Environmental Social Governance (ESG) integration focuses on evaluating a company's non-financial performance related to environmental impact, social responsibility, and governance practices to inform investment decisions. Sustainability accounting measures and reports on an organization's environmental and social effects alongside financial outcomes, emphasizing transparency and long-term value creation. Explore how these frameworks drive corporate accountability and strategic decision-making in modern accounting.

Why it is important

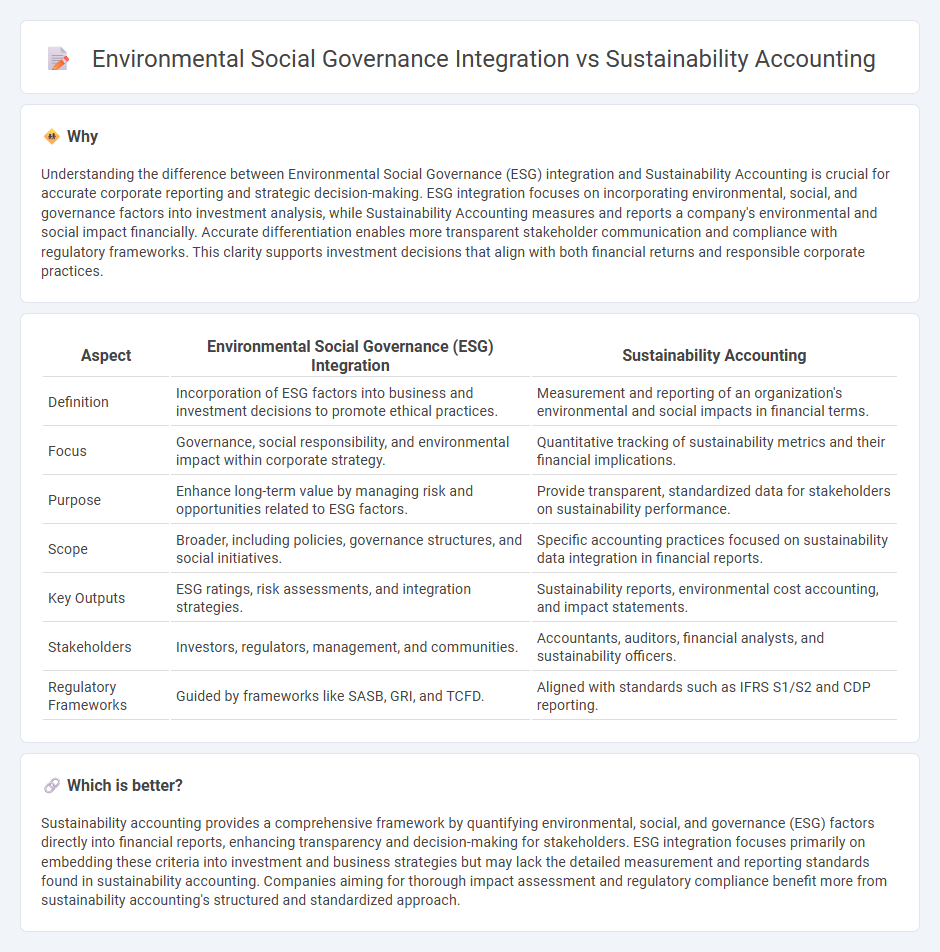

Understanding the difference between Environmental Social Governance (ESG) integration and Sustainability Accounting is crucial for accurate corporate reporting and strategic decision-making. ESG integration focuses on incorporating environmental, social, and governance factors into investment analysis, while Sustainability Accounting measures and reports a company's environmental and social impact financially. Accurate differentiation enables more transparent stakeholder communication and compliance with regulatory frameworks. This clarity supports investment decisions that align with both financial returns and responsible corporate practices.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Integration | Sustainability Accounting |

|---|---|---|

| Definition | Incorporation of ESG factors into business and investment decisions to promote ethical practices. | Measurement and reporting of an organization's environmental and social impacts in financial terms. |

