Supply chain finance enhances cash flow by optimizing payment terms between suppliers and buyers, improving liquidity throughout the supply chain. Credit insurance protects businesses from losses due to customer non-payment, mitigating credit risk and ensuring financial stability. Explore how integrating supply chain finance and credit insurance strategies can strengthen your company's financial resilience.

Why it is important

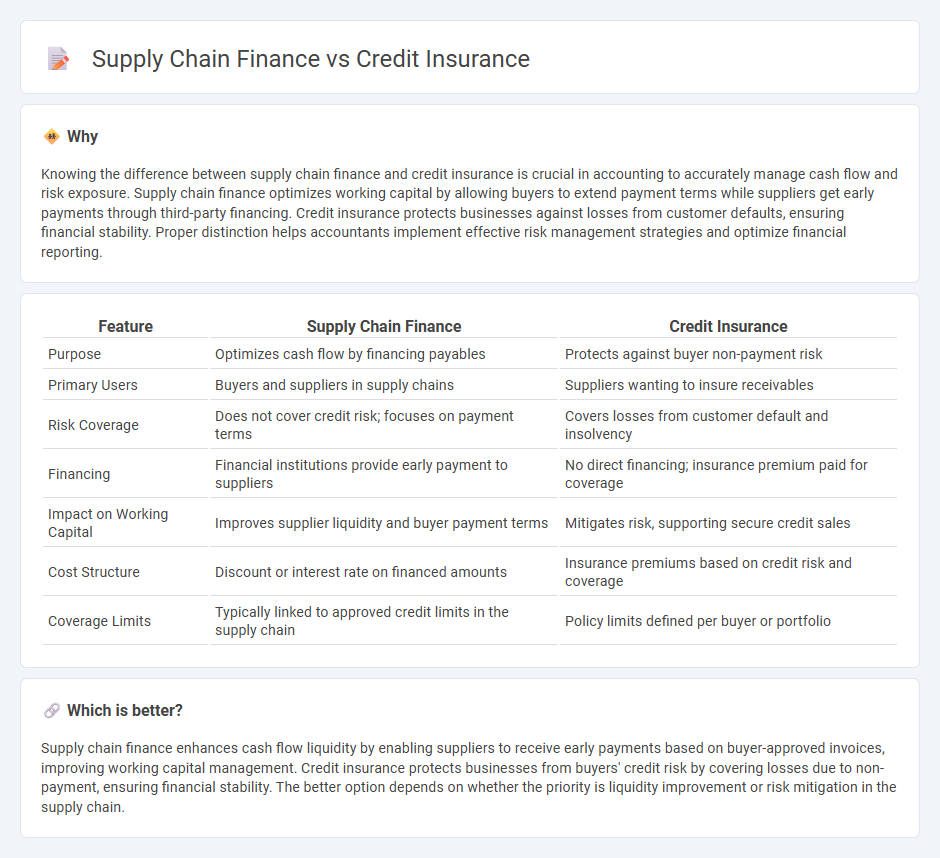

Knowing the difference between supply chain finance and credit insurance is crucial in accounting to accurately manage cash flow and risk exposure. Supply chain finance optimizes working capital by allowing buyers to extend payment terms while suppliers get early payments through third-party financing. Credit insurance protects businesses against losses from customer defaults, ensuring financial stability. Proper distinction helps accountants implement effective risk management strategies and optimize financial reporting.

Comparison Table

| Feature | Supply Chain Finance | Credit Insurance |

|---|---|---|

| Purpose | Optimizes cash flow by financing payables | Protects against buyer non-payment risk |

| Primary Users | Buyers and suppliers in supply chains | Suppliers wanting to insure receivables |

| Risk Coverage | Does not cover credit risk; focuses on payment terms | Covers losses from customer default and insolvency |

| Financing | Financial institutions provide early payment to suppliers | No direct financing; insurance premium paid for coverage |

| Impact on Working Capital | Improves supplier liquidity and buyer payment terms | Mitigates risk, supporting secure credit sales |

| Cost Structure | Discount or interest rate on financed amounts | Insurance premiums based on credit risk and coverage |

| Coverage Limits | Typically linked to approved credit limits in the supply chain | Policy limits defined per buyer or portfolio |

Which is better?

Supply chain finance enhances cash flow liquidity by enabling suppliers to receive early payments based on buyer-approved invoices, improving working capital management. Credit insurance protects businesses from buyers' credit risk by covering losses due to non-payment, ensuring financial stability. The better option depends on whether the priority is liquidity improvement or risk mitigation in the supply chain.

Connection

Supply chain finance enhances liquidity by accelerating payments to suppliers, reducing their risk and improving cash flow, while credit insurance protects these transactions against buyer default or insolvency, ensuring financial stability across the supply chain. Both instruments mitigate credit risk and improve the overall financial health of businesses involved in supply chain operations. Integrating supply chain finance with credit insurance optimizes working capital management and secures trade relationships.

Key Terms

Risk Mitigation

Credit insurance safeguards businesses by covering losses from customer defaults, reducing exposure to bad debt risk. Supply chain finance improves liquidity by allowing suppliers to receive early payments, which helps stabilize cash flow but does not directly mitigate credit risk. Discover how these financial tools complement each other to enhance overall risk management strategies.

Working Capital

Credit insurance protects businesses from non-payment risks, ensuring steady cash flow and safeguarding working capital against customer defaults. Supply chain finance optimizes working capital by accelerating receivables and extending payables through financing solutions tailored to the supply chain. Explore how these financial tools can enhance liquidity and risk management in your operations.

Receivables

Credit insurance protects businesses by covering losses from unpaid receivables due to customer insolvency or default, ensuring cash flow stability. Supply chain finance optimizes working capital by accelerating receivables through third-party financing, improving liquidity without increasing debt. Explore how these tools impact receivables management and business cash flow strategies.

Source and External Links

Credit insurance - A policy purchased by a borrower to protect their lender from loss due to insolvency, disability, death, or unemployment by paying off the debt on behalf of the borrower.

What Is Credit Insurance? - An optional insurance policy covering loan or credit card payments if the borrower cannot pay due to death, disability, unemployment, or other events.

Credit insurance - Sold by lenders to protect them by making payments on loans if the borrower loses a job, becomes disabled, or dies, often at a high cost to the borrower.

dowidth.com

dowidth.com