Outsourced bookkeeping services offer specialized financial record-keeping by external professionals, enhancing flexibility and cost-efficiency for businesses with varying transaction volumes. Shared service centers centralize accounting functions within an organization or group, streamlining processes and ensuring consistency across multiple departments or subsidiaries. Explore the benefits and differences of these approaches to optimize your company's accounting operations.

Why it is important

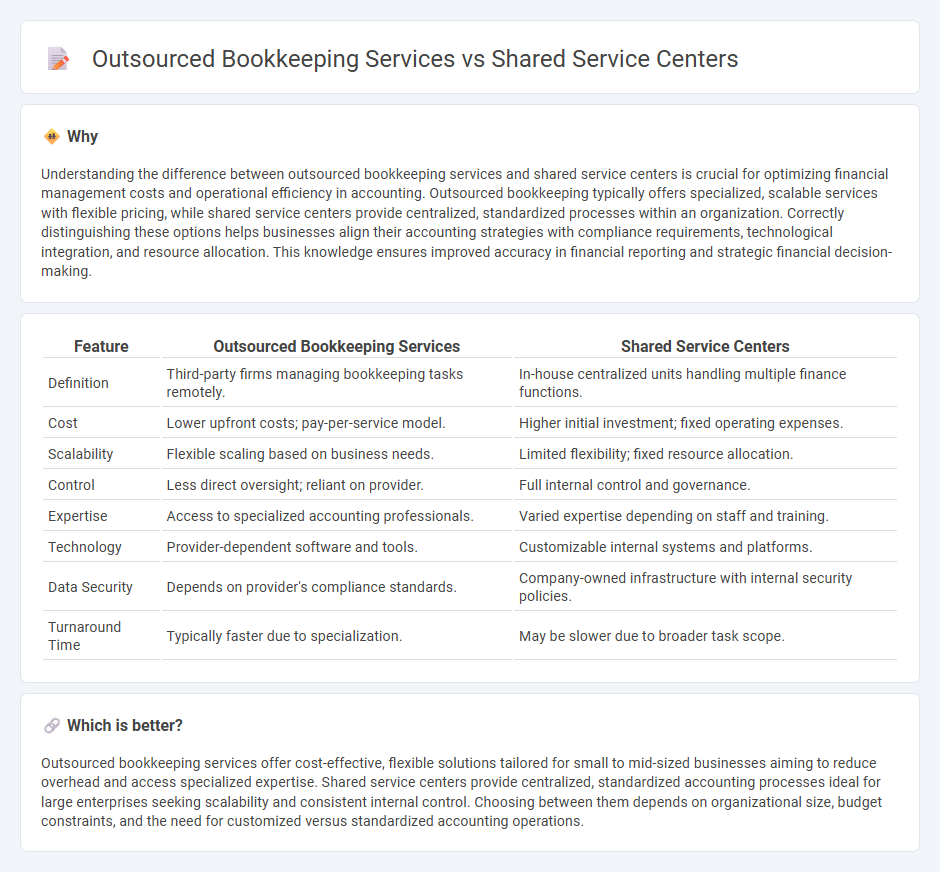

Understanding the difference between outsourced bookkeeping services and shared service centers is crucial for optimizing financial management costs and operational efficiency in accounting. Outsourced bookkeeping typically offers specialized, scalable services with flexible pricing, while shared service centers provide centralized, standardized processes within an organization. Correctly distinguishing these options helps businesses align their accounting strategies with compliance requirements, technological integration, and resource allocation. This knowledge ensures improved accuracy in financial reporting and strategic financial decision-making.

Comparison Table

| Feature | Outsourced Bookkeeping Services | Shared Service Centers |

|---|---|---|

| Definition | Third-party firms managing bookkeeping tasks remotely. | In-house centralized units handling multiple finance functions. |

| Cost | Lower upfront costs; pay-per-service model. | Higher initial investment; fixed operating expenses. |

| Scalability | Flexible scaling based on business needs. | Limited flexibility; fixed resource allocation. |

| Control | Less direct oversight; reliant on provider. | Full internal control and governance. |

| Expertise | Access to specialized accounting professionals. | Varied expertise depending on staff and training. |

| Technology | Provider-dependent software and tools. | Customizable internal systems and platforms. |

| Data Security | Depends on provider's compliance standards. | Company-owned infrastructure with internal security policies. |

| Turnaround Time | Typically faster due to specialization. | May be slower due to broader task scope. |

Which is better?

Outsourced bookkeeping services offer cost-effective, flexible solutions tailored for small to mid-sized businesses aiming to reduce overhead and access specialized expertise. Shared service centers provide centralized, standardized accounting processes ideal for large enterprises seeking scalability and consistent internal control. Choosing between them depends on organizational size, budget constraints, and the need for customized versus standardized accounting operations.

Connection

Outsourced bookkeeping services and shared service centers both aim to streamline financial processes by centralizing accounting tasks, reducing costs, and enhancing accuracy. Shared service centers often incorporate outsourced bookkeeping as a component to handle transactional accounting functions efficiently. Integrating these solutions enables organizations to leverage specialized expertise and technology while maintaining consistent financial reporting and compliance.

Key Terms

Centralization

Shared service centers centralize bookkeeping functions within an organization, streamlining processes and reducing redundancy by consolidating financial data management across multiple departments. Outsourced bookkeeping services, by contrast, delegate these tasks to external providers, allowing companies to benefit from specialized expertise without internal infrastructure investment. Explore the advantages and best practices of each approach to determine the optimal centralization strategy for your business.

Cost Efficiency

Shared Service Centers centralize bookkeeping within an organization, reducing redundant processes and achieving economies of scale, which generally leads to lower operational costs. Outsourced bookkeeping services offer flexibility and access to specialized expertise without the need for in-house staffing but may involve higher per-transaction fees and less control over processes. Explore the detailed cost comparison and strategic benefits to determine the optimal choice for your business needs.

Control

Shared service centers provide centralized control over bookkeeping processes by integrating them within a company's internal framework, ensuring consistent compliance with corporate policies and enhanced data security. Outsourced bookkeeping services, while offering cost efficiency and access to specialized expertise, may present challenges in maintaining direct oversight and aligning with specific organizational controls. Discover how to balance control and efficiency by exploring the advantages and limitations of each service model.

Source and External Links

Shared services center - Wikipedia - A shared services center is an organizational entity that centralizes and manages specific operational tasks--such as accounting, human resources, payroll, IT, legal, compliance, purchasing, and security--for multiple business units, aiming to reduce costs and increase efficiency through specialization and economies of scale.

The ABCs of SSCs: Shared Services Centers Explained - SPARK Blog - Shared services centers centralize transactional and decision-support services for internal clients, using service level agreements (SLAs) and key performance indicators (KPIs) to define and measure service delivery, often charging business units for the services provided.

What is a shared services center? - ProcessMaker - Shared service centers act as centralized hubs within organizations, streamlining operations by providing specialized services to various departments, eliminating redundancy, and allowing businesses to focus on their core activities while fostering collaboration and innovation.

dowidth.com

dowidth.com