Real-time auditing leverages advanced technology to provide continuous monitoring of financial transactions, ensuring immediate detection of irregularities and enhancing accuracy. Compliance auditing, on the other hand, focuses on verifying adherence to regulatory standards and internal policies at specific intervals, emphasizing thorough documentation and risk mitigation. Explore the key differences and benefits of these auditing methods to optimize your organization's financial oversight.

Why it is important

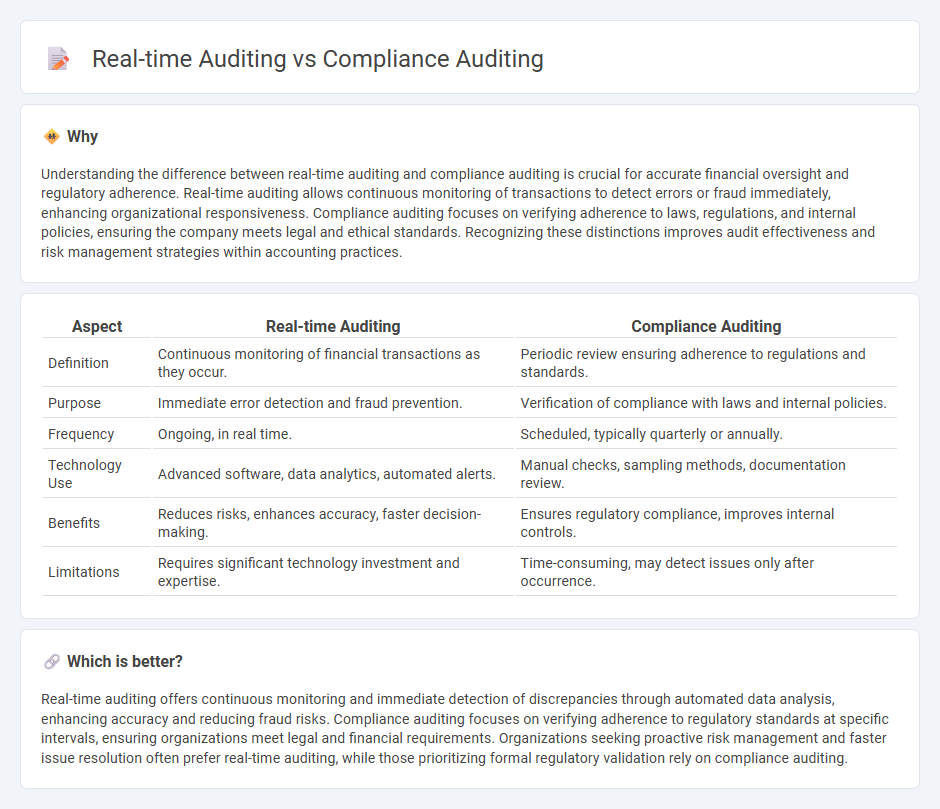

Understanding the difference between real-time auditing and compliance auditing is crucial for accurate financial oversight and regulatory adherence. Real-time auditing allows continuous monitoring of transactions to detect errors or fraud immediately, enhancing organizational responsiveness. Compliance auditing focuses on verifying adherence to laws, regulations, and internal policies, ensuring the company meets legal and ethical standards. Recognizing these distinctions improves audit effectiveness and risk management strategies within accounting practices.

Comparison Table

| Aspect | Real-time Auditing | Compliance Auditing |

|---|---|---|

| Definition | Continuous monitoring of financial transactions as they occur. | Periodic review ensuring adherence to regulations and standards. |

| Purpose | Immediate error detection and fraud prevention. | Verification of compliance with laws and internal policies. |

| Frequency | Ongoing, in real time. | Scheduled, typically quarterly or annually. |

| Technology Use | Advanced software, data analytics, automated alerts. | Manual checks, sampling methods, documentation review. |

| Benefits | Reduces risks, enhances accuracy, faster decision-making. | Ensures regulatory compliance, improves internal controls. |

| Limitations | Requires significant technology investment and expertise. | Time-consuming, may detect issues only after occurrence. |

Which is better?

Real-time auditing offers continuous monitoring and immediate detection of discrepancies through automated data analysis, enhancing accuracy and reducing fraud risks. Compliance auditing focuses on verifying adherence to regulatory standards at specific intervals, ensuring organizations meet legal and financial requirements. Organizations seeking proactive risk management and faster issue resolution often prefer real-time auditing, while those prioritizing formal regulatory validation rely on compliance auditing.

Connection

Real-time auditing utilizes continuous data monitoring to detect discrepancies instantly, enhancing the effectiveness of compliance auditing by ensuring that financial activities adhere to regulatory standards consistently. This integration reduces the risk of non-compliance by enabling immediate corrective actions and maintaining accurate audit trails. Organizations implementing real-time auditing benefit from improved transparency and regulatory compliance, minimizing potential penalties and financial risks.

Key Terms

Regulatory Standards (Compliance Auditing)

Compliance auditing systematically verifies adherence to regulatory standards such as GDPR, HIPAA, and SOX, ensuring organizational processes meet established legal requirements. Real-time auditing offers continuous monitoring but may lack the depth of historical compliance verification provided by traditional audits. Explore the advantages of each approach to determine the best fit for your regulatory compliance strategy.

Continuous Monitoring (Real-time Auditing)

Compliance auditing typically involves periodic reviews to ensure adherence to regulations and internal policies, focusing on historical data analysis. Real-time auditing emphasizes continuous monitoring, leveraging automated tools and real-time data feeds to detect anomalies and compliance issues immediately, enhancing risk management and operational efficiency. Explore how continuous monitoring transforms auditing practices and strengthens organizational compliance frameworks.

Audit Trail

Compliance auditing emphasizes maintaining a comprehensive audit trail to ensure regulatory requirements are met by documenting every transaction and change systematically over time. Real-time auditing enhances this process by continuously monitoring and recording activities, enabling instant detection of discrepancies and immediate corrective actions. Explore deeper insights into how audit trails transform compliance and risk management in dynamic environments.

Source and External Links

What is Compliance Audit: A Comprehensive Guide | MetricStream - A compliance audit is a formal review to determine if an organization follows regulatory guidelines and internal policies, aiming to identify non-compliance, mitigate risks, and improve operations through planning, execution, reporting, and follow-up steps.

Compliance Audit: Definition, Types, and What to Expect - AuditBoard - Compliance audits are independent evaluations of an organization's adherence to regulatory frameworks, involving evidence collection and interviews to ensure effective internal controls and regulatory compliance.

What is a compliance audit? Definition, strategy & reporting - Diligent - Compliance audits independently assess whether an organization is following external laws, regulations, and internal policies, focusing on the effectiveness of internal controls and providing documented evidence of compliance.

dowidth.com

dowidth.com