Forensic analytics involves examining financial data to detect fraud, errors, or irregularities, using advanced statistical techniques and data mining tools. Budgeting focuses on planning and allocating resources to control costs and guide financial decisions within an organization. Explore the distinct roles of forensic analytics and budgeting to enhance financial management and accountability.

Why it is important

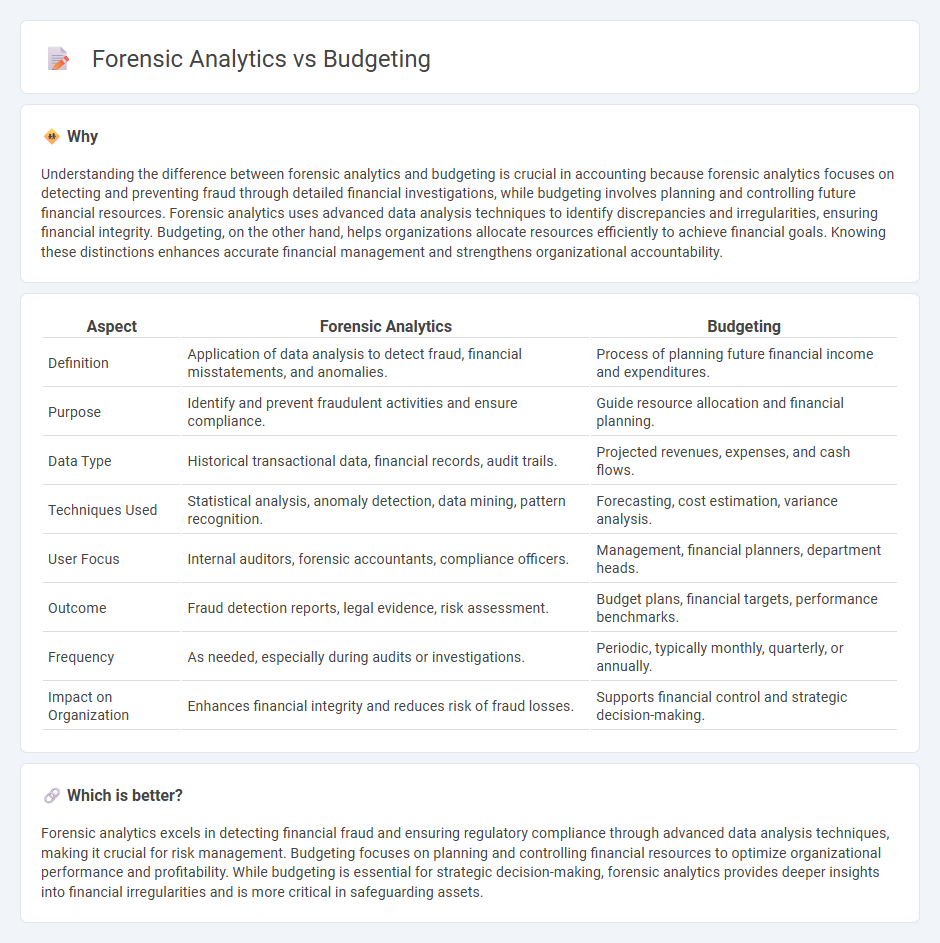

Understanding the difference between forensic analytics and budgeting is crucial in accounting because forensic analytics focuses on detecting and preventing fraud through detailed financial investigations, while budgeting involves planning and controlling future financial resources. Forensic analytics uses advanced data analysis techniques to identify discrepancies and irregularities, ensuring financial integrity. Budgeting, on the other hand, helps organizations allocate resources efficiently to achieve financial goals. Knowing these distinctions enhances accurate financial management and strengthens organizational accountability.

Comparison Table

| Aspect | Forensic Analytics | Budgeting |

|---|---|---|

| Definition | Application of data analysis to detect fraud, financial misstatements, and anomalies. | Process of planning future financial income and expenditures. |

| Purpose | Identify and prevent fraudulent activities and ensure compliance. | Guide resource allocation and financial planning. |

| Data Type | Historical transactional data, financial records, audit trails. | Projected revenues, expenses, and cash flows. |

| Techniques Used | Statistical analysis, anomaly detection, data mining, pattern recognition. | Forecasting, cost estimation, variance analysis. |

| User Focus | Internal auditors, forensic accountants, compliance officers. | Management, financial planners, department heads. |

| Outcome | Fraud detection reports, legal evidence, risk assessment. | Budget plans, financial targets, performance benchmarks. |

| Frequency | As needed, especially during audits or investigations. | Periodic, typically monthly, quarterly, or annually. |

| Impact on Organization | Enhances financial integrity and reduces risk of fraud losses. | Supports financial control and strategic decision-making. |

Which is better?

Forensic analytics excels in detecting financial fraud and ensuring regulatory compliance through advanced data analysis techniques, making it crucial for risk management. Budgeting focuses on planning and controlling financial resources to optimize organizational performance and profitability. While budgeting is essential for strategic decision-making, forensic analytics provides deeper insights into financial irregularities and is more critical in safeguarding assets.

Connection

Forensic analytics enhances budgeting accuracy by identifying discrepancies and potential fraud through detailed financial data examination. Integrating forensic techniques in budgeting processes ensures more transparent allocation of resources and strengthens internal controls. This connection improves overall financial integrity and aids in strategic decision-making within organizations.

Key Terms

**Budgeting:**

Budgeting involves creating a financial plan that outlines expected revenues and expenses to manage resources effectively and ensure organizational goals are met. It uses historical data, forecasting techniques, and variance analysis to allocate funds, control costs, and optimize cash flow. Discover how precise budgeting strategies can enhance financial stability and decision-making in your business.

Forecasting

Budgeting relies on historical data and planned expenditures to create financial forecasts that guide organizational spending and resource allocation. Forensic analytics enhances forecasting accuracy by detecting anomalies and patterns that indicate potential risks or fraud, ensuring more reliable financial projections. Explore how combining budgeting and forensic analytics can improve your forecasting processes in dynamic business environments.

Variance Analysis

Budgeting involves forecasting financial performance and setting benchmarks, while forensic analytics focuses on investigating discrepancies and anomalies through detailed variance analysis. Variance analysis compares actual financial outcomes against budgets to identify irregularities, deviations, and potential fraud. Explore our comprehensive guide to master variance analysis techniques in budgeting and forensic analytics.

Source and External Links

Your guide to creating a budget plan - Better Money Habits - Budgeting starts by calculating your net income, tracking your spending by categorizing expenses into fixed and variable, then setting realistic goals to create a manageable budget plan that puts you in control of your money.

Free Budget Template and Tips For Getting Started - NerdWallet - Use a budget planner with the 50/30/20 rule to allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment, starting by gathering your take-home pay, fixed expenses, variable costs, and debts for accurate budgeting.

How to Budget Money: A Step-By-Step Guide - NerdWallet - Key budgeting priorities include building an emergency fund, contributing enough to get a 401(k) match, and paying off high-interest debt, alongside choosing a budgeting system and tracking your progress to improve financial health.

dowidth.com

dowidth.com