Digital asset valuation focuses on determining the market value of cryptocurrencies, NFTs, and other blockchain-based assets that exhibit high volatility and lack standardized appraisal methods. Fixed asset revaluation involves adjusting the book value of tangible assets like machinery, buildings, and land to reflect current market conditions or depreciation over time. Explore the key differences and methodologies in digital asset valuation versus fixed asset revaluation to sharpen your accounting insights.

Why it is important

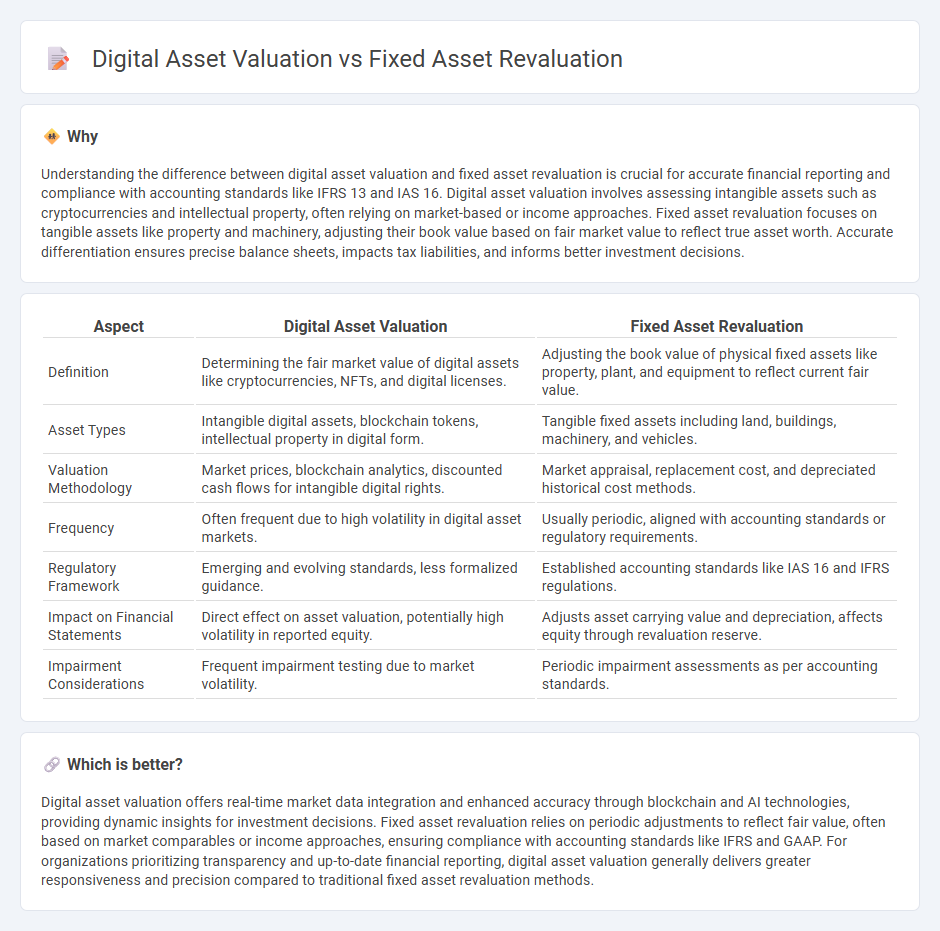

Understanding the difference between digital asset valuation and fixed asset revaluation is crucial for accurate financial reporting and compliance with accounting standards like IFRS 13 and IAS 16. Digital asset valuation involves assessing intangible assets such as cryptocurrencies and intellectual property, often relying on market-based or income approaches. Fixed asset revaluation focuses on tangible assets like property and machinery, adjusting their book value based on fair market value to reflect true asset worth. Accurate differentiation ensures precise balance sheets, impacts tax liabilities, and informs better investment decisions.

Comparison Table

| Aspect | Digital Asset Valuation | Fixed Asset Revaluation |

|---|---|---|

| Definition | Determining the fair market value of digital assets like cryptocurrencies, NFTs, and digital licenses. | Adjusting the book value of physical fixed assets like property, plant, and equipment to reflect current fair value. |

| Asset Types | Intangible digital assets, blockchain tokens, intellectual property in digital form. | Tangible fixed assets including land, buildings, machinery, and vehicles. |

| Valuation Methodology | Market prices, blockchain analytics, discounted cash flows for intangible digital rights. | Market appraisal, replacement cost, and depreciated historical cost methods. |

| Frequency | Often frequent due to high volatility in digital asset markets. | Usually periodic, aligned with accounting standards or regulatory requirements. |

| Regulatory Framework | Emerging and evolving standards, less formalized guidance. | Established accounting standards like IAS 16 and IFRS regulations. |

| Impact on Financial Statements | Direct effect on asset valuation, potentially high volatility in reported equity. | Adjusts asset carrying value and depreciation, affects equity through revaluation reserve. |

| Impairment Considerations | Frequent impairment testing due to market volatility. | Periodic impairment assessments as per accounting standards. |

Which is better?

Digital asset valuation offers real-time market data integration and enhanced accuracy through blockchain and AI technologies, providing dynamic insights for investment decisions. Fixed asset revaluation relies on periodic adjustments to reflect fair value, often based on market comparables or income approaches, ensuring compliance with accounting standards like IFRS and GAAP. For organizations prioritizing transparency and up-to-date financial reporting, digital asset valuation generally delivers greater responsiveness and precision compared to traditional fixed asset revaluation methods.

Connection

Digital asset valuation and fixed asset revaluation are connected through their roles in updating the recorded value of assets on a company's balance sheet, ensuring accurate financial reporting and compliance with accounting standards. Both processes involve assessing current market values or fair values to reflect changes such as depreciation, impairment, or market fluctuations. Integrating digital asset valuation tools with fixed asset revaluation methods enhances precision and efficiency in asset management and financial analysis.

Key Terms

Fair Value

Fixed asset revaluation involves adjusting the book value of tangible assets like machinery and property to reflect their current market value, ensuring financial statements present accurate and updated fair values. Digital asset valuation, on the other hand, deals with intangible assets such as cryptocurrencies, NFTs, and digital licenses, requiring specialized models to capture market volatility and technological factors impacting fair value. Explore the nuances and methodologies behind fair value assessments for both asset types to enhance your financial accuracy and strategic planning.

Depreciation/Amortization

Fixed asset revaluation adjusts the book value of tangible assets like machinery or buildings, impacting depreciation schedules by recalculating asset life and residual value. Digital asset valuation involves estimating the worth of intangible assets such as software or cryptocurrencies, where amortization reflects the gradual consumption of their economic benefits. Explore how these valuation methods influence financial statements and tax obligations.

Impairment

Fixed asset revaluation involves adjusting the book value of tangible assets like machinery and buildings to reflect current market value, often considering impairment losses that reduce asset carrying amounts. Digital asset valuation focuses on intangible assets such as cryptocurrencies or intellectual property, where impairment assessments require specialized models due to volatility and lack of physical form. Explore detailed methodologies and impacts on financial statements to understand these valuation differences and impairment considerations better.

Source and External Links

Assets Revaluation - Asset revaluation adjusts the value of a fixed asset to its current market value, which can be crucial for business sales or mergers.

Overview of Revaluing Assets - Revaluation records assets at their fair market value, differing from depreciation which is tied to use over time.

Revalue Fixed Assets - Revaluation involves appreciations, write-downs, or adjustments to reflect changes in asset values over time.

dowidth.com

dowidth.com