Revenue recognition automation streamlines the process of recording sales and income by accurately capturing transaction data and applying relevant accounting standards, reducing errors and improving financial reporting speed. Fixed asset management automation enhances the tracking, depreciation, and maintenance scheduling of physical assets, ensuring compliance and optimizing asset utilization throughout their lifecycle. Discover how these automation solutions transform accounting efficiency and accuracy.

Why it is important

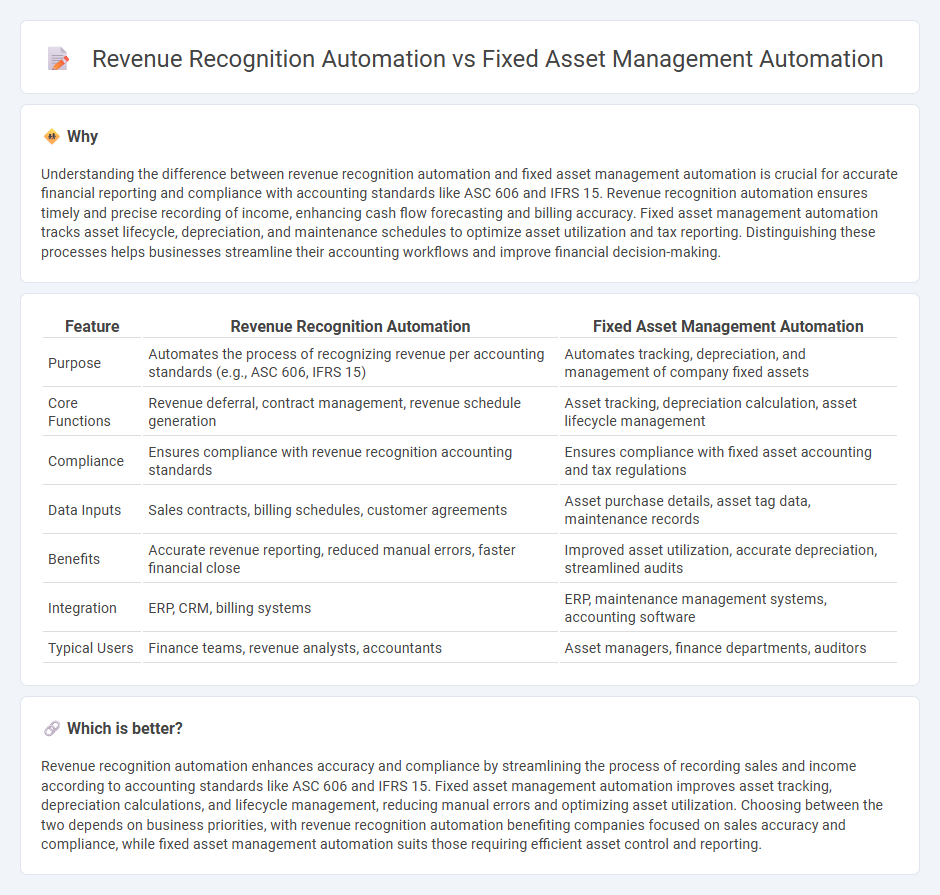

Understanding the difference between revenue recognition automation and fixed asset management automation is crucial for accurate financial reporting and compliance with accounting standards like ASC 606 and IFRS 15. Revenue recognition automation ensures timely and precise recording of income, enhancing cash flow forecasting and billing accuracy. Fixed asset management automation tracks asset lifecycle, depreciation, and maintenance schedules to optimize asset utilization and tax reporting. Distinguishing these processes helps businesses streamline their accounting workflows and improve financial decision-making.

Comparison Table

| Feature | Revenue Recognition Automation | Fixed Asset Management Automation |

|---|---|---|

| Purpose | Automates the process of recognizing revenue per accounting standards (e.g., ASC 606, IFRS 15) | Automates tracking, depreciation, and management of company fixed assets |

| Core Functions | Revenue deferral, contract management, revenue schedule generation | Asset tracking, depreciation calculation, asset lifecycle management |

| Compliance | Ensures compliance with revenue recognition accounting standards | Ensures compliance with fixed asset accounting and tax regulations |

| Data Inputs | Sales contracts, billing schedules, customer agreements | Asset purchase details, asset tag data, maintenance records |

| Benefits | Accurate revenue reporting, reduced manual errors, faster financial close | Improved asset utilization, accurate depreciation, streamlined audits |

| Integration | ERP, CRM, billing systems | ERP, maintenance management systems, accounting software |

| Typical Users | Finance teams, revenue analysts, accountants | Asset managers, finance departments, auditors |

Which is better?

Revenue recognition automation enhances accuracy and compliance by streamlining the process of recording sales and income according to accounting standards like ASC 606 and IFRS 15. Fixed asset management automation improves asset tracking, depreciation calculations, and lifecycle management, reducing manual errors and optimizing asset utilization. Choosing between the two depends on business priorities, with revenue recognition automation benefiting companies focused on sales accuracy and compliance, while fixed asset management automation suits those requiring efficient asset control and reporting.

Connection

Revenue recognition automation and fixed asset management automation are connected through accurate financial reporting and streamlined compliance processes, ensuring that asset depreciation and revenue realization align with accounting standards like GAAP and IFRS. Automating both areas enhances data consistency across ledgers, reduces manual errors, and provides real-time insights into asset-related revenues and expenses. This integrated approach supports unified audit trails and improved decision-making for enterprise financial management.

Key Terms

**Fixed Asset Management Automation:**

Fixed Asset Management Automation streamlines tracking, depreciation, and maintenance schedules of company assets using advanced software solutions that improve accuracy and reduce manual errors. Efficient asset lifecycle management enables better financial planning and compliance with accounting standards such as IFRS and GAAP. Explore how integrating automation can optimize your asset management processes and enhance operational efficiency.

Depreciation Scheduling

Depreciation scheduling in fixed asset management automation optimizes the allocation of asset costs over their useful lives, ensuring accurate financial reporting and compliance with accounting standards such as IFRS and GAAP. Revenue recognition automation, in contrast, focuses on timing and allocation of income based on contract terms, impacting cash flow and earnings accuracy rather than asset value. Explore how integrating these automations can streamline your financial processes and enhance operational efficiency.

Asset Tracking

Fixed asset management automation streamlines asset tracking by integrating real-time data capture, maintenance schedules, and depreciation calculations to enhance accuracy and reduce manual errors. Revenue recognition automation focuses on financial processes, ensuring compliant and timely recognition of revenue but lacks detailed asset tracking capabilities. Explore how optimizing fixed asset management automation can transform your asset tracking efficiency.

Source and External Links

How to Improve Fixed Asset Management with Technology - Organizations can automate tracking and monitoring of fixed assets using advanced software, IoT devices, and RFID or barcode tagging, resulting in increased efficiency, real-time insights, and better compliance.

6 Steps to Implementing Asset Management Automation - Begin asset management automation by defining goals, assessing current processes for inefficiencies, and selecting a solution that is scalable, user-friendly, and aligned with industry needs.

We Found the 10 Best Fixed Asset Management Software Solutions - Fixed asset management software centralizes asset data, automates depreciation tracking and maintenance scheduling, and helps organizations maintain compliance while reducing costs and operational risks.

dowidth.com

dowidth.com