Embedded lease accounting involves identifying lease components within contracts that contain multiple elements, recognizing lease liabilities and right-of-use assets accordingly. Finance lease accounting requires lessees to record leased assets and corresponding liabilities on the balance sheet when lease terms transfer substantially all risks and rewards of ownership. Explore further to understand the distinct recognition and measurement criteria for each lease type.

Why it is important

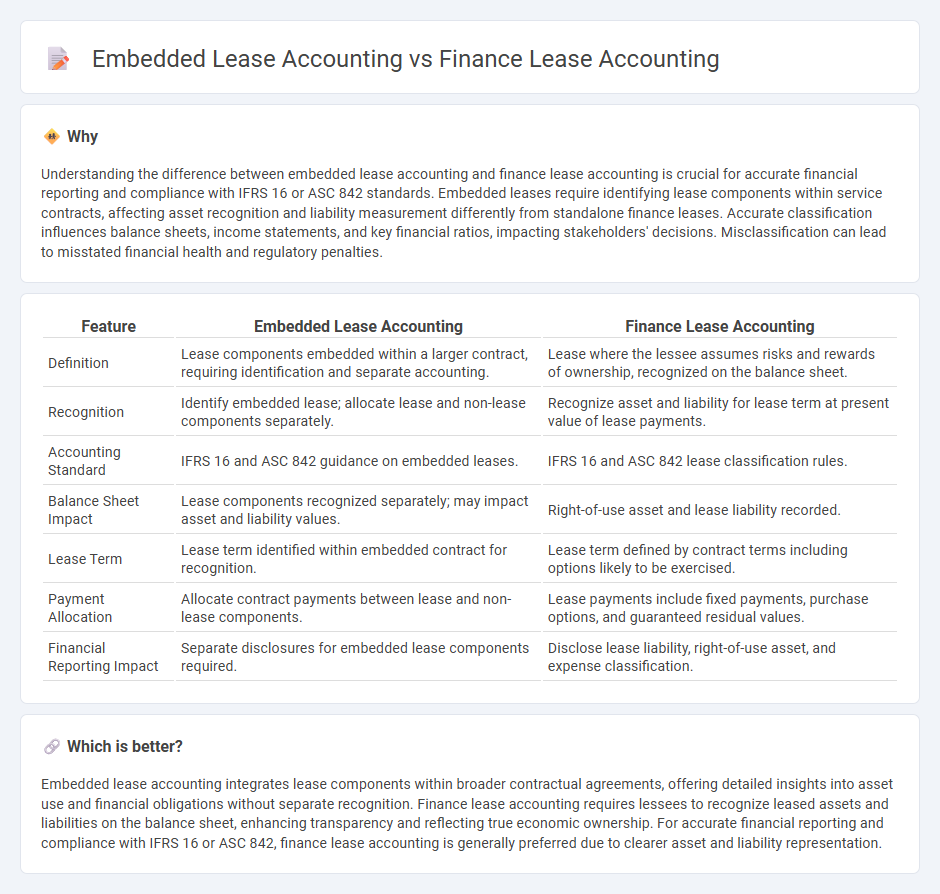

Understanding the difference between embedded lease accounting and finance lease accounting is crucial for accurate financial reporting and compliance with IFRS 16 or ASC 842 standards. Embedded leases require identifying lease components within service contracts, affecting asset recognition and liability measurement differently from standalone finance leases. Accurate classification influences balance sheets, income statements, and key financial ratios, impacting stakeholders' decisions. Misclassification can lead to misstated financial health and regulatory penalties.

Comparison Table

| Feature | Embedded Lease Accounting | Finance Lease Accounting |

|---|---|---|

| Definition | Lease components embedded within a larger contract, requiring identification and separate accounting. | Lease where the lessee assumes risks and rewards of ownership, recognized on the balance sheet. |

| Recognition | Identify embedded lease; allocate lease and non-lease components separately. | Recognize asset and liability for lease term at present value of lease payments. |

| Accounting Standard | IFRS 16 and ASC 842 guidance on embedded leases. | IFRS 16 and ASC 842 lease classification rules. |

| Balance Sheet Impact | Lease components recognized separately; may impact asset and liability values. | Right-of-use asset and lease liability recorded. |

| Lease Term | Lease term identified within embedded contract for recognition. | Lease term defined by contract terms including options likely to be exercised. |

| Payment Allocation | Allocate contract payments between lease and non-lease components. | Lease payments include fixed payments, purchase options, and guaranteed residual values. |

| Financial Reporting Impact | Separate disclosures for embedded lease components required. | Disclose lease liability, right-of-use asset, and expense classification. |

Which is better?

Embedded lease accounting integrates lease components within broader contractual agreements, offering detailed insights into asset use and financial obligations without separate recognition. Finance lease accounting requires lessees to recognize leased assets and liabilities on the balance sheet, enhancing transparency and reflecting true economic ownership. For accurate financial reporting and compliance with IFRS 16 or ASC 842, finance lease accounting is generally preferred due to clearer asset and liability representation.

Connection

Embedded lease accounting and finance lease accounting are connected through the recognition and measurement of lease liabilities and right-of-use assets on the balance sheet. Both approaches ensure compliance with accounting standards such as IFRS 16 and ASC 842, providing transparency in lease-related financial reporting. Accurate identification of embedded leases within contracts is essential for applying finance lease accounting principles effectively.

Key Terms

Right-of-Use Asset

Finance lease accounting recognizes the Right-of-Use (ROU) asset on the balance sheet, reflecting the lessee's control over the leased asset throughout the lease term, with initial measurement based on lease liabilities and present value of lease payments under ASC 842 or IFRS 16. In embedded lease accounting, the ROU asset arises when a contract contains a lease component embedded within a larger contract, requiring identification and separation of the lease element to properly account for the ROU asset and lease liability. Explore detailed guidance on distinguishing and accounting for embedded leases to enhance accuracy in financial reporting.

Lease Liability

Finance lease accounting records lease liabilities based on the present value of lease payments over the lease term, reflecting ownership transfer risks and rewards. Embedded lease accounting identifies lease components within larger contracts, requiring separation and recognition of lease liabilities when asset control is conveyed. Explore comprehensive guidelines and detailed examples to fully understand lease liability treatment in both contexts.

Embedded Lease Identification

Finance lease accounting recognizes leases based on control and transfer of risks and rewards, while embedded lease accounting focuses on identifying lease components within contracts that may not be explicitly labeled as leases. Embedded lease identification involves analyzing contract terms and assessing whether an asset's use is conveyed, triggering lease accounting standards under IFRS 16 and ASC 842. Explore comprehensive methods and tools to effectively identify embedded leases in complex contracts.

Source and External Links

What is Finance Lease Accounting | MRI Software AU - Finance lease accounting records long-term leases on the balance sheet, recognizing both the asset and lease liability, where the lessee assumes ownership risks and rewards, often when lease terms cover 75% or more of asset life or payments equal 90% or more of asset value, per ASC 842 and IFRS 16.

Lease Accounting Explained - Corporate Finance Institute - New standards like ASC 842 and IFRS 16 require finance leases to be recognized on the balance sheet as right-of-use assets with corresponding liabilities, increasing transparency and preventing off-balance-sheet financing.

Accounting for leases | F7 Financial Reporting - ACCA Global - Initial finance lease accounting requires capitalizing the leased asset and recognizing a lease liability at the lower of the asset's fair value or present value of minimum lease payments, with amortization and interest recognized over the lease term.

dowidth.com

dowidth.com