Fair value measurement reflects the estimated market price at which an asset could be exchanged between knowledgeable, willing parties in an arm's length transaction, emphasizing current market conditions. Liquidation value represents the estimated amount that could be realized if an asset were sold quickly, often under distressed conditions, typically lower than fair value. Explore further to understand how these valuation methods impact financial reporting and decision-making.

Why it is important

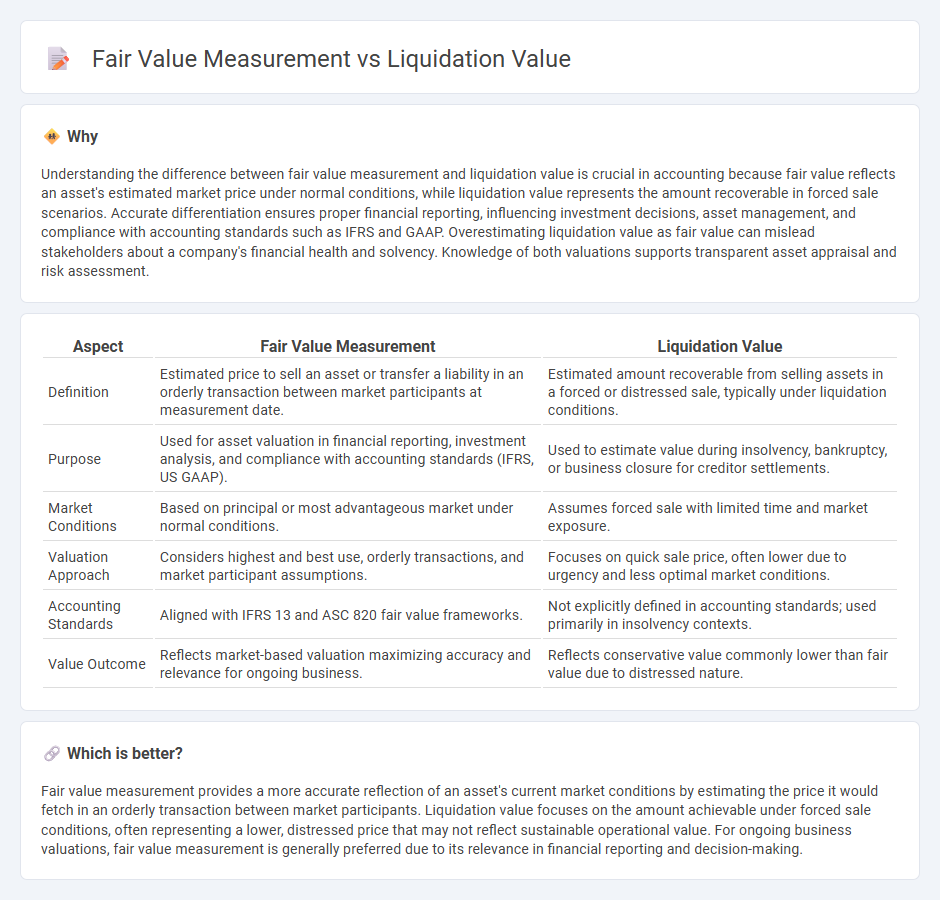

Understanding the difference between fair value measurement and liquidation value is crucial in accounting because fair value reflects an asset's estimated market price under normal conditions, while liquidation value represents the amount recoverable in forced sale scenarios. Accurate differentiation ensures proper financial reporting, influencing investment decisions, asset management, and compliance with accounting standards such as IFRS and GAAP. Overestimating liquidation value as fair value can mislead stakeholders about a company's financial health and solvency. Knowledge of both valuations supports transparent asset appraisal and risk assessment.

Comparison Table

| Aspect | Fair Value Measurement | Liquidation Value |

|---|---|---|

| Definition | Estimated price to sell an asset or transfer a liability in an orderly transaction between market participants at measurement date. | Estimated amount recoverable from selling assets in a forced or distressed sale, typically under liquidation conditions. |

| Purpose | Used for asset valuation in financial reporting, investment analysis, and compliance with accounting standards (IFRS, US GAAP). | Used to estimate value during insolvency, bankruptcy, or business closure for creditor settlements. |

| Market Conditions | Based on principal or most advantageous market under normal conditions. | Assumes forced sale with limited time and market exposure. |

| Valuation Approach | Considers highest and best use, orderly transactions, and market participant assumptions. | Focuses on quick sale price, often lower due to urgency and less optimal market conditions. |

| Accounting Standards | Aligned with IFRS 13 and ASC 820 fair value frameworks. | Not explicitly defined in accounting standards; used primarily in insolvency contexts. |

| Value Outcome | Reflects market-based valuation maximizing accuracy and relevance for ongoing business. | Reflects conservative value commonly lower than fair value due to distressed nature. |

Which is better?

Fair value measurement provides a more accurate reflection of an asset's current market conditions by estimating the price it would fetch in an orderly transaction between market participants. Liquidation value focuses on the amount achievable under forced sale conditions, often representing a lower, distressed price that may not reflect sustainable operational value. For ongoing business valuations, fair value measurement is generally preferred due to its relevance in financial reporting and decision-making.

Connection

Fair value measurement and liquidation value are connected through their roles in asset valuation during financial reporting and distress scenarios. Fair value measurement reflects the estimated price an asset would fetch in an orderly transaction between market participants, while liquidation value represents the amount expected from selling assets in a forced sale or bankruptcy situation. Both concepts are crucial for accountants to provide accurate valuations under different market conditions and ensure transparency in financial statements.

Key Terms

Asset Valuation

Liquidation value reflects the estimated amount an asset can generate under forced sale conditions, often lower than its market worth, while fair value represents an asset's price in an orderly transaction between market participants. Asset valuation under liquidation value prioritizes quick conversion to cash, often at a discount, contrasting with fair value's emphasis on market-based, objective valuation. Explore further to understand the implications of these measurements on financial reporting and decision-making.

Market Value

Liquidation value represents the estimated amount an asset would fetch if sold quickly in a forced sale, often below market conditions, whereas fair value measurement reflects the price that would be received in an orderly transaction between market participants at the measurement date. Market value serves as a critical benchmark in fair value measurement, incorporating current market conditions, supply-demand dynamics, and buyer-seller considerations, contrasting with the typically distressed assumptions underlying liquidation value. Explore how market value influences asset valuation and reporting standards for a deeper understanding.

Orderly Transaction

Liquidation value measures the estimated amount an asset would fetch if sold quickly in an orderly transaction, reflecting a forced sale rather than normal market conditions. Fair value measurement, defined by IFRS 13, represents the price at which an asset would be exchanged between knowledgeable, willing parties in an orderly transaction at the measurement date. Explore further to understand the nuances of these valuation approaches in financial reporting.

Source and External Links

How to Calculate the Liquidation Value of a Company - Liquidation value is the estimated total value available if a company's tangible assets are sold off to pay creditors, calculated by subtracting discounted inventory, receivables, and liabilities from the market value of tangible assets.

Liquidation Value Definition, Formula, and Example - A company's liquidation value is the net value of its physical assets after liabilities, excluding intangible assets, often used to simulate worst-case bankruptcy scenarios or for merger considerations.

Liquidation Value - Overview, Use, Calculation - Liquidation value estimates the final proceeds from a quick sale of company assets, usually during bankruptcy, by subtracting liabilities from auction-value appraised tangible assets and excluding intangible assets.

dowidth.com

dowidth.com