Blockchain-based accounting leverages decentralized ledger technology to enhance transparency, immutability, and real-time transaction verification, reducing the risk of fraud and errors. ERP accounting integrates financial management with core business processes, offering centralized data control and automating workflows for improved efficiency. Explore how these systems redefine financial reporting and operational accuracy in modern enterprises.

Why it is important

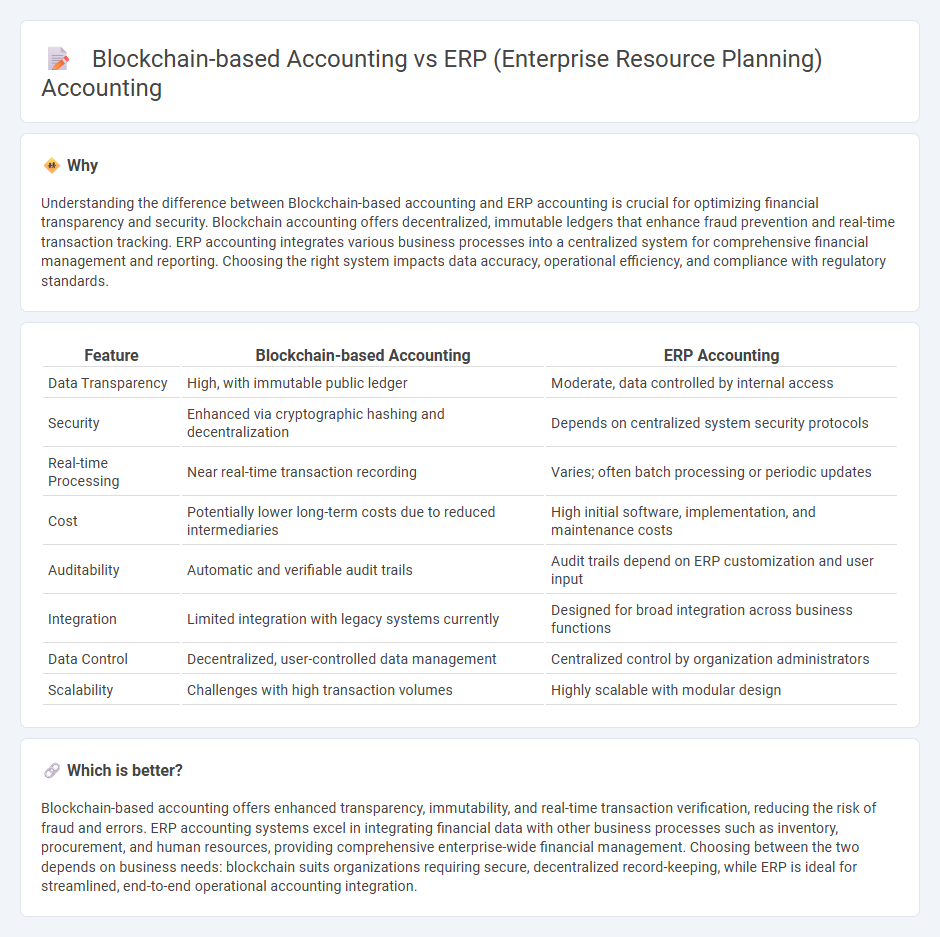

Understanding the difference between Blockchain-based accounting and ERP accounting is crucial for optimizing financial transparency and security. Blockchain accounting offers decentralized, immutable ledgers that enhance fraud prevention and real-time transaction tracking. ERP accounting integrates various business processes into a centralized system for comprehensive financial management and reporting. Choosing the right system impacts data accuracy, operational efficiency, and compliance with regulatory standards.

Comparison Table

| Feature | Blockchain-based Accounting | ERP Accounting |

|---|---|---|

| Data Transparency | High, with immutable public ledger | Moderate, data controlled by internal access |

| Security | Enhanced via cryptographic hashing and decentralization | Depends on centralized system security protocols |

| Real-time Processing | Near real-time transaction recording | Varies; often batch processing or periodic updates |

| Cost | Potentially lower long-term costs due to reduced intermediaries | High initial software, implementation, and maintenance costs |

| Auditability | Automatic and verifiable audit trails | Audit trails depend on ERP customization and user input |

| Integration | Limited integration with legacy systems currently | Designed for broad integration across business functions |

| Data Control | Decentralized, user-controlled data management | Centralized control by organization administrators |

| Scalability | Challenges with high transaction volumes | Highly scalable with modular design |

Which is better?

Blockchain-based accounting offers enhanced transparency, immutability, and real-time transaction verification, reducing the risk of fraud and errors. ERP accounting systems excel in integrating financial data with other business processes such as inventory, procurement, and human resources, providing comprehensive enterprise-wide financial management. Choosing between the two depends on business needs: blockchain suits organizations requiring secure, decentralized record-keeping, while ERP is ideal for streamlined, end-to-end operational accounting integration.

Connection

Blockchain-based accounting enhances ERP systems by providing immutable, transparent transaction records that increase data integrity and reduce fraud risks within business processes. Integration of blockchain technology into ERP platforms facilitates real-time auditing, automated reconciliation, and secure data sharing across departments, improving operational efficiency. This connection streamlines financial reporting and compliance by combining blockchain's decentralized ledger capabilities with ERP's structured resource management.

Key Terms

**ERP Accounting:**

ERP accounting integrates financial management with core business processes such as procurement, inventory, and sales, providing a centralized system that enhances data accuracy and operational efficiency. It automates routine tasks like invoicing, payroll, and financial reporting, enabling real-time insights and compliance with regulatory standards. Explore how ERP accounting can transform your business operations and financial management.

Centralized Ledger

ERP accounting relies on a centralized ledger system where all financial data is stored and managed within a single database, enabling streamlined processes and real-time access for authorized users. Blockchain-based accounting decentralizes the ledger, distributing records across multiple nodes, enhancing transparency, immutability, and security against tampering. Explore deeper differences between these accounting systems to understand their impacts on financial data integrity and operational efficiency.

Real-time Reporting

ERP accounting systems integrate financial data across business functions for consolidated real-time reporting, enhancing accuracy and decision-making speed. Blockchain-based accounting utilizes decentralized ledgers to provide immutable, transparent, and instantaneous transaction records, significantly reducing fraud risks. Explore deeper insights into how these technologies transform financial reporting in modern enterprises.

Source and External Links

ERP for Accounting and Financial Management - ERP systems provide comprehensive accounting and finance functionalities including general ledger, accounts payable/receivable, cash management, budgeting, forecasting, and reporting by centralizing data for improved efficiency, accuracy, and financial visibility across the organization.

ERP vs. Accounting Software Explained - Unlike standalone accounting software that focuses only on financial bookkeeping, ERP encompasses accounting plus all business operations, enabling integrated reporting and scalable management of a company's entire processes.

What Is an ERP System in Accounting? - ERP systems centralize data from multiple departments, automating and streamlining accounting workflows and can be integrated with specialized accounting solutions to enhance payment processing, cash flow, and operational insights for finance teams.

dowidth.com

dowidth.com