Tax technology streamlines compliance, automates tax calculations, and ensures accurate filing through advanced software solutions designed to handle complex tax codes and regulations. Expense management software focuses on tracking, approving, and reimbursing employee expenses efficiently, providing real-time visibility into spending patterns and budget adherence. Discover how integrating both tools can optimize financial operations and enhance overall accounting accuracy.

Why it is important

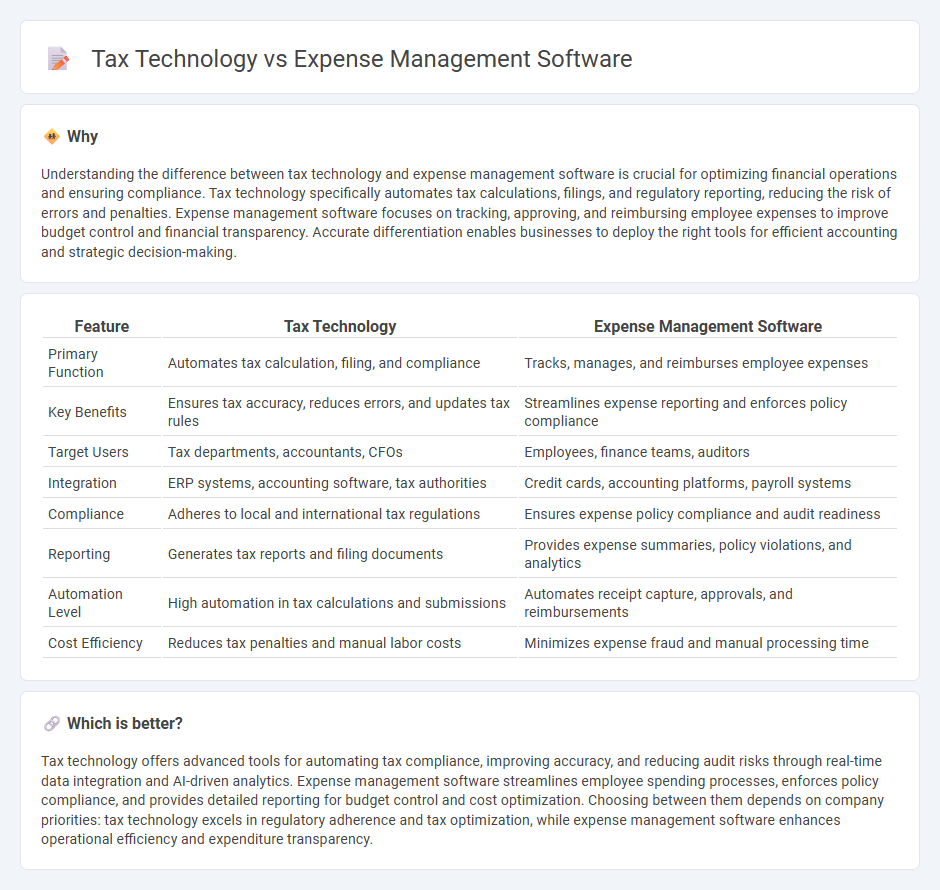

Understanding the difference between tax technology and expense management software is crucial for optimizing financial operations and ensuring compliance. Tax technology specifically automates tax calculations, filings, and regulatory reporting, reducing the risk of errors and penalties. Expense management software focuses on tracking, approving, and reimbursing employee expenses to improve budget control and financial transparency. Accurate differentiation enables businesses to deploy the right tools for efficient accounting and strategic decision-making.

Comparison Table

| Feature | Tax Technology | Expense Management Software |

|---|---|---|

| Primary Function | Automates tax calculation, filing, and compliance | Tracks, manages, and reimburses employee expenses |

| Key Benefits | Ensures tax accuracy, reduces errors, and updates tax rules | Streamlines expense reporting and enforces policy compliance |

| Target Users | Tax departments, accountants, CFOs | Employees, finance teams, auditors |

| Integration | ERP systems, accounting software, tax authorities | Credit cards, accounting platforms, payroll systems |

| Compliance | Adheres to local and international tax regulations | Ensures expense policy compliance and audit readiness |

| Reporting | Generates tax reports and filing documents | Provides expense summaries, policy violations, and analytics |

| Automation Level | High automation in tax calculations and submissions | Automates receipt capture, approvals, and reimbursements |

| Cost Efficiency | Reduces tax penalties and manual labor costs | Minimizes expense fraud and manual processing time |

Which is better?

Tax technology offers advanced tools for automating tax compliance, improving accuracy, and reducing audit risks through real-time data integration and AI-driven analytics. Expense management software streamlines employee spending processes, enforces policy compliance, and provides detailed reporting for budget control and cost optimization. Choosing between them depends on company priorities: tax technology excels in regulatory adherence and tax optimization, while expense management software enhances operational efficiency and expenditure transparency.

Connection

Tax technology and expense management software are closely connected through their role in streamlining financial data accuracy and compliance. Expense management software automates the tracking and categorization of costs, providing precise records essential for tax reporting and deduction calculations. Integrating tax technology enhances this process by ensuring real-time tax rule updates and seamless filing, reducing errors and optimizing tax liabilities.

Key Terms

Cost Tracking

Expense management software streamlines cost tracking by automating expense reports, enforcing spending policies, and providing real-time visibility into company expenditures. Tax technology specializes in accurate tax compliance, deduction optimization, and regulatory reporting but often lacks comprehensive cost tracking capabilities. Discover how integrating both solutions can enhance your financial oversight and cost control strategies.

Compliance Automation

Expense management software streamlines the tracking, approval, and reporting of business expenses, ensuring adherence to internal policies and regulatory requirements. Tax technology leverages automation to enhance compliance by calculating tax obligations, managing filings, and reducing errors in real-time across jurisdictions. Explore how compliance automation in both solutions can transform your financial operations and minimize risk.

Tax Reporting

Expense management software streamlines the tracking and approval of business expenditures, ensuring real-time visibility and compliance with organizational budgets. Tax technology, particularly in tax reporting, automates the accurate calculation, filing, and documentation of taxes, reducing errors and enhancing regulatory adherence. Explore how integrating these solutions can optimize your company's financial workflows and tax compliance processes.

Source and External Links

Best Expense Management Software Reviews 2025 - Gartner - Offers comparisons and reviews of top expense management software to help businesses choose the right solution for their needs.

Best Expense Management Software - Receipt & Expense - Expensify - Expensify is a simple yet powerful expense management software that simplifies receipt tracking and expense reporting for businesses of all sizes.

Expense Report & Management Software | Paychex - Provides cloud-based expense management integrated with payroll and accounting systems to streamline expense reporting and reimbursement processes.

dowidth.com

dowidth.com