Ledger tokenization enhances data security by converting sensitive accounting entries into encrypted tokens, minimizing fraud risks and ensuring compliance with financial regulations. Traditional ledger systems focus on recording transactions but lack the advanced encryption features that tokenization provides for protecting asset data. Explore how ledger tokenization revolutionizes accounting accuracy and security in modern finance.

Why it is important

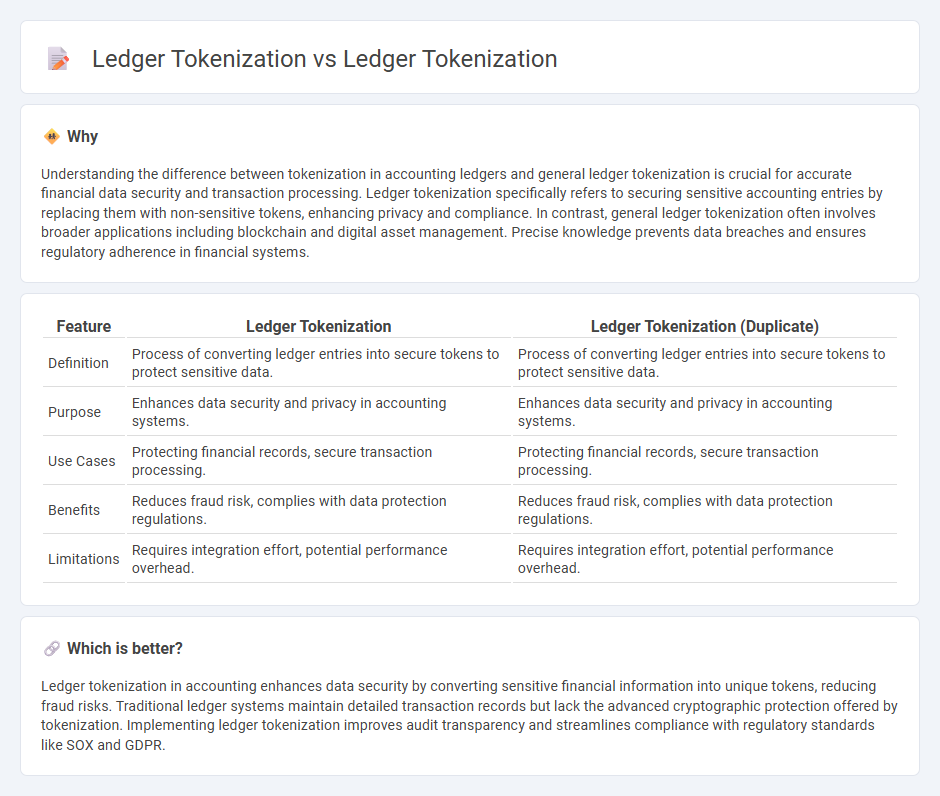

Understanding the difference between tokenization in accounting ledgers and general ledger tokenization is crucial for accurate financial data security and transaction processing. Ledger tokenization specifically refers to securing sensitive accounting entries by replacing them with non-sensitive tokens, enhancing privacy and compliance. In contrast, general ledger tokenization often involves broader applications including blockchain and digital asset management. Precise knowledge prevents data breaches and ensures regulatory adherence in financial systems.

Comparison Table

| Feature | Ledger Tokenization | Ledger Tokenization (Duplicate) |

|---|---|---|

| Definition | Process of converting ledger entries into secure tokens to protect sensitive data. | Process of converting ledger entries into secure tokens to protect sensitive data. |

| Purpose | Enhances data security and privacy in accounting systems. | Enhances data security and privacy in accounting systems. |

| Use Cases | Protecting financial records, secure transaction processing. | Protecting financial records, secure transaction processing. |

| Benefits | Reduces fraud risk, complies with data protection regulations. | Reduces fraud risk, complies with data protection regulations. |

| Limitations | Requires integration effort, potential performance overhead. | Requires integration effort, potential performance overhead. |

Which is better?

Ledger tokenization in accounting enhances data security by converting sensitive financial information into unique tokens, reducing fraud risks. Traditional ledger systems maintain detailed transaction records but lack the advanced cryptographic protection offered by tokenization. Implementing ledger tokenization improves audit transparency and streamlines compliance with regulatory standards like SOX and GDPR.

Connection

Ledger tokenization transforms traditional accounting records into secure digital tokens, enhancing data integrity and traceability. This process leverages blockchain technology to ensure immutable transaction ledgers, reducing fraud and errors in financial reporting. Integrating ledger tokenization with standard accounting practices streamlines audits and compliance through transparent and verifiable records.

Key Terms

Digital Assets

Ledger tokenization transforms traditional ledger entries into blockchain-based digital tokens, enabling enhanced security, transparency, and immutability in financial record-keeping. Digital asset ledger tokenization specifically targets the representation and management of digital assets such as cryptocurrencies, non-fungible tokens (NFTs), and security tokens, facilitating seamless trading and ownership verification. Explore more to understand how ledger tokenization reshapes digital asset management and unlocks new opportunities in blockchain finance.

Distributed Ledger

Distributed ledger tokenization leverages decentralized blockchain technology to enhance transparency, security, and immutability of digital asset transactions compared to traditional ledger tokenization. By distributing data across multiple nodes, it reduces the risk of fraud and single points of failure, making it ideal for real-time asset management and cross-border settlements. Explore the benefits and applications of distributed ledger tokenization to revolutionize your asset management strategy.

Smart Contracts

Ledger tokenization transforms real-world assets into digital tokens recorded on a blockchain, enhancing transparency and security through immutable ledger entries. Integrating smart contracts automates rights management and transaction execution, ensuring trustless and programmable asset exchanges. Explore how smart contract-enabled ledger tokenization revolutionizes digital asset management and compliance.

Source and External Links

Tokenizing Real-World Assets: A Look At XRP Ledger - This webpage explores how the XRP Ledger can be used for tokenization, simplifying transactions and enhancing financial opportunities.

An Investment Perspective on Tokenization Part I - This report discusses the process, benefits, and challenges of tokenization from an investment perspective, highlighting its impact on financial and real-world assets.

Tokenization - This webpage outlines the potential of tokenization on the XRP Ledger, focusing on efficiency, security, and revolutionary ownership models.

dowidth.com

dowidth.com