Revenue recognition automation streamlines the accurate recording of earned income by applying predefined accounting principles and real-time transaction data, ensuring compliance with standards like ASC 606 and IFRS 15. Accounts receivable automation focuses on enhancing cash flow management by automating invoice generation, payment tracking, and collection processes, reducing errors and improving efficiency. Explore how integrating both systems can optimize financial workflows and improve overall accounting accuracy.

Why it is important

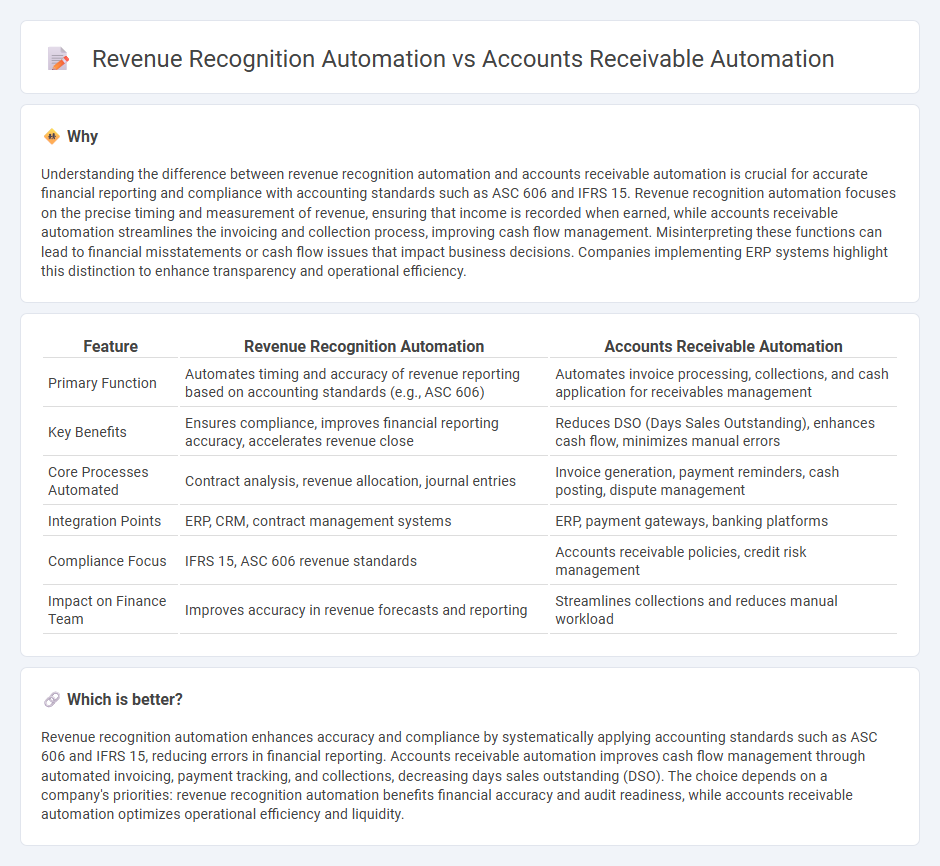

Understanding the difference between revenue recognition automation and accounts receivable automation is crucial for accurate financial reporting and compliance with accounting standards such as ASC 606 and IFRS 15. Revenue recognition automation focuses on the precise timing and measurement of revenue, ensuring that income is recorded when earned, while accounts receivable automation streamlines the invoicing and collection process, improving cash flow management. Misinterpreting these functions can lead to financial misstatements or cash flow issues that impact business decisions. Companies implementing ERP systems highlight this distinction to enhance transparency and operational efficiency.

Comparison Table

| Feature | Revenue Recognition Automation | Accounts Receivable Automation |

|---|---|---|

| Primary Function | Automates timing and accuracy of revenue reporting based on accounting standards (e.g., ASC 606) | Automates invoice processing, collections, and cash application for receivables management |

| Key Benefits | Ensures compliance, improves financial reporting accuracy, accelerates revenue close | Reduces DSO (Days Sales Outstanding), enhances cash flow, minimizes manual errors |

| Core Processes Automated | Contract analysis, revenue allocation, journal entries | Invoice generation, payment reminders, cash posting, dispute management |

| Integration Points | ERP, CRM, contract management systems | ERP, payment gateways, banking platforms |

| Compliance Focus | IFRS 15, ASC 606 revenue standards | Accounts receivable policies, credit risk management |

| Impact on Finance Team | Improves accuracy in revenue forecasts and reporting | Streamlines collections and reduces manual workload |

Which is better?

Revenue recognition automation enhances accuracy and compliance by systematically applying accounting standards such as ASC 606 and IFRS 15, reducing errors in financial reporting. Accounts receivable automation improves cash flow management through automated invoicing, payment tracking, and collections, decreasing days sales outstanding (DSO). The choice depends on a company's priorities: revenue recognition automation benefits financial accuracy and audit readiness, while accounts receivable automation optimizes operational efficiency and liquidity.

Connection

Revenue recognition automation ensures accurate and timely recording of income by linking sales data directly to financial statements. Accounts receivable automation streamlines invoice processing and payment tracking, improving cash flow management and reducing errors. Both systems integrate seamlessly to enhance financial accuracy, accelerate revenue cycles, and maintain compliance with accounting standards such as ASC 606 and IFRS 15.

Key Terms

**Accounts Receivable Automation:**

Accounts Receivable Automation streamlines the invoicing process, reduces manual errors, and accelerates cash flow by automatically tracking customer payments and managing outstanding balances. This technology integrates with ERP systems to ensure accurate financial records and improves collections efficiency through timely reminders and optimized workflows. Explore how implementing accounts receivable automation can transform your cash management and enhance financial reporting.

Invoice Processing

Accounts receivable automation streamlines invoice processing by reducing manual entry errors, accelerating payment cycles, and improving cash flow management through automated invoice generation, tracking, and collection workflows. Revenue recognition automation ensures compliance with accounting standards like ASC 606 by accurately matching invoices with corresponding revenue timelines, enabling real-time financial reporting and audit readiness. Explore the differences and benefits of each automation type to enhance your financial operations and optimize invoice processing efficiency.

Payment Matching

Accounts receivable automation streamlines payment matching by automatically reconciling incoming payments with outstanding invoices, reducing manual errors and accelerating cash flow. Revenue recognition automation ensures compliance with accounting standards by systematically recognizing revenue when earned, yet often lacks integrated payment matching functionality. Discover how integrating payment matching enhances financial accuracy and operational efficiency.

Source and External Links

Accounts Receivable (AR) Automation: A Complete Guide - AR automation streamlines invoicing, payment collection, reconciliation, and reporting, reducing manual work, errors, and costs while improving cash flow and integration with existing accounting systems.

4 Ways Automation Improves Accounts Receivable - Automation enhances invoicing accuracy, enables instant and recurring billing, uses AI for cash application to match payments to invoices, and integrates with bank feeds to automate reconciliation and exception handling.

Accounts Receivable Automation: The Complete Guide - Automating AR processes with specialized software saves time, reduces manual intervention, prevents errors, and improves cash flow efficiency by handling invoicing, payment follow-up, and collections automatically.

dowidth.com

dowidth.com