Embedded finance accounting integrates financial services directly within non-financial platforms, streamlining transactions and improving data accuracy through real-time processing. Decentralized finance (DeFi) accounting, on the other hand, operates on blockchain technology, emphasizing transparency and immutability in recording financial activities without intermediaries. Explore further to understand the distinct accounting methodologies and advantages in these innovative financial ecosystems.

Why it is important

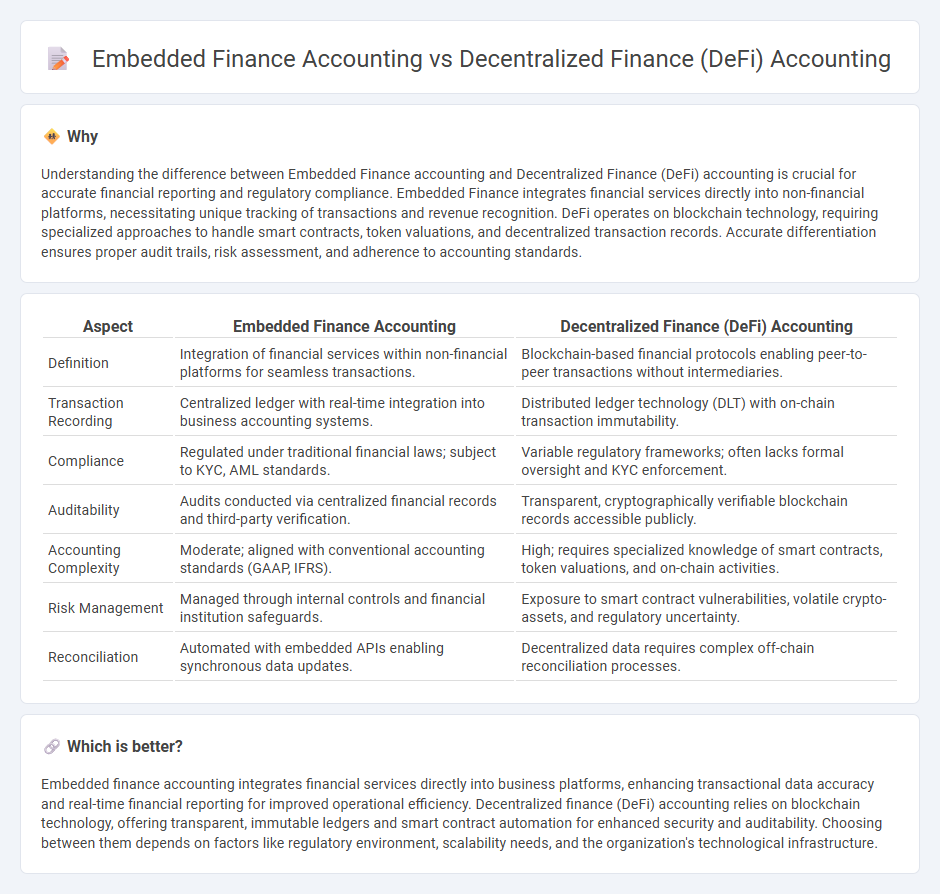

Understanding the difference between Embedded Finance accounting and Decentralized Finance (DeFi) accounting is crucial for accurate financial reporting and regulatory compliance. Embedded Finance integrates financial services directly into non-financial platforms, necessitating unique tracking of transactions and revenue recognition. DeFi operates on blockchain technology, requiring specialized approaches to handle smart contracts, token valuations, and decentralized transaction records. Accurate differentiation ensures proper audit trails, risk assessment, and adherence to accounting standards.

