Continuous audit involves real-time or frequent examination of financial transactions and controls using automated tools to ensure ongoing compliance and accuracy, enhancing risk management and operational efficiency. Statutory audit, mandated by law, is a periodic and comprehensive review of financial statements conducted by external auditors to verify their conformity with legal and regulatory standards. Explore the key differences and benefits of continuous audit versus statutory audit to optimize your organization's financial oversight.

Why it is important

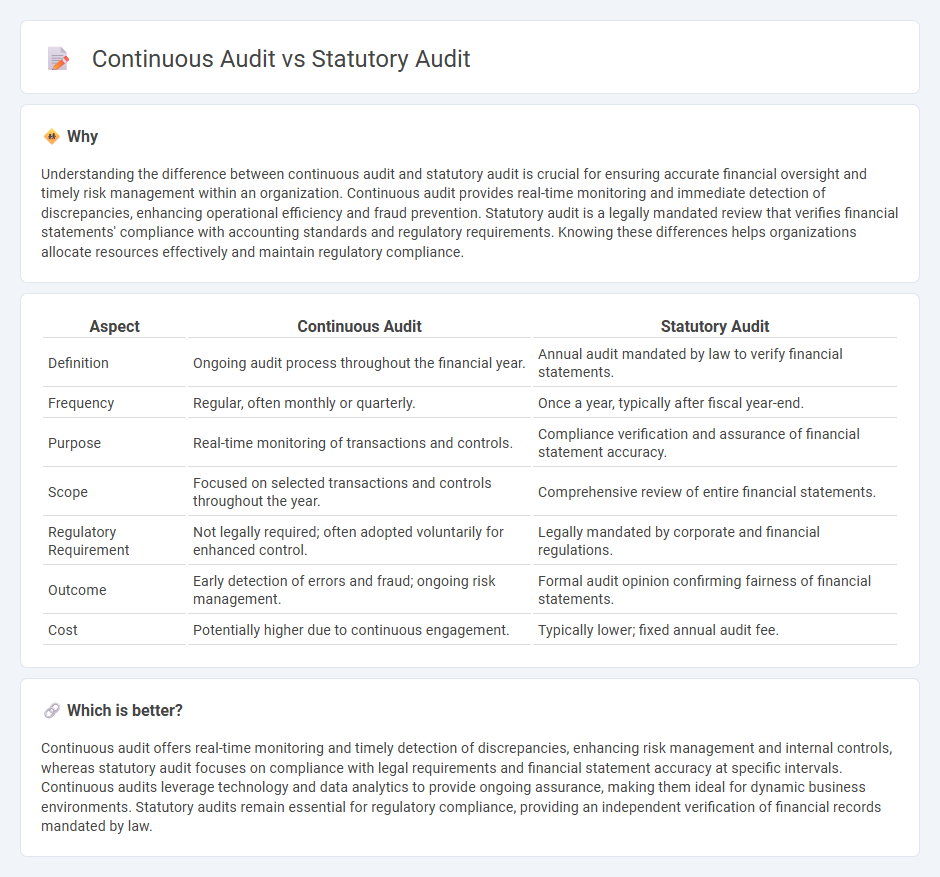

Understanding the difference between continuous audit and statutory audit is crucial for ensuring accurate financial oversight and timely risk management within an organization. Continuous audit provides real-time monitoring and immediate detection of discrepancies, enhancing operational efficiency and fraud prevention. Statutory audit is a legally mandated review that verifies financial statements' compliance with accounting standards and regulatory requirements. Knowing these differences helps organizations allocate resources effectively and maintain regulatory compliance.

Comparison Table

| Aspect | Continuous Audit | Statutory Audit |

|---|---|---|

| Definition | Ongoing audit process throughout the financial year. | Annual audit mandated by law to verify financial statements. |

| Frequency | Regular, often monthly or quarterly. | Once a year, typically after fiscal year-end. |

| Purpose | Real-time monitoring of transactions and controls. | Compliance verification and assurance of financial statement accuracy. |

| Scope | Focused on selected transactions and controls throughout the year. | Comprehensive review of entire financial statements. |

| Regulatory Requirement | Not legally required; often adopted voluntarily for enhanced control. | Legally mandated by corporate and financial regulations. |

| Outcome | Early detection of errors and fraud; ongoing risk management. | Formal audit opinion confirming fairness of financial statements. |

| Cost | Potentially higher due to continuous engagement. | Typically lower; fixed annual audit fee. |

Which is better?

Continuous audit offers real-time monitoring and timely detection of discrepancies, enhancing risk management and internal controls, whereas statutory audit focuses on compliance with legal requirements and financial statement accuracy at specific intervals. Continuous audits leverage technology and data analytics to provide ongoing assurance, making them ideal for dynamic business environments. Statutory audits remain essential for regulatory compliance, providing an independent verification of financial records mandated by law.

Connection

Continuous audit utilizes advanced technology to provide real-time transaction monitoring, which enhances the efficiency of statutory audits by delivering up-to-date financial data and identifying discrepancies early. Statutory audit relies on these continuous audit findings to ensure compliance with legal accounting standards, improve audit accuracy, and reduce the risk of financial misstatements. This integration strengthens overall audit quality, supports timely financial reporting, and ensures adherence to regulatory frameworks such as GAAP or IFRS.

Key Terms

Legal Requirement

Statutory audit is a legally mandated examination of a company's financial statements to ensure compliance with statutory regulations and provide stakeholders with an opinion on financial accuracy. Continuous audit refers to an ongoing, real-time review of financial transactions and controls aimed at early detection of errors or fraud but is not legally required. Explore detailed insights into the legal distinctions and operational benefits of statutory and continuous audits.

Frequency of Examination

Statutory audits are conducted periodically, typically annually, to ensure compliance with financial regulations and standards. Continuous audits involve ongoing examination throughout the fiscal period, providing real-time insights and immediate issue detection. Explore more to understand how audit frequency impacts financial accuracy and risk management.

Period Covered

Statutory audits typically cover a fixed financial period, often annually, assessing compliance and accuracy of financial statements within that timeframe. Continuous audits, by contrast, involve ongoing assessment and monitoring of transactions and controls throughout the fiscal year, providing real-time insights and early detection of issues. Explore further to understand the impact of audit timing on financial reliability and risk management.

Source and External Links

What is a Statutory Audit? - A statutory audit is a legally required review of a company's financial statements to verify their accuracy and completeness, mandated by law for certain public, private, and public sector entities to protect stakeholders and ensure reliable financial reporting.

Statutory audits demystified: what to expect & how to prepare - It is a legally required independent audit that not only ensures compliance but improves credibility, internal controls, risk mitigation, and fraud prevention for companies that meet specific thresholds or statutory requirements.

Statutory Audit: Definition, Procedure, Types, and FAQs - The statutory audit process involves understanding the business, assessing controls, substantive testing, verification of assets and liabilities, and issuing an audit report, with mandatory audits required annually for all companies under laws such as India's Companies Act, 2013.

dowidth.com

dowidth.com