Outsourced bookkeeping services provide expert human oversight, ensuring accuracy and personalized financial management for businesses seeking tailored bookkeeping solutions. AI-driven accounting platforms utilize machine learning algorithms and automation to process transactions rapidly and reduce errors, appealing to companies prioritizing efficiency and scalability. Explore how combining these approaches can optimize your accounting operations and enhance financial decision-making.

Why it is important

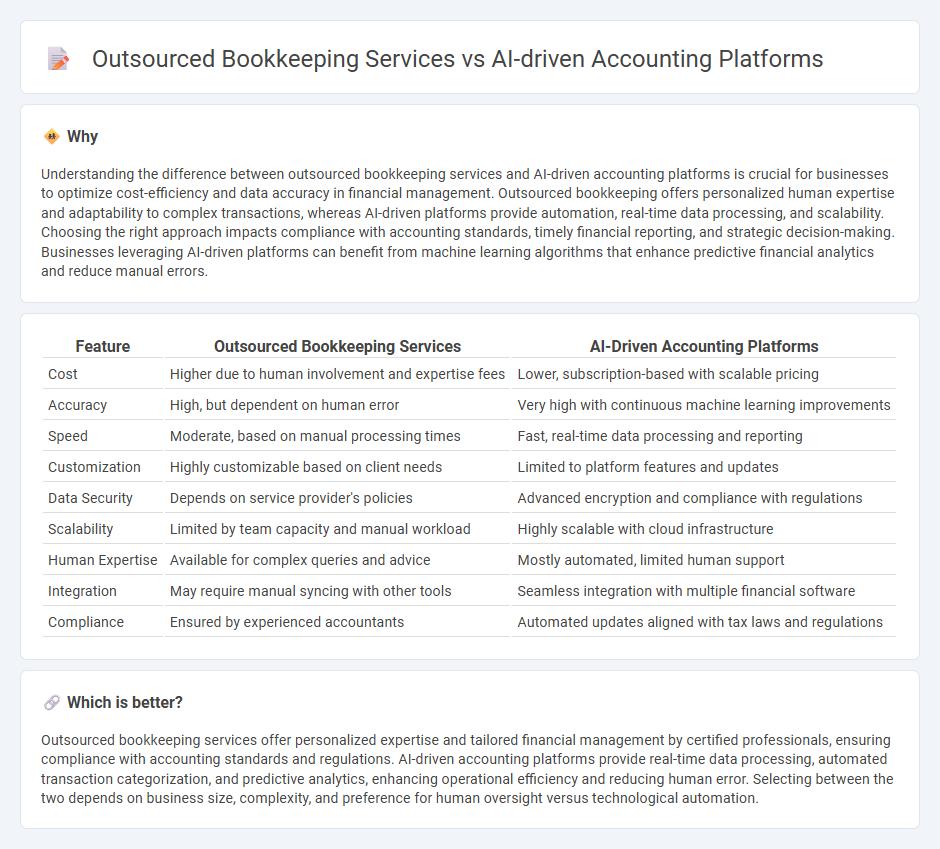

Understanding the difference between outsourced bookkeeping services and AI-driven accounting platforms is crucial for businesses to optimize cost-efficiency and data accuracy in financial management. Outsourced bookkeeping offers personalized human expertise and adaptability to complex transactions, whereas AI-driven platforms provide automation, real-time data processing, and scalability. Choosing the right approach impacts compliance with accounting standards, timely financial reporting, and strategic decision-making. Businesses leveraging AI-driven platforms can benefit from machine learning algorithms that enhance predictive financial analytics and reduce manual errors.

Comparison Table

| Feature | Outsourced Bookkeeping Services | AI-Driven Accounting Platforms |

|---|---|---|

| Cost | Higher due to human involvement and expertise fees | Lower, subscription-based with scalable pricing |

| Accuracy | High, but dependent on human error | Very high with continuous machine learning improvements |

| Speed | Moderate, based on manual processing times | Fast, real-time data processing and reporting |

| Customization | Highly customizable based on client needs | Limited to platform features and updates |

| Data Security | Depends on service provider's policies | Advanced encryption and compliance with regulations |

| Scalability | Limited by team capacity and manual workload | Highly scalable with cloud infrastructure |

| Human Expertise | Available for complex queries and advice | Mostly automated, limited human support |

| Integration | May require manual syncing with other tools | Seamless integration with multiple financial software |

| Compliance | Ensured by experienced accountants | Automated updates aligned with tax laws and regulations |

Which is better?

Outsourced bookkeeping services offer personalized expertise and tailored financial management by certified professionals, ensuring compliance with accounting standards and regulations. AI-driven accounting platforms provide real-time data processing, automated transaction categorization, and predictive analytics, enhancing operational efficiency and reducing human error. Selecting between the two depends on business size, complexity, and preference for human oversight versus technological automation.

Connection

Outsourced bookkeeping services leverage AI-driven accounting platforms to enhance accuracy and efficiency in financial data management. These platforms automate routine tasks such as transaction categorization and invoice processing, enabling bookkeepers to focus on higher-value analysis. The integration reduces errors and accelerates report generation, improving overall financial decision-making for businesses.

Key Terms

Automation

AI-driven accounting platforms leverage advanced machine learning algorithms to automate transaction categorization, invoicing, and real-time financial reporting, significantly reducing human error and operational costs. Outsourced bookkeeping services, while effective, rely heavily on manual data entry and periodic review, leading to slower processing times and potential inconsistencies. Explore how AI-driven automation transforms accounting accuracy and efficiency compared to traditional outsourcing methods.

Data Security

AI-driven accounting platforms leverage advanced encryption protocols and real-time anomaly detection to safeguard sensitive financial information, reducing the risk of data breaches. Outsourced bookkeeping services rely heavily on stringent access controls and compliance with regulatory standards such as GDPR and SOC 2 to ensure data security. Explore in-depth comparisons to understand which solution better aligns with your company's security requirements.

Cost Efficiency

AI-driven accounting platforms reduce expenses by automating data entry, reconciliation, and reporting, cutting labor costs by up to 40%. Outsourced bookkeeping services offer flexible pricing models and expert financial management, but often incur higher ongoing fees due to manual processing. Explore how each solution impacts your company's financial efficiency and scalability.

Source and External Links

Trullion - An AI-powered accounting platform that automates financial workflows for accounting and audit teams, enhancing compliance and efficiency with features like lease accounting and revenue recognition.

TaxDome - A platform that utilizes AI to automate tax preparation and other accounting processes, offering a robust client portal for collaboration and document management.

Vic.ai - An AI-first accounts payable automation software that provides real-time financial insights, reduces errors, and optimizes financial operations at scale.

dowidth.com

dowidth.com