Integrated reporting combines financial and non-financial data to provide a comprehensive view of a company's value creation over time, incorporating environmental, social, and governance factors alongside traditional financial metrics. Management commentary focuses on qualitative narrative that explains financial results, business strategy, risks, and future outlook, offering critical context to stakeholders for decision-making. Explore how these reporting approaches enhance corporate transparency and stakeholder communication.

Why it is important

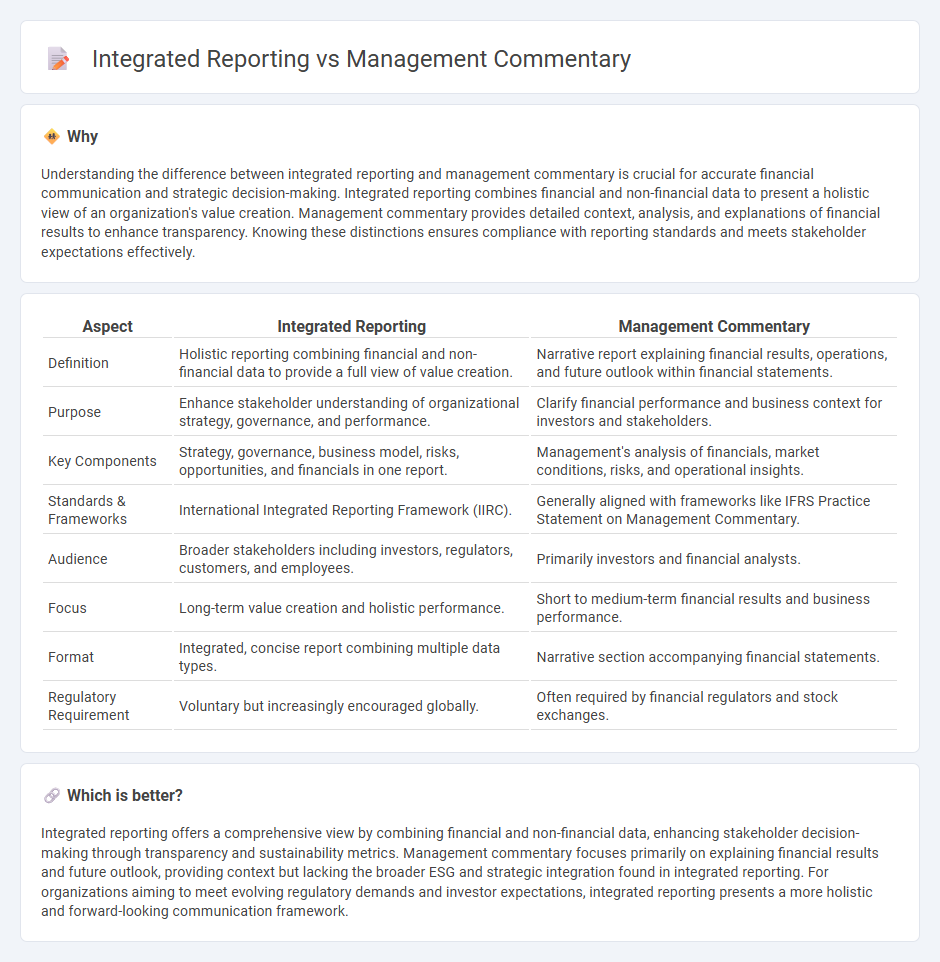

Understanding the difference between integrated reporting and management commentary is crucial for accurate financial communication and strategic decision-making. Integrated reporting combines financial and non-financial data to present a holistic view of an organization's value creation. Management commentary provides detailed context, analysis, and explanations of financial results to enhance transparency. Knowing these distinctions ensures compliance with reporting standards and meets stakeholder expectations effectively.

Comparison Table

| Aspect | Integrated Reporting | Management Commentary |

|---|---|---|

| Definition | Holistic reporting combining financial and non-financial data to provide a full view of value creation. | Narrative report explaining financial results, operations, and future outlook within financial statements. |

| Purpose | Enhance stakeholder understanding of organizational strategy, governance, and performance. | Clarify financial performance and business context for investors and stakeholders. |

| Key Components | Strategy, governance, business model, risks, opportunities, and financials in one report. | Management's analysis of financials, market conditions, risks, and operational insights. |

| Standards & Frameworks | International Integrated Reporting Framework (IIRC). | Generally aligned with frameworks like IFRS Practice Statement on Management Commentary. |

| Audience | Broader stakeholders including investors, regulators, customers, and employees. | Primarily investors and financial analysts. |

| Focus | Long-term value creation and holistic performance. | Short to medium-term financial results and business performance. |

| Format | Integrated, concise report combining multiple data types. | Narrative section accompanying financial statements. |

| Regulatory Requirement | Voluntary but increasingly encouraged globally. | Often required by financial regulators and stock exchanges. |

Which is better?

Integrated reporting offers a comprehensive view by combining financial and non-financial data, enhancing stakeholder decision-making through transparency and sustainability metrics. Management commentary focuses primarily on explaining financial results and future outlook, providing context but lacking the broader ESG and strategic integration found in integrated reporting. For organizations aiming to meet evolving regulatory demands and investor expectations, integrated reporting presents a more holistic and forward-looking communication framework.

Connection

Integrated reporting combines financial and non-financial data into a cohesive narrative, enhancing transparency and strategic insight for stakeholders. Management commentary complements this by providing contextual explanations of business performance, risks, and future prospects, enriching the integrated report's value. Together, they deliver a comprehensive understanding of a company's overall health and strategic direction.

Key Terms

Narrative Reporting

Management commentary provides detailed insights into a company's financial performance, strategy, risks, and future outlook, emphasizing qualitative analysis beyond numerical data. Integrated reporting combines financial, environmental, social, and governance (ESG) information within a single report to present a holistic view of organizational value creation over time. Explore more about how narrative reporting enhances transparency and connects diverse performance metrics in corporate disclosures.

Value Creation

Management commentary provides narrative insights emphasizing a company's performance, strategy, and future outlook, often focusing on financial and operational value creation. Integrated reporting extends beyond financials to merge financial, environmental, social, and governance (ESG) factors, offering a holistic view of how value is sustained and enhanced over time. Explore deeper differences and best practices to leverage each approach for comprehensive value communication.

Stakeholder Engagement

Management commentary centers on providing a narrative that explains a company's financial statements, emphasizing transparent communication with investors and regulators to clarify business strategies and risks. Integrated reporting goes beyond financials by combining financial and non-financial data, including environmental, social, and governance (ESG) aspects, to present a holistic view of value creation for a broader range of stakeholders such as customers, employees, and communities. Explore comprehensive insights into how both approaches enhance stakeholder engagement and drive strategic decision-making.

Source and External Links

Management Commentary A framework for presentation - Provides management's view of an entity's performance, position, and progress, supplementing financial statements with integrated information.

Management Commentary A framework for presentation - Offers guidelines for management commentary to enhance users' understanding of an entity's financial position and performance.

The IFRS Practice Statement 1 Management Commentary - Revised to improve users' understanding of an entity's financial performance and position through management's perspective.

dowidth.com

dowidth.com