Revenue recognition automation leverages advanced algorithms to accurately record earned income according to accounting standards, enhancing financial reporting precision and compliance. Invoice processing automation streamlines the capture, validation, and payment of invoices, reducing manual errors and accelerating accounts payable cycles. Explore how integrating these automation technologies can transform your accounting operations and drive efficiency.

Why it is important

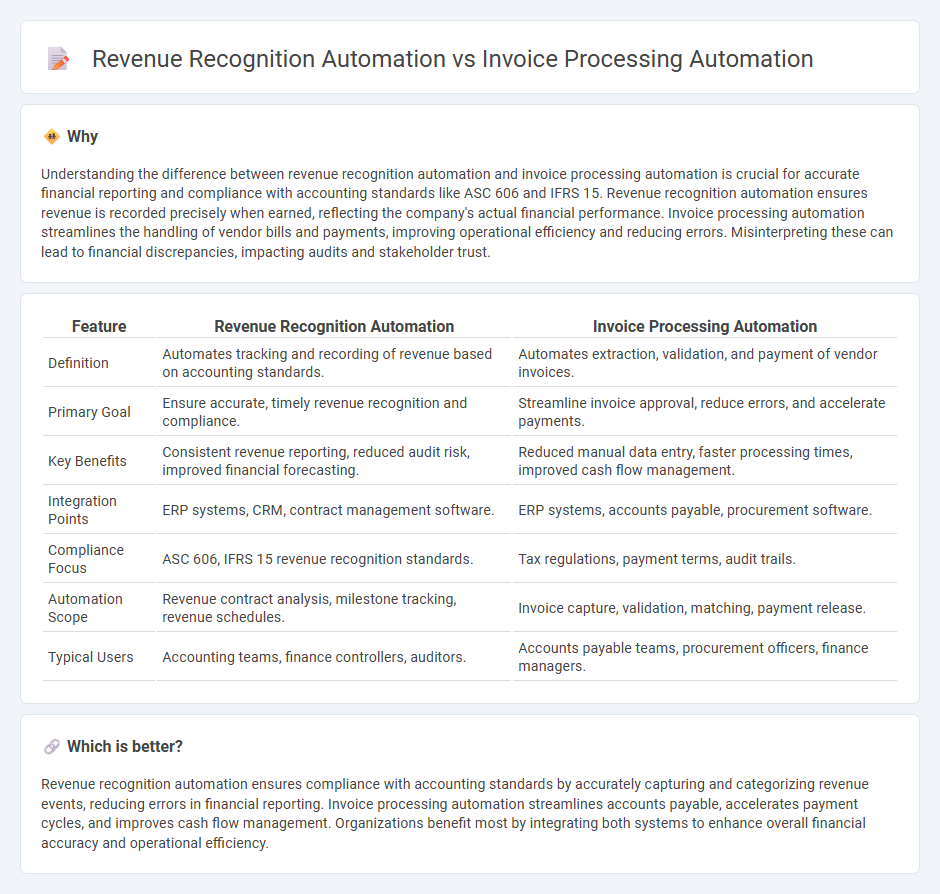

Understanding the difference between revenue recognition automation and invoice processing automation is crucial for accurate financial reporting and compliance with accounting standards like ASC 606 and IFRS 15. Revenue recognition automation ensures revenue is recorded precisely when earned, reflecting the company's actual financial performance. Invoice processing automation streamlines the handling of vendor bills and payments, improving operational efficiency and reducing errors. Misinterpreting these can lead to financial discrepancies, impacting audits and stakeholder trust.

Comparison Table

| Feature | Revenue Recognition Automation | Invoice Processing Automation |

|---|---|---|

| Definition | Automates tracking and recording of revenue based on accounting standards. | Automates extraction, validation, and payment of vendor invoices. |

| Primary Goal | Ensure accurate, timely revenue recognition and compliance. | Streamline invoice approval, reduce errors, and accelerate payments. |

| Key Benefits | Consistent revenue reporting, reduced audit risk, improved financial forecasting. | Reduced manual data entry, faster processing times, improved cash flow management. |

| Integration Points | ERP systems, CRM, contract management software. | ERP systems, accounts payable, procurement software. |

| Compliance Focus | ASC 606, IFRS 15 revenue recognition standards. | Tax regulations, payment terms, audit trails. |

| Automation Scope | Revenue contract analysis, milestone tracking, revenue schedules. | Invoice capture, validation, matching, payment release. |

| Typical Users | Accounting teams, finance controllers, auditors. | Accounts payable teams, procurement officers, finance managers. |

Which is better?

Revenue recognition automation ensures compliance with accounting standards by accurately capturing and categorizing revenue events, reducing errors in financial reporting. Invoice processing automation streamlines accounts payable, accelerates payment cycles, and improves cash flow management. Organizations benefit most by integrating both systems to enhance overall financial accuracy and operational efficiency.

Connection

Revenue recognition automation relies on accurate and timely invoice processing automation to ensure financial records reflect true earnings in compliance with accounting standards like ASC 606 and IFRS 15. Automated invoice processing systems extract and validate billing data, which feeds directly into revenue recognition workflows, minimizing errors and accelerating month-end close cycles. Integrating these automated processes enhances financial reporting accuracy, reduces manual intervention, and improves audit readiness.

Key Terms

**Invoice Processing Automation:**

Invoice processing automation streamlines the entire accounts payable workflow by using AI-powered tools to capture, validate, and approve invoices with minimal manual intervention. This technology reduces errors, accelerates payment cycles, and enhances cash flow management, directly impacting financial efficiency. Explore how integrating invoice processing automation can transform your accounts payable operations and drive cost savings.

Optical Character Recognition (OCR)

Invoice processing automation leverages Optical Character Recognition (OCR) to extract and digitize key data from various invoice formats, enhancing accuracy and speeding up accounts payable workflows. Revenue recognition automation uses OCR to identify and classify revenue-related information from contracts and invoices, ensuring compliance with accounting standards like ASC 606 and IFRS 15. Explore more to understand how OCR technology transforms financial operations and drives efficiency in automation processes.

Workflow Automation

Invoice processing automation streamlines the capture, validation, and approval of invoices using optical character recognition (OCR) and machine learning, reducing manual errors and accelerating payment cycles. Revenue recognition automation ensures compliance with accounting standards like ASC 606 and IFRS 15 by automating the allocation and timing of revenue based on contract terms and performance obligations. Explore how workflow automation can seamlessly integrate both processes to enhance financial accuracy and operational efficiency.

Source and External Links

How Automated Invoice Processing Works: A Starter Guide - Ramp - Automated invoice processing software captures, extracts, validates, and routes invoices for approval and payment with minimal human intervention, creating detailed audit trails for compliance.

How automation works in invoice processing - Stripe - Automation aggregates invoices from multiple sources, uses OCR and machine learning for data extraction, validates against internal records, routes for approval, handles exceptions, schedules payments, and integrates with accounting systems for real-time reporting.

Invoice Automation Explained (How it Works, Benefits & More) - Invoice automation converts paper and electronic invoices into digital formats, extracts key data, matches against purchase orders, routes through approval workflows, and integrates with ERP systems to speed up processing and reduce errors.

dowidth.com

dowidth.com