Taxonomy alignment in accounting standardizes financial data reporting by ensuring consistency across various regulatory frameworks, enhancing comparability and transparency. Intercompany eliminations remove internal transactions within consolidated financial statements to prevent double counting and accurately reflect the economic position of the parent company. Explore our detailed insights to understand the critical differences and applications of taxonomy alignment and intercompany eliminations.

Why it is important

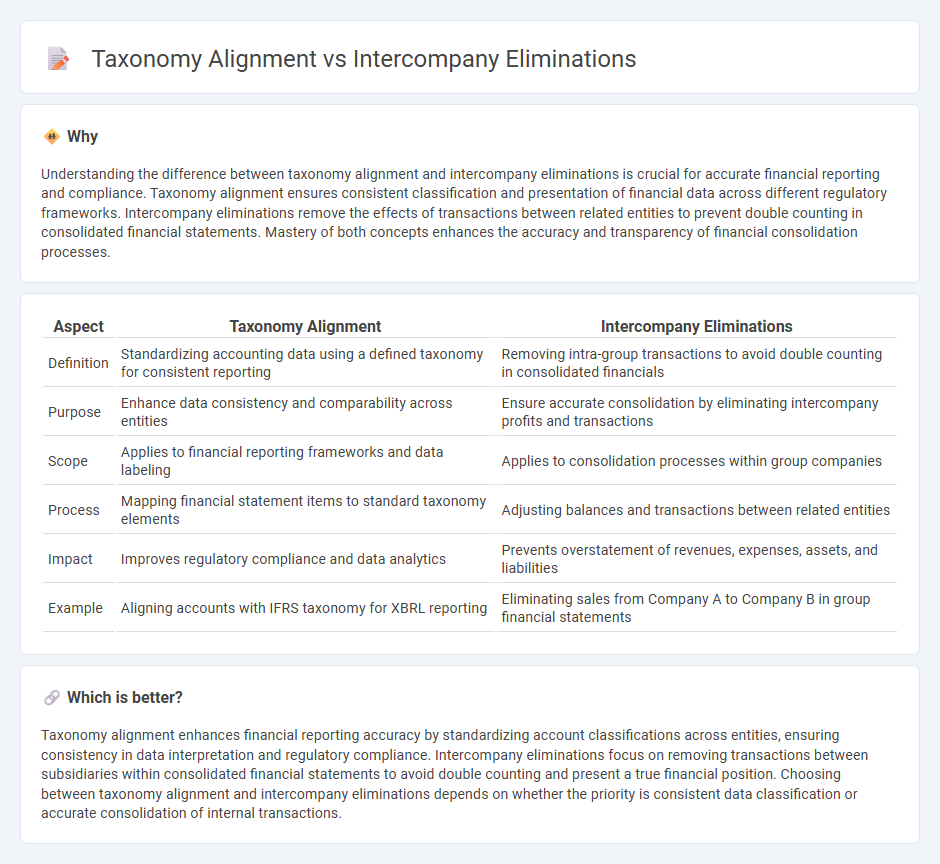

Understanding the difference between taxonomy alignment and intercompany eliminations is crucial for accurate financial reporting and compliance. Taxonomy alignment ensures consistent classification and presentation of financial data across different regulatory frameworks. Intercompany eliminations remove the effects of transactions between related entities to prevent double counting in consolidated financial statements. Mastery of both concepts enhances the accuracy and transparency of financial consolidation processes.

Comparison Table

| Aspect | Taxonomy Alignment | Intercompany Eliminations |

|---|---|---|

| Definition | Standardizing accounting data using a defined taxonomy for consistent reporting | Removing intra-group transactions to avoid double counting in consolidated financials |

| Purpose | Enhance data consistency and comparability across entities | Ensure accurate consolidation by eliminating intercompany profits and transactions |

| Scope | Applies to financial reporting frameworks and data labeling | Applies to consolidation processes within group companies |

| Process | Mapping financial statement items to standard taxonomy elements | Adjusting balances and transactions between related entities |

| Impact | Improves regulatory compliance and data analytics | Prevents overstatement of revenues, expenses, assets, and liabilities |

| Example | Aligning accounts with IFRS taxonomy for XBRL reporting | Eliminating sales from Company A to Company B in group financial statements |

Which is better?

Taxonomy alignment enhances financial reporting accuracy by standardizing account classifications across entities, ensuring consistency in data interpretation and regulatory compliance. Intercompany eliminations focus on removing transactions between subsidiaries within consolidated financial statements to avoid double counting and present a true financial position. Choosing between taxonomy alignment and intercompany eliminations depends on whether the priority is consistent data classification or accurate consolidation of internal transactions.

Connection

Taxonomy alignment in accounting ensures consistent classification standards across financial statements, facilitating accurate intercompany transaction tracking. Intercompany eliminations depend on this alignment to identify and remove duplicate entries from consolidated financial reports. Proper taxonomy alignment streamlines the reconciliation process, enhancing overall financial transparency and compliance.

Key Terms

**Intercompany Eliminations:**

Intercompany eliminations are essential in consolidated financial reporting to remove all transactions between affiliated entities, ensuring accurate reflection of the group's financial position and performance. This process addresses intercompany sales, receivables, payables, and dividends to prevent double counting within consolidated statements. Explore more to understand how precise intercompany eliminations enhance compliance and financial clarity.

Consolidation Adjustments

Consolidation adjustments play a critical role in intercompany eliminations by removing transactions and balances between entities within a corporate group to avoid double counting and ensure accurate consolidated financial statements. Taxonomy alignment enhances this process by standardizing the classification and tagging of financial data, which facilitates consistent reporting and improves regulatory compliance across jurisdictions. Explore the detailed methodologies and best practices for optimizing consolidation adjustments through taxonomy alignment to improve financial transparency.

Intercompany Transactions

Intercompany eliminations ensure accurate financial reporting by removing reciprocal transactions between subsidiaries, preventing double counting in consolidated statements. Taxonomy alignment standardizes reporting formats and definitions, promoting consistency across entities and regulatory compliance. Explore deeper insights into optimizing intercompany transaction management for enhanced financial transparency.

Source and External Links

What are Intercompany Eliminations? - Intercompany elimination is the process that removes transactions between subsidiaries to ensure accurate financial consolidation.

Guide to Intercompany Eliminations - This guide explains intercompany eliminations as a method to cancel transactions that do not impact a parent company's net assets.

Intercompany Eliminations - CCH Tagetik - Intercompany elimination is a process used by parent companies to remove transactions between subsidiaries for consolidated financial reporting.

dowidth.com

dowidth.com