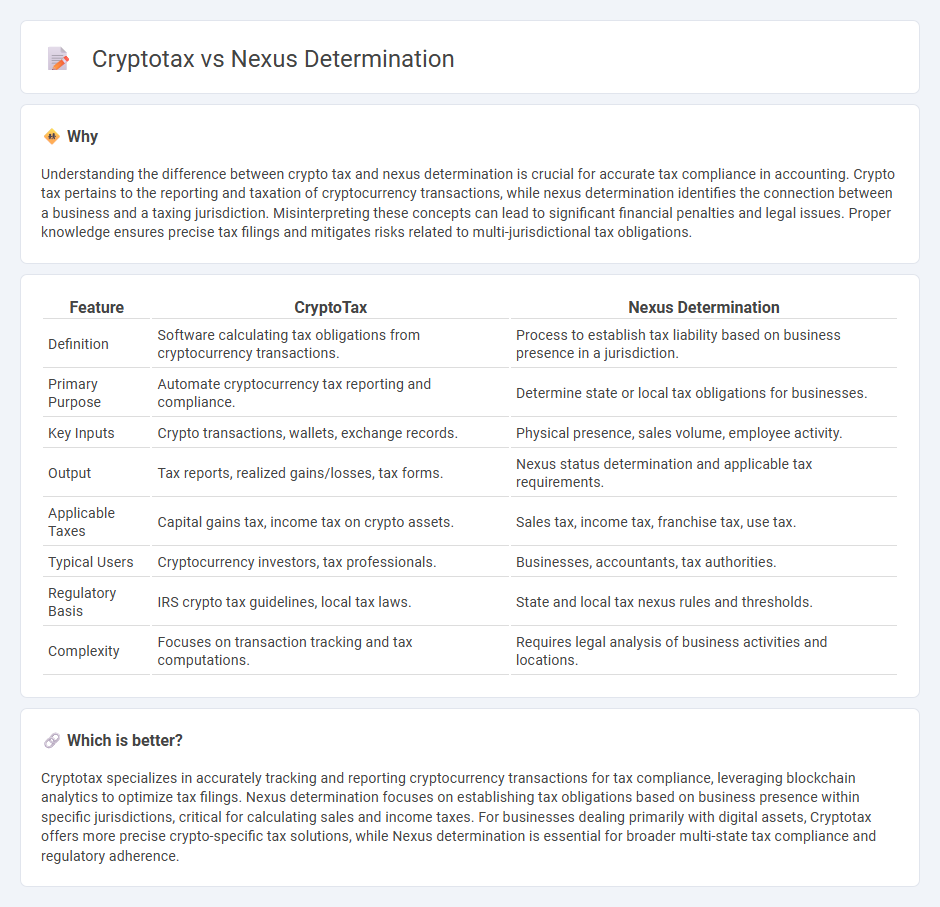

Understanding the difference between crypto tax and nexus determination is crucial for accurate tax compliance in accounting. Crypto tax pertains to the reporting and taxation of cryptocurrency transactions, while nexus determination identifies the connection between a business and a taxing jurisdiction. Misinterpreting these concepts can lead to significant financial penalties and legal issues. Proper knowledge ensures precise tax filings and mitigates risks related to multi-jurisdictional tax obligations.

Comparison Table

| Feature | CryptoTax | Nexus Determination |

|---|---|---|

| Definition | Software calculating tax obligations from cryptocurrency transactions. | Process to establish tax liability based on business presence in a jurisdiction. |

| Primary Purpose | Automate cryptocurrency tax reporting and compliance. | Determine state or local tax obligations for businesses. |

| Key Inputs | Crypto transactions, wallets, exchange records. | Physical presence, sales volume, employee activity. |

| Output | Tax reports, realized gains/losses, tax forms. | Nexus status determination and applicable tax requirements. |

| Applicable Taxes | Capital gains tax, income tax on crypto assets. | Sales tax, income tax, franchise tax, use tax. |

| Typical Users | Cryptocurrency investors, tax professionals. | Businesses, accountants, tax authorities. |

| Regulatory Basis | IRS crypto tax guidelines, local tax laws. | State and local tax nexus rules and thresholds. |

| Complexity | Focuses on transaction tracking and tax computations. | Requires legal analysis of business activities and locations. |

Which is better?

Cryptotax specializes in accurately tracking and reporting cryptocurrency transactions for tax compliance, leveraging blockchain analytics to optimize tax filings. Nexus determination focuses on establishing tax obligations based on business presence within specific jurisdictions, critical for calculating sales and income taxes. For businesses dealing primarily with digital assets, Cryptotax offers more precise crypto-specific tax solutions, while Nexus determination is essential for broader multi-state tax compliance and regulatory adherence.

Connection

Cryptotax compliance depends heavily on nexus determination, as establishing a business's tax nexus defines the jurisdiction where cryptocurrency transactions are taxable. Accurate nexus analysis ensures that digital asset holders or businesses report and remit crypto-related taxes in correct states or countries. Failure to properly assess nexus can lead to significant tax liabilities and penalties in the rapidly evolving landscape of cryptocurrency regulation.

Key Terms

Physical Presence

Nexus determination in tax law hinges on the taxpayer's physical presence within a jurisdiction, which establishes tax obligations based on economic activity and location-specific connections. CryptoTax platforms automate nexus analysis by tracking digital asset transactions across states, integrating physical presence data with virtual activity to ensure compliance with varying state tax laws. Explore how combining physical presence and digital tracking enhances accurate nexus determination for crypto taxation.

Sourcing Rules

Nexus determination establishes the tax jurisdiction based on business presence and economic activity, while crypto tax sourcing rules address how cryptocurrency transactions are geographically sourced for tax purposes. Understanding the interplay between nexus laws and crypto sourcing rules is critical for accurate tax compliance across jurisdictions. Explore detailed analysis to optimize your tax strategy in the evolving digital economy.

Token Classification

Nexus determination in cryptocurrency tax law assesses the connection between a taxpayer and a taxing jurisdiction, which directly influences tax obligations on digital assets, whereas crypto tax frameworks emphasize accurate token classification for compliance with diverse tax regulations. Token classification differentiates utility tokens, security tokens, and payment tokens, each subject to distinct tax treatments based on their functional characteristics and use cases. Explore further to understand how precise token classification impacts nexus considerations and optimizes your crypto tax strategy.

Source and External Links

How to Determine Sales Tax Nexus - Provides a comprehensive checklist for businesses to review their operations, sales, property, payroll, marketing, and third-party activities to assess where sales tax collection is required.

How to Determine Your Sales Tax Nexus Exposure - Explains that nexus is not limited to physical presence and outlines multiple types (physical, economic, click-through, marketplace) while emphasizing the need for regular monitoring of business activities and changing state laws to ensure compliance.

Sales Tax Nexus by State - States that sales tax nexus is typically triggered when a business's retail activity in a state meets specific sales thresholds or transaction counts, and highlights the constitutional limitations on state taxing authority under the Due Process and Commerce Clauses.

dowidth.com

dowidth.com