Cryptofinance reconciliation involves verifying and matching cryptocurrency transactions across wallets and exchanges to ensure accuracy in digital asset records. Intercompany reconciliation focuses on aligning financial transactions and balances between different entities within the same corporate group to prevent discrepancies and eliminate double-counting. Explore the distinctions and methodologies behind these reconciliations to enhance your accounting precision.

Why it is important

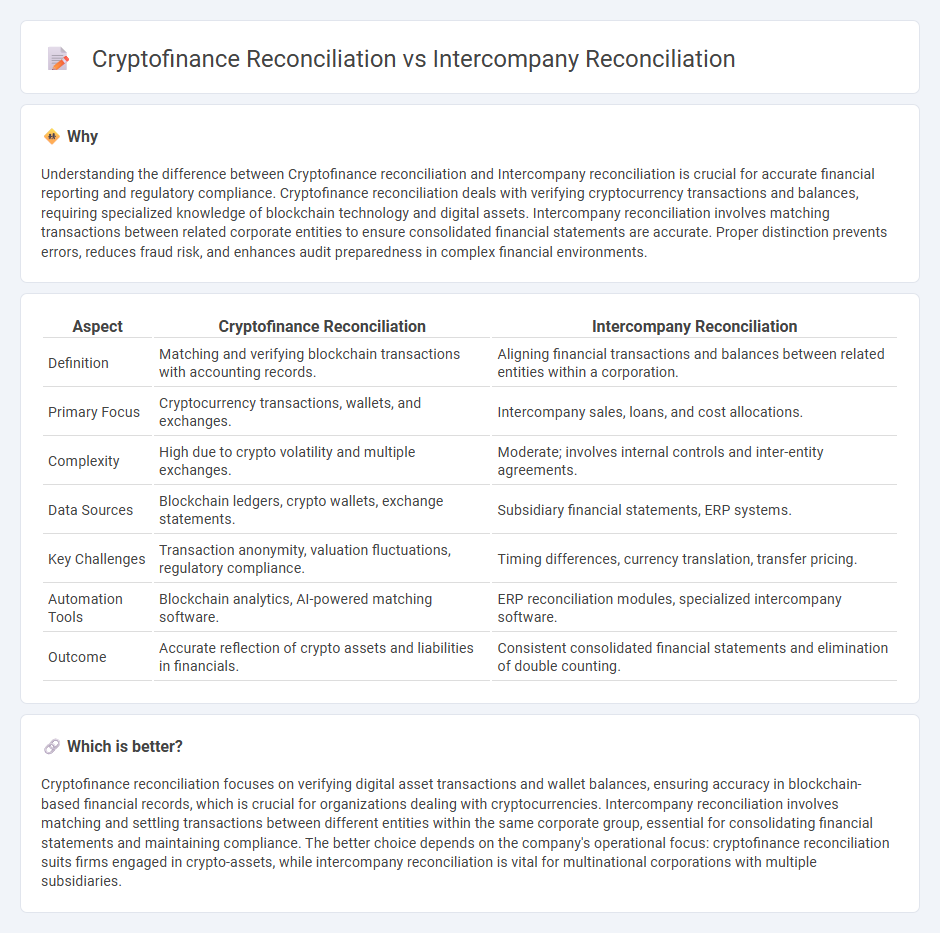

Understanding the difference between Cryptofinance reconciliation and Intercompany reconciliation is crucial for accurate financial reporting and regulatory compliance. Cryptofinance reconciliation deals with verifying cryptocurrency transactions and balances, requiring specialized knowledge of blockchain technology and digital assets. Intercompany reconciliation involves matching transactions between related corporate entities to ensure consolidated financial statements are accurate. Proper distinction prevents errors, reduces fraud risk, and enhances audit preparedness in complex financial environments.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Intercompany Reconciliation |

