Smart contracts accounting involves automated recording and verification of transactions through self-executing code, ensuring accuracy and transparency in contractual obligations. Digital assets accounting focuses on the valuation, tracking, and reporting of cryptocurrency and token holdings, addressing unique challenges like volatility and regulatory compliance. Explore further to understand the key differences and applications between these innovative accounting approaches.

Why it is important

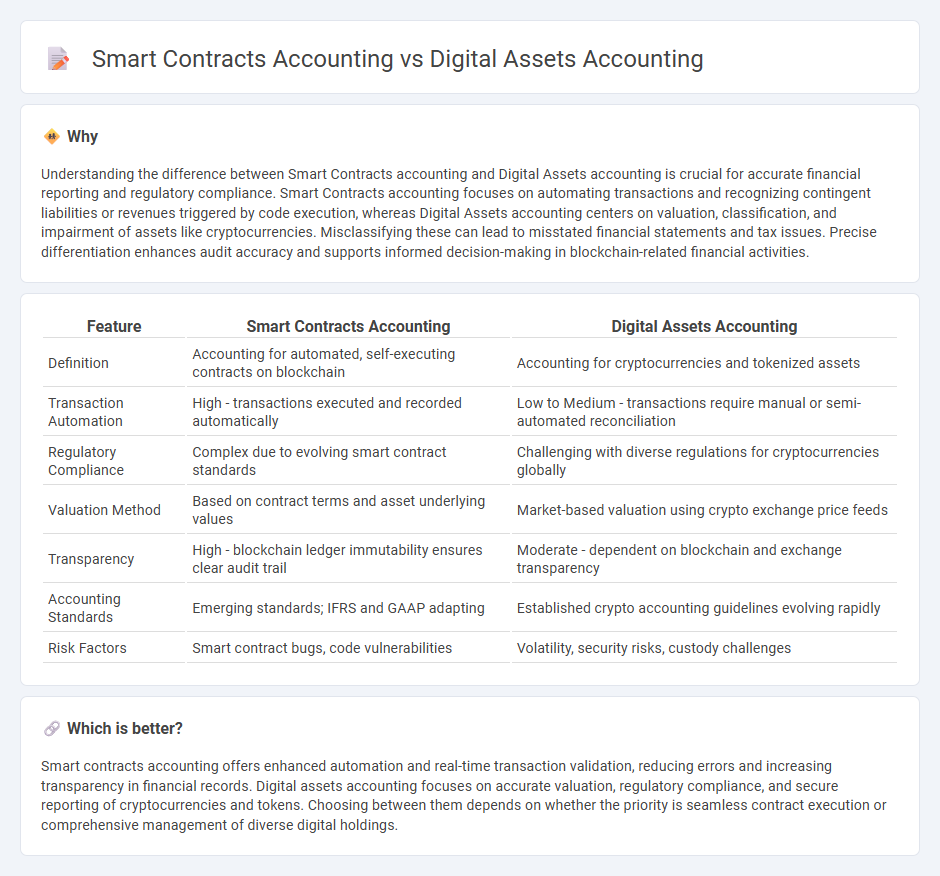

Understanding the difference between Smart Contracts accounting and Digital Assets accounting is crucial for accurate financial reporting and regulatory compliance. Smart Contracts accounting focuses on automating transactions and recognizing contingent liabilities or revenues triggered by code execution, whereas Digital Assets accounting centers on valuation, classification, and impairment of assets like cryptocurrencies. Misclassifying these can lead to misstated financial statements and tax issues. Precise differentiation enhances audit accuracy and supports informed decision-making in blockchain-related financial activities.

Comparison Table

| Feature | Smart Contracts Accounting | Digital Assets Accounting |

|---|---|---|

| Definition | Accounting for automated, self-executing contracts on blockchain | Accounting for cryptocurrencies and tokenized assets |

| Transaction Automation | High - transactions executed and recorded automatically | Low to Medium - transactions require manual or semi-automated reconciliation |

| Regulatory Compliance | Complex due to evolving smart contract standards | Challenging with diverse regulations for cryptocurrencies globally |

| Valuation Method | Based on contract terms and asset underlying values | Market-based valuation using crypto exchange price feeds |

| Transparency | High - blockchain ledger immutability ensures clear audit trail | Moderate - dependent on blockchain and exchange transparency |

| Accounting Standards | Emerging standards; IFRS and GAAP adapting | Established crypto accounting guidelines evolving rapidly |

| Risk Factors | Smart contract bugs, code vulnerabilities | Volatility, security risks, custody challenges |

Which is better?

Smart contracts accounting offers enhanced automation and real-time transaction validation, reducing errors and increasing transparency in financial records. Digital assets accounting focuses on accurate valuation, regulatory compliance, and secure reporting of cryptocurrencies and tokens. Choosing between them depends on whether the priority is seamless contract execution or comprehensive management of diverse digital holdings.

Connection

Smart contracts accounting automates financial transactions by securely recording actions on the blockchain, ensuring transparent and immutable audit trails. Digital assets accounting involves tracking and valuing cryptocurrencies, tokens, and other digital holdings, which rely on smart contracts for executing and verifying asset transfers and compliance. The integration of smart contracts streamlines digital assets accounting by enabling real-time transaction validation, reducing errors, and enhancing financial reporting accuracy.

Key Terms

Valuation

Digital assets accounting primarily focuses on fair value measurement, market-based pricing, and volatility analysis to ensure accurate financial reporting of cryptocurrencies and tokens. Smart contracts accounting emphasizes the recognition and valuation of embedded rights and obligations, including the assessment of conditional performance obligations and potential contract modifications. Explore detailed methodologies and regulatory considerations to enhance your understanding of valuation in both domains.

Recognition

Digital assets accounting centers on recognizing blockchain-based tokens or cryptocurrencies as intangible assets, emphasizing valuation and impairment rules under frameworks like IFRS or US GAAP. Smart contracts accounting requires identifying these self-executing code agreements as contingent liabilities or contract assets, focusing on their performance obligations and revenue recognition criteria. Explore detailed distinctions and compliance guidelines to master recognition challenges in both domains.

Revenue recognition

Digital assets accounting typically involves recognizing revenue based on the transfer of ownership or control of digital tokens, relying heavily on standards like IFRS 15 or ASC 606 for identifying performance obligations and transaction price allocation. Smart contracts accounting automates revenue recognition by executing contract terms programmatically, ensuring real-time, verifiable recognition tied directly to contract milestones or conditions without manual intervention. Explore further how smart contracts enhance transparency and efficiency in revenue recognition through blockchain-driven automation.

Source and External Links

Accounting treatments for your digital assets - This article discusses the accounting treatments for digital assets under IAS 2 and IAS 38, focusing on inventory and intangible asset valuation methods.

The United States' First Digital Asset Accounting Rules - This article outlines the new guidelines by the FASB for accounting digital assets, adopting fair value accounting to enhance transparency and financial reporting.

Technical Line: Accounting for digital assets, including crypto assets - This document provides insights into the accounting procedures for digital assets under US GAAP, emphasizing the importance of evaluating ownership and asset characteristics.

dowidth.com

dowidth.com