Tax technology automates compliance, improves accuracy in tax calculations, and streamlines filing processes, reducing the risk of errors and penalties. Inventory management systems track stock levels, optimize supply chain operations, and enhance order fulfillment efficiency, directly impacting cost control and financial reporting. Explore the key differences and benefits to determine which solution best supports your business accounting needs.

Why it is important

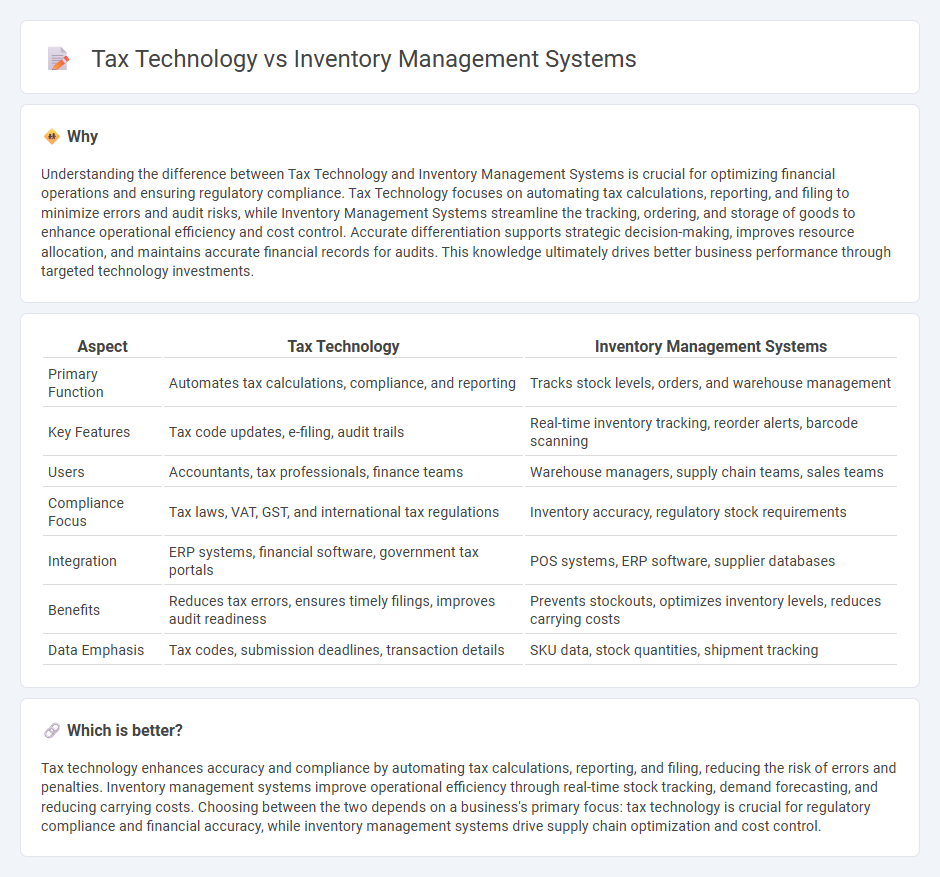

Understanding the difference between Tax Technology and Inventory Management Systems is crucial for optimizing financial operations and ensuring regulatory compliance. Tax Technology focuses on automating tax calculations, reporting, and filing to minimize errors and audit risks, while Inventory Management Systems streamline the tracking, ordering, and storage of goods to enhance operational efficiency and cost control. Accurate differentiation supports strategic decision-making, improves resource allocation, and maintains accurate financial records for audits. This knowledge ultimately drives better business performance through targeted technology investments.

Comparison Table

| Aspect | Tax Technology | Inventory Management Systems |

|---|---|---|

| Primary Function | Automates tax calculations, compliance, and reporting | Tracks stock levels, orders, and warehouse management |

| Key Features | Tax code updates, e-filing, audit trails | Real-time inventory tracking, reorder alerts, barcode scanning |

| Users | Accountants, tax professionals, finance teams | Warehouse managers, supply chain teams, sales teams |

| Compliance Focus | Tax laws, VAT, GST, and international tax regulations | Inventory accuracy, regulatory stock requirements |

| Integration | ERP systems, financial software, government tax portals | POS systems, ERP software, supplier databases |

| Benefits | Reduces tax errors, ensures timely filings, improves audit readiness | Prevents stockouts, optimizes inventory levels, reduces carrying costs |

| Data Emphasis | Tax codes, submission deadlines, transaction details | SKU data, stock quantities, shipment tracking |

Which is better?

Tax technology enhances accuracy and compliance by automating tax calculations, reporting, and filing, reducing the risk of errors and penalties. Inventory management systems improve operational efficiency through real-time stock tracking, demand forecasting, and reducing carrying costs. Choosing between the two depends on a business's primary focus: tax technology is crucial for regulatory compliance and financial accuracy, while inventory management systems drive supply chain optimization and cost control.

Connection

Tax technology integrates seamlessly with inventory management systems by automating the calculation of tax liabilities based on real-time inventory data, ensuring accurate compliance with evolving tax regulations. These systems track product movement, stock levels, and sales transactions, enabling precise tax reporting and minimizing errors in tax filing. Leveraging AI-driven tax solutions with inventory data enhances decision-making for businesses, optimizing tax planning and reducing audit risks.

Key Terms

Perpetual Inventory System

Perpetual Inventory Systems maintain real-time inventory records by automatically updating stock levels with each transaction, enhancing accuracy and reducing discrepancies in businesses. Unlike tax technology, which primarily focuses on compliance and automating tax calculations, perpetual inventory systems optimize supply chain efficiency and streamline stock control. Explore how integrating perpetual inventory systems can transform operational efficiency and inventory accuracy in your organization.

Automated Tax Calculation

Inventory management systems streamline stock control by tracking quantities, orders, and deliveries in real-time, enhancing operational efficiency. Automated tax calculation technology integrates with sales and inventory platforms to accurately compute taxes based on jurisdictional rules, reducing errors and compliance risks. Explore the benefits of combining these technologies to optimize both inventory accuracy and tax compliance.

Inventory Valuation Methods

Inventory management systems automate tracking stock levels and movements, optimizing operational efficiency across just-in-time and FIFO methods. Tax technology ensures compliance by accurately calculating inventory valuation for tax reporting using methods like LIFO, weighted average cost, and specific identification. Explore deeper insights on how integrating both systems enhances financial accuracy and regulatory adherence.

Source and External Links

Inventory Management Systems: Ultimate Buying Guide - Shopify - Inventory management systems help businesses optimize stock levels, prevent stockouts and overselling, and improve multi-channel sales by centralizing inventory data, with key features including inventory monitoring, control, forecasting, purchase order generation, and multi-warehouse syncing.

What Is Inventory Management? Benefits, Types, & Techniques - NetSuite - NetSuite provides cloud-based inventory management solutions with features like automated replenishment, lot and serial tracking, multi-location planning, and real-time visibility to help businesses optimize inventory, reduce costs, and improve cash flow.

What is Inventory Management? - IBM - Inventory management tracks products across the supply chain using tools like barcodes and RFID, automates ordering and shipping, and offers analytics for forecasting demand, helping businesses maintain accurate inventory and improve efficiency.

dowidth.com

dowidth.com