Cryptocurrency auditing focuses on verifying digital asset transactions, wallet security, and blockchain integrity to ensure accurate financial reporting within decentralized systems. Compliance auditing examines adherence to regulatory frameworks, including Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, to mitigate legal and financial risks. Explore the nuances between these auditing approaches to enhance your understanding of modern financial oversight.

Why it is important

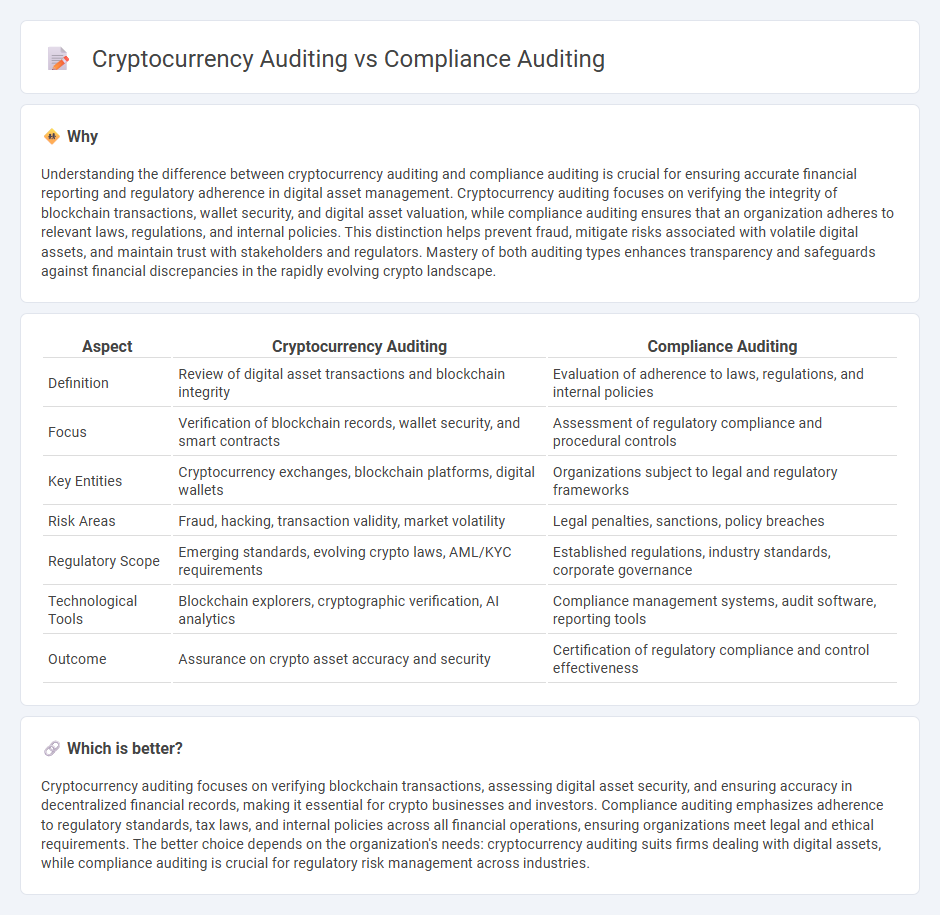

Understanding the difference between cryptocurrency auditing and compliance auditing is crucial for ensuring accurate financial reporting and regulatory adherence in digital asset management. Cryptocurrency auditing focuses on verifying the integrity of blockchain transactions, wallet security, and digital asset valuation, while compliance auditing ensures that an organization adheres to relevant laws, regulations, and internal policies. This distinction helps prevent fraud, mitigate risks associated with volatile digital assets, and maintain trust with stakeholders and regulators. Mastery of both auditing types enhances transparency and safeguards against financial discrepancies in the rapidly evolving crypto landscape.

Comparison Table

| Aspect | Cryptocurrency Auditing | Compliance Auditing |

|---|---|---|

| Definition | Review of digital asset transactions and blockchain integrity | Evaluation of adherence to laws, regulations, and internal policies |

| Focus | Verification of blockchain records, wallet security, and smart contracts | Assessment of regulatory compliance and procedural controls |

| Key Entities | Cryptocurrency exchanges, blockchain platforms, digital wallets | Organizations subject to legal and regulatory frameworks |

| Risk Areas | Fraud, hacking, transaction validity, market volatility | Legal penalties, sanctions, policy breaches |

| Regulatory Scope | Emerging standards, evolving crypto laws, AML/KYC requirements | Established regulations, industry standards, corporate governance |

| Technological Tools | Blockchain explorers, cryptographic verification, AI analytics | Compliance management systems, audit software, reporting tools |

| Outcome | Assurance on crypto asset accuracy and security | Certification of regulatory compliance and control effectiveness |

Which is better?

Cryptocurrency auditing focuses on verifying blockchain transactions, assessing digital asset security, and ensuring accuracy in decentralized financial records, making it essential for crypto businesses and investors. Compliance auditing emphasizes adherence to regulatory standards, tax laws, and internal policies across all financial operations, ensuring organizations meet legal and ethical requirements. The better choice depends on the organization's needs: cryptocurrency auditing suits firms dealing with digital assets, while compliance auditing is crucial for regulatory risk management across industries.

Connection

Cryptocurrency auditing and compliance auditing are interconnected through their shared focus on verifying accuracy, transparency, and adherence to regulations in financial transactions. Cryptocurrency auditing ensures digital assets are accurately recorded and safeguarded, while compliance auditing confirms that organizations meet legal requirements, including anti-money laundering (AML) and know-your-customer (KYC) standards. Both types of auditing leverage blockchain technology insights and regulatory frameworks to enhance accountability and reduce financial risk.

Key Terms

**Compliance Auditing:**

Compliance auditing ensures organizations adhere to regulatory standards, internal policies, and industry-specific guidelines by systematically evaluating financial records, operational processes, and controls. This type of audit emphasizes risk management, legal requirements, and corporate governance to maintain transparency and accountability. Discover more about how compliance auditing safeguards business integrity and fosters regulatory trust.

Regulatory Standards

Compliance auditing evaluates adherence to established legal and regulatory frameworks across various industries, focusing on internal controls and risk management to ensure accountability. Cryptocurrency auditing targets blockchain transactions and digital asset management, emphasizing compliance with evolving financial regulations and anti-money laundering (AML) standards specific to decentralized environments. Discover detailed insights on how regulatory standards shape auditing practices in traditional and crypto sectors.

Internal Controls

Compliance auditing emphasizes evaluating adherence to laws and internal controls designed to ensure operational integrity and regulatory compliance across industries. Cryptocurrency auditing specifically targets blockchain-based transactions and smart contracts, requiring specialized knowledge of decentralized ledger technologies and risk management in digital asset security. Explore how integrating these auditing approaches enhances financial transparency and security in evolving digital economies.

Source and External Links

What is a compliance audit? Definition, strategy & reporting - A compliance audit is an independent evaluation to ensure an organization follows external rules, regulations, laws, and internal policies, assessing both adherence and the effectiveness of internal controls.

What is compliance audit? | Definition from TechTarget - A compliance audit is a comprehensive review of an organization's adherence to regulatory guidelines, evaluating the strength of its compliance preparations, security policies, and risk management procedures.

Compliance Audit: Definition, Types, and What to Expect - Compliance audits are formal, independent assessments of an organization's adherence to specific frameworks or regulatory requirements, resulting in a report or opinion on compliance status.

dowidth.com

dowidth.com