Cryptocurrency taxation involves reporting gains and losses from buying, selling, or trading digital assets, while mining income is treated as taxable business income based on the fair market value of the mined coins at the time of receipt. Understanding the distinctions between capital gains tax applicable to trading and ordinary income tax on mined cryptocurrency is essential for accurate financial reporting. Explore comprehensive guidance on cryptocurrency taxation versus mining income to ensure compliance and optimize your tax strategy.

Why it is important

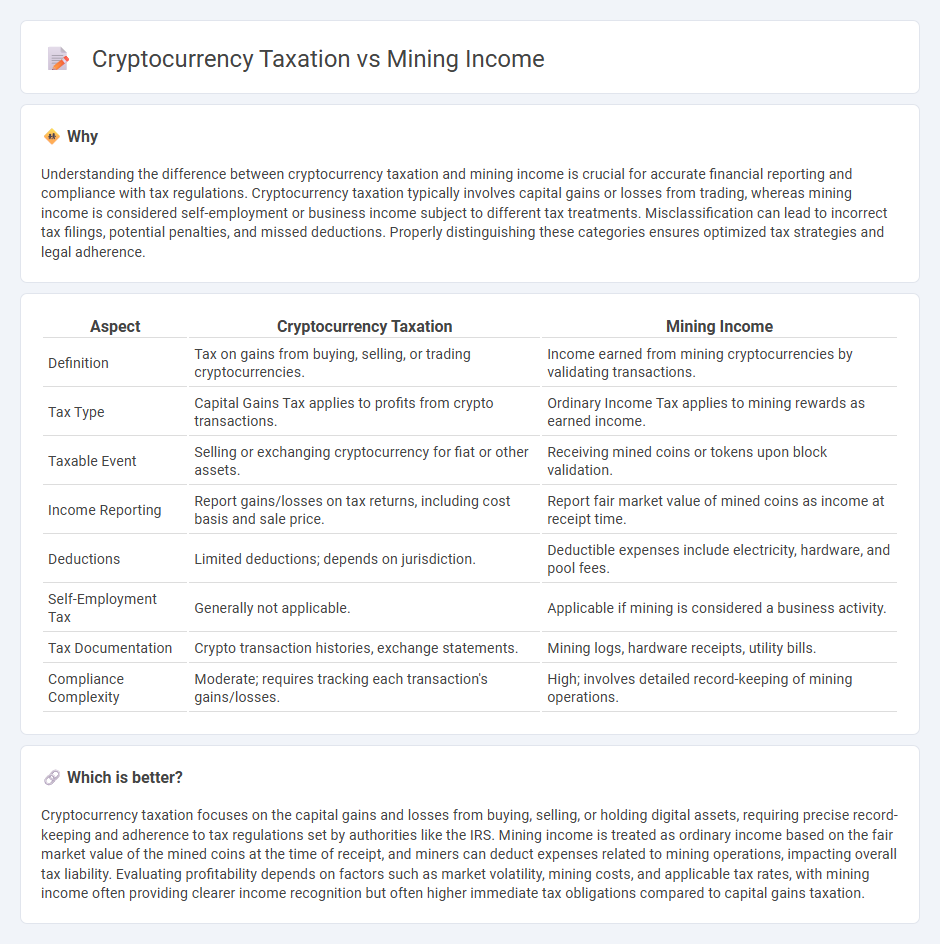

Understanding the difference between cryptocurrency taxation and mining income is crucial for accurate financial reporting and compliance with tax regulations. Cryptocurrency taxation typically involves capital gains or losses from trading, whereas mining income is considered self-employment or business income subject to different tax treatments. Misclassification can lead to incorrect tax filings, potential penalties, and missed deductions. Properly distinguishing these categories ensures optimized tax strategies and legal adherence.

Comparison Table

| Aspect | Cryptocurrency Taxation | Mining Income |

|---|---|---|

| Definition | Tax on gains from buying, selling, or trading cryptocurrencies. | Income earned from mining cryptocurrencies by validating transactions. |

| Tax Type | Capital Gains Tax applies to profits from crypto transactions. | Ordinary Income Tax applies to mining rewards as earned income. |

| Taxable Event | Selling or exchanging cryptocurrency for fiat or other assets. | Receiving mined coins or tokens upon block validation. |

| Income Reporting | Report gains/losses on tax returns, including cost basis and sale price. | Report fair market value of mined coins as income at receipt time. |

| Deductions | Limited deductions; depends on jurisdiction. | Deductible expenses include electricity, hardware, and pool fees. |

| Self-Employment Tax | Generally not applicable. | Applicable if mining is considered a business activity. |

| Tax Documentation | Crypto transaction histories, exchange statements. | Mining logs, hardware receipts, utility bills. |

| Compliance Complexity | Moderate; requires tracking each transaction's gains/losses. | High; involves detailed record-keeping of mining operations. |

Which is better?

Cryptocurrency taxation focuses on the capital gains and losses from buying, selling, or holding digital assets, requiring precise record-keeping and adherence to tax regulations set by authorities like the IRS. Mining income is treated as ordinary income based on the fair market value of the mined coins at the time of receipt, and miners can deduct expenses related to mining operations, impacting overall tax liability. Evaluating profitability depends on factors such as market volatility, mining costs, and applicable tax rates, with mining income often providing clearer income recognition but often higher immediate tax obligations compared to capital gains taxation.

Connection

Cryptocurrency taxation directly impacts mining income as mined coins are considered taxable income upon receipt, with miners required to report the fair market value at the time of mining. Tax authorities classify mining rewards as ordinary income, subject to income tax, and any subsequent sale or exchange of mined cryptocurrency triggers capital gains tax based on the asset's appreciation. Accurate record-keeping of mining activities, including the date, value, and transaction details, is essential for compliance with tax regulations and proper reporting of cryptocurrency income.

Key Terms

Ordinary Income

Mining income is classified as ordinary income by the IRS and is subject to taxation based on the fair market value of the cryptocurrency at the time of receipt. This income must be reported on your tax return and is taxed at your applicable income tax rates, not as capital gains. Learn more about how mining earnings impact your tax liabilities and reporting requirements.

Capital Gains

Mining income is typically taxed as ordinary income based on the fair market value of the cryptocurrency at the time of receipt, while capital gains taxation applies when the mined coins are sold or exchanged. Capital gains tax rates depend on the holding period, with short-term gains taxed at higher ordinary income rates and long-term gains benefiting from reduced rates. Explore detailed regulations and strategies to optimize your cryptocurrency taxation obligations.

Fair Market Value

Mining income is typically taxed based on the fair market value (FMV) of the cryptocurrency at the time it is mined, which is treated as ordinary income for tax purposes. The accurate determination of FMV is crucial for compliance, as it sets the baseline for subsequent capital gains or losses when the mined cryptocurrency is sold or exchanged. Explore comprehensive guidelines to optimize your tax reporting and ensure adherence to regulations.

Source and External Links

Crypto Mining Taxes: Beginner's Guide 2025 - This guide explains how mining income is taxed as ordinary income based on the fair market value at the time of receipt, with additional capital gains taxes upon disposal.

Bitcoin Mining Calculator - This tool helps calculate Bitcoin mining profitability based on hashrate, power consumption, and costs, providing estimates of daily and annual mining income.

A Detailed Guide on How Cryptocurrency Mining Works - This guide outlines the tax implications of cryptocurrency mining, including recognizing gross income upon receipt of reward tokens and potential self-employment taxes.

dowidth.com

dowidth.com