Green ledger accounting focuses on sustainable financial practices, integrating environmental impact and resource efficiency into traditional accounting systems. Blue book accounting emphasizes regulatory compliance and standard financial reporting to ensure transparency and accuracy in corporate records. Explore the distinctions between green ledger and blue book accounting to enhance your financial management strategies.

Why it is important

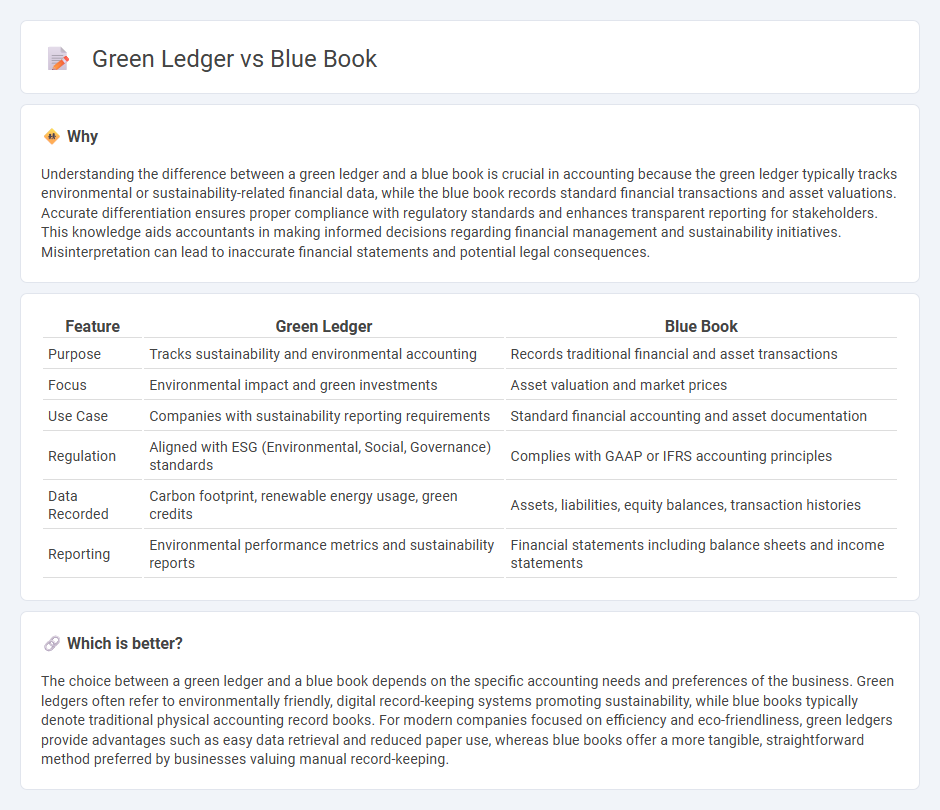

Understanding the difference between a green ledger and a blue book is crucial in accounting because the green ledger typically tracks environmental or sustainability-related financial data, while the blue book records standard financial transactions and asset valuations. Accurate differentiation ensures proper compliance with regulatory standards and enhances transparent reporting for stakeholders. This knowledge aids accountants in making informed decisions regarding financial management and sustainability initiatives. Misinterpretation can lead to inaccurate financial statements and potential legal consequences.

Comparison Table

| Feature | Green Ledger | Blue Book |

|---|---|---|

| Purpose | Tracks sustainability and environmental accounting | Records traditional financial and asset transactions |

| Focus | Environmental impact and green investments | Asset valuation and market prices |

| Use Case | Companies with sustainability reporting requirements | Standard financial accounting and asset documentation |

| Regulation | Aligned with ESG (Environmental, Social, Governance) standards | Complies with GAAP or IFRS accounting principles |

| Data Recorded | Carbon footprint, renewable energy usage, green credits | Assets, liabilities, equity balances, transaction histories |

| Reporting | Environmental performance metrics and sustainability reports | Financial statements including balance sheets and income statements |

Which is better?

The choice between a green ledger and a blue book depends on the specific accounting needs and preferences of the business. Green ledgers often refer to environmentally friendly, digital record-keeping systems promoting sustainability, while blue books typically denote traditional physical accounting record books. For modern companies focused on efficiency and eco-friendliness, green ledgers provide advantages such as easy data retrieval and reduced paper use, whereas blue books offer a more tangible, straightforward method preferred by businesses valuing manual record-keeping.

Connection

The green ledger and blue book are connected through their roles in environmental accounting and sustainability reporting. The green ledger tracks eco-friendly financial transactions and carbon credits, while the blue book provides standards and guidelines for reporting environmental impact in corporate financial statements. Together, they support transparent accounting practices that emphasize ecological responsibility and sustainable business operations.

Key Terms

Valuation

Blue Book valuation provides standardized vehicle value estimates widely recognized in the automotive industry, reflecting retail, trade-in, and private party prices based on extensive market data. Green Ledger valuation emphasizes environmentally sustainable assets and integrates eco-friendly factors, often used in green finance and asset management to support carbon footprint assessments. Explore more to understand how these valuation methods impact financial decisions and asset transparency.

Regulatory Reporting

Blue Book and Green Ledger serve distinct roles in regulatory reporting frameworks, with the Blue Book focusing on comprehensive financial data disclosures mandated by regulatory authorities, ensuring transparency and compliance with accounting standards. The Green Ledger emphasizes environmental, social, and governance (ESG) metrics, aligning with sustainability reporting requirements and supporting regulators' push for corporate responsibility. Explore the differences in detail to optimize your regulatory reporting strategy.

Classification

Blue Book classification typically organizes financial data using standardized accounting codes to ensure consistency and comparability across reports. Green Ledger classification emphasizes environmental impact categories, integrating sustainability metrics directly into financial records for eco-conscious decision-making. Explore more about the distinct classification methods to optimize your financial and environmental reporting accuracy.

Source and External Links

Blue Book - A leading source for produce industry news, company credit reports, and supplier information to optimize financial decisions and grow sales.

The Bluebook - A uniform system of citation widely used by legal professionals for proper citation formats.

Kelley Blue Book - An app providing vehicle valuation and market insights to help with car sales and trades.

dowidth.com

dowidth.com