|---|---|---|

| Definition | Matching and verifying blockchain transactions with accounting records. | Aligning financial transactions and balances between related entities within a corporation. |

| Primary Focus | Cryptocurrency transactions, wallets, and exchanges. | Intercompany sales, loans, and cost allocations. |

| Complexity | High due to crypto volatility and multiple exchanges. | Moderate; involves internal controls and inter-entity agreements. |

| Data Sources | Blockchain ledgers, crypto wallets, exchange statements. | Subsidiary financial statements, ERP systems. |

| Key Challenges | Transaction anonymity, valuation fluctuations, regulatory compliance. | Timing differences, currency translation, transfer pricing. |

| Automation Tools | Blockchain analytics, AI-powered matching software. | ERP reconciliation modules, specialized intercompany software. |

| Outcome | Accurate reflection of crypto assets and liabilities in financials. | Consistent consolidated financial statements and elimination of double counting. |

Which is better?

Cryptofinance reconciliation focuses on verifying digital asset transactions and wallet balances, ensuring accuracy in blockchain-based financial records, which is crucial for organizations dealing with cryptocurrencies. Intercompany reconciliation involves matching and settling transactions between different entities within the same corporate group, essential for consolidating financial statements and maintaining compliance. The better choice depends on the company's operational focus: cryptofinance reconciliation suits firms engaged in crypto-assets, while intercompany reconciliation is vital for multinational corporations with multiple subsidiaries.

Connection

Cryptofinance reconciliation ensures accurate matching of cryptocurrency transactions across multiple wallets and exchanges, while intercompany reconciliation aligns financial records between different entities within a corporate group. Both processes rely on precise transaction verification and data consistency to maintain transparent financial reporting and compliance. Integrating cryptofinance reconciliation into intercompany reconciliation streamlines consolidation efforts and reduces discrepancies in financial statements involving digital assets.

Key Terms

**Intercompany reconciliation:**

Intercompany reconciliation involves matching and resolving transactions between different entities within the same corporate group to ensure accuracy in financial statements and eliminate intercompany profit or loss. It requires detailed review of intercompany invoices, payments, and account balances to maintain compliance with accounting standards and prevent discrepancies. Explore more about best practices and tools for efficient intercompany reconciliation to enhance your financial reporting accuracy.

Eliminations

Intercompany reconciliation involves matching and eliminating transactions between subsidiaries to prevent double-counting in consolidated financial statements, ensuring accuracy in reporting intercompany profits and balances. Cryptofinance reconciliation focuses on verifying and eliminating discrepancies between cryptocurrency wallets and exchange records, addressing challenges like transaction immutability and decentralized ledger verification. Explore detailed strategies and tools to enhance elimination processes in both intercompany and cryptofinance reconciliations.

Subsidiaries

Intercompany reconciliation involves verifying and matching financial transactions between subsidiaries to ensure consistency in consolidated financial statements. Cryptofinance reconciliation focuses on tracking and validating cryptocurrency transactions across subsidiaries to prevent discrepancies caused by volatile asset values and complex blockchain records. Explore detailed insights on optimizing reconciliation processes across subsidiaries in both traditional and crypto finance environments.

Source and External Links

What is intercompany reconciliation? - Intercompany reconciliation is the process of ensuring all financial transactions between different entities within the same corporate group are accurately recorded and balanced to prevent discrepancies and support accurate consolidated financial reporting.

Intercompany Reconciliation: How to Reconcile Multi-Entity ... - Intercompany reconciliations involve matching and verifying transactions between entities in the same corporate group to ensure that intercompany balances net to zero, which is essential for reliable consolidated financial statements and maintaining transparency with stakeholders.

What is Intercompany Reconciliation: Process and Examples - Intercompany accounts reconciliation is the process of reviewing and matching transactions between related companies to ensure all amounts are recorded correctly and consistently, which is crucial for financial accuracy, regulatory compliance, and organizational transparency.

dowidth.com

dowidth.com