Comparison Table

| Aspect | Embedded Finance Accounting | Decentralized Finance (DeFi) Accounting |

|---|---|---|

| Definition | Integration of financial services within non-financial platforms for seamless transactions. | Blockchain-based financial protocols enabling peer-to-peer transactions without intermediaries. |

| Transaction Recording | Centralized ledger with real-time integration into business accounting systems. | Distributed ledger technology (DLT) with on-chain transaction immutability. |

| Compliance | Regulated under traditional financial laws; subject to KYC, AML standards. | Variable regulatory frameworks; often lacks formal oversight and KYC enforcement. |

| Auditability | Audits conducted via centralized financial records and third-party verification. | Transparent, cryptographically verifiable blockchain records accessible publicly. |

| Accounting Complexity | Moderate; aligned with conventional accounting standards (GAAP, IFRS). | High; requires specialized knowledge of smart contracts, token valuations, and on-chain activities. |

| Risk Management | Managed through internal controls and financial institution safeguards. | Exposure to smart contract vulnerabilities, volatile crypto-assets, and regulatory uncertainty. |

| Reconciliation | Automated with embedded APIs enabling synchronous data updates. | Decentralized data requires complex off-chain reconciliation processes. |

Which is better?

Embedded finance accounting integrates financial services directly into business platforms, enhancing transactional data accuracy and real-time financial reporting for improved operational efficiency. Decentralized finance (DeFi) accounting relies on blockchain technology, offering transparent, immutable ledgers and smart contract automation for enhanced security and auditability. Choosing between them depends on factors like regulatory environment, scalability needs, and the organization's technological infrastructure.

Connection

Embedded finance accounting integrates financial services directly into non-financial platforms, creating seamless transactional data flows that require specialized accounting processes aligned with real-time operations. Decentralized finance (DeFi) accounting involves tracking blockchain-based financial activities, smart contracts, and cryptocurrency transactions, necessitating transparent, immutable, and automated ledger systems. Both embedded finance and DeFi accounting converge through their reliance on innovative technology to enhance transactional accuracy, real-time data reconciliation, and the governance of digital assets within complex financial ecosystems.

Key Terms

Smart Contracts

Decentralized finance (DeFi) accounting relies heavily on blockchain technology to record transactions executed through smart contracts, ensuring transparency, immutability, and real-time verification without intermediaries. Embedded finance accounting integrates financial services directly into non-financial platforms, utilizing smart contracts to automate payments and settlements while maintaining compliance with traditional accounting systems. Explore how smart contracts revolutionize accuracy and efficiency in both DeFi and embedded finance accounting frameworks.

On-chain Transactions

DeFi accounting prioritizes transparency and immutability by recording on-chain transactions directly on blockchain ledgers, enabling real-time verification and auditability of assets and liabilities. Embedded finance accounting integrates financial services within non-financial platforms, tracking on-chain transactions alongside off-chain data to provide seamless financial operations within apps and ecosystems. Explore the distinctions and operational implications of on-chain transaction handling in DeFi versus embedded finance accounting to optimize your financial strategies.

Revenue Recognition

Revenue recognition in decentralized finance (DeFi) accounting centers on tracking revenue generated from smart contract interactions, token transactions, and protocol fees, often requiring real-time blockchain data integration. In contrast, embedded finance accounting focuses on recognizing revenue from integrated financial services within non-financial platforms, such as payments or lending, relying heavily on traditional accounting standards for service fees and commissions. Explore detailed methodologies and compliance strategies to optimize revenue recognition in both DeFi and embedded finance contexts.

Source and External Links

How Accountants Are Taming the Cryptocurrency Chaos - Accounting for DeFi involves complex challenges such as tracking peer-to-peer blockchain transactions, valuing volatile tokens and NFTs, handling the lack of standardized financial reporting, and managing evolving tax implications in decentralized finance environments.

DeFi Accounting | Onchain Accounting | #1 Expert - DeFi accounting focuses on accurate tracking and recording of DeFi activities like yield farming and liquidity providing, ensuring compliance with evolving regulations through specialized blockchain and crypto CPA expertise.

Accounting and decentralized finance (DeFi) - The decentralized nature of DeFi eliminates intermediaries, creating unique challenges for asset security auditability, transparency, and governance, driving accounting professionals to adapt auditing and assurance practices to this new financial ecosystem.

dowidth.com

dowidth.com