| Focus | Governance, social responsibility, and environmental impact within corporate strategy. | Quantitative tracking of sustainability metrics and their financial implications. |

| Purpose | Enhance long-term value by managing risk and opportunities related to ESG factors. | Provide transparent, standardized data for stakeholders on sustainability performance. |

| Scope | Broader, including policies, governance structures, and social initiatives. | Specific accounting practices focused on sustainability data integration in financial reports. |

| Key Outputs | ESG ratings, risk assessments, and integration strategies. | Sustainability reports, environmental cost accounting, and impact statements. |

| Stakeholders | Investors, regulators, management, and communities. | Accountants, auditors, financial analysts, and sustainability officers. |

| Regulatory Frameworks | Guided by frameworks like SASB, GRI, and TCFD. | Aligned with standards such as IFRS S1/S2 and CDP reporting. |

Which is better?

Sustainability accounting provides a comprehensive framework by quantifying environmental, social, and governance (ESG) factors directly into financial reports, enhancing transparency and decision-making for stakeholders. ESG integration focuses primarily on embedding these criteria into investment and business strategies but may lack the detailed measurement and reporting standards found in sustainability accounting. Companies aiming for thorough impact assessment and regulatory compliance benefit more from sustainability accounting's structured and standardized approach.

Connection

Environmental, Social, and Governance (ESG) integration directly influences sustainability accounting by embedding non-financial performance metrics into traditional financial reporting frameworks. Sustainability accounting captures the environmental impact, social responsibility, and governance practices of organizations, enabling transparent measurement of ESG criteria. This connection enhances corporate accountability and informs investment decisions focused on long-term sustainable value creation.

Key Terms

Triple Bottom Line (TBL)

Sustainability accounting quantifies economic, environmental, and social impacts aligned with the Triple Bottom Line (TBL) framework, emphasizing measurable outcomes across profit, planet, and people dimensions. Environmental Social Governance (ESG) integration incorporates TBL principles into corporate strategies to enhance transparency and stakeholder trust through reporting standards such as GRI and SASB. Explore detailed methodologies to optimize business performance while driving sustainable value.

ESG Reporting

Sustainability accounting emphasizes quantifying environmental and social impacts through standardized metrics, while Environmental, Social, and Governance (ESG) integration incorporates these factors into broader investment and corporate decision-making frameworks. ESG reporting offers a comprehensive view by combining quantitative data with qualitative assessments, enabling stakeholders to evaluate long-term risks and opportunities tied to sustainability performance. Explore the latest methodologies and best practices to enhance your ESG reporting effectiveness.

Materiality Assessment

Sustainability accounting centers on quantifying environmental, social, and governance (ESG) impacts using precise metrics and reporting frameworks such as GRI and SASB. ESG integration emphasizes embedding materiality assessment into strategic decision-making to address stakeholders' primary concerns including climate risks, social equity, and corporate governance. Explore how aligning materiality assessment enhances both sustainability accounting rigor and ESG integration effectiveness.

Source and External Links

Sustainability accounting - Wikipedia - Sustainability accounting is a subcategory of financial accounting focused on disclosing non-financial information about a company's environmental, social, and economic performance to external stakeholders, often guided by frameworks like the Global Reporting Initiative (GRI) and emphasizing the triple bottom line (People, Planet, Profit).

Sustainability accounting: Using accounting to better society - Ohio University - Also known as ESG (Environmental, Social, and Governance) accounting, sustainability accounting involves measuring and reporting a company's broader impacts beyond financials, helping organizations set, track, and achieve sustainability goals while being held accountable by investors, governments, and the public.

What is sustainability accounting? What does ESG mean? We have answers - Carleton University - Sustainability accounting is the practice of measuring, analyzing, and transparently reporting a company's social and environmental impacts, using frameworks such as the Global Reporting Initiative to inform a wide range of stakeholders and support long-term sustainable business practices.

dowidth.com

dowidth.com