Cryptofinance reconciliation focuses on verifying and matching cryptocurrency transactions and wallet balances to ensure accuracy in digital asset management. Loan reconciliation involves comparing loan records, payment schedules, and account balances to detect discrepancies and maintain financial integrity. Explore more to understand the key differences and best practices in both reconciliation processes.

Why it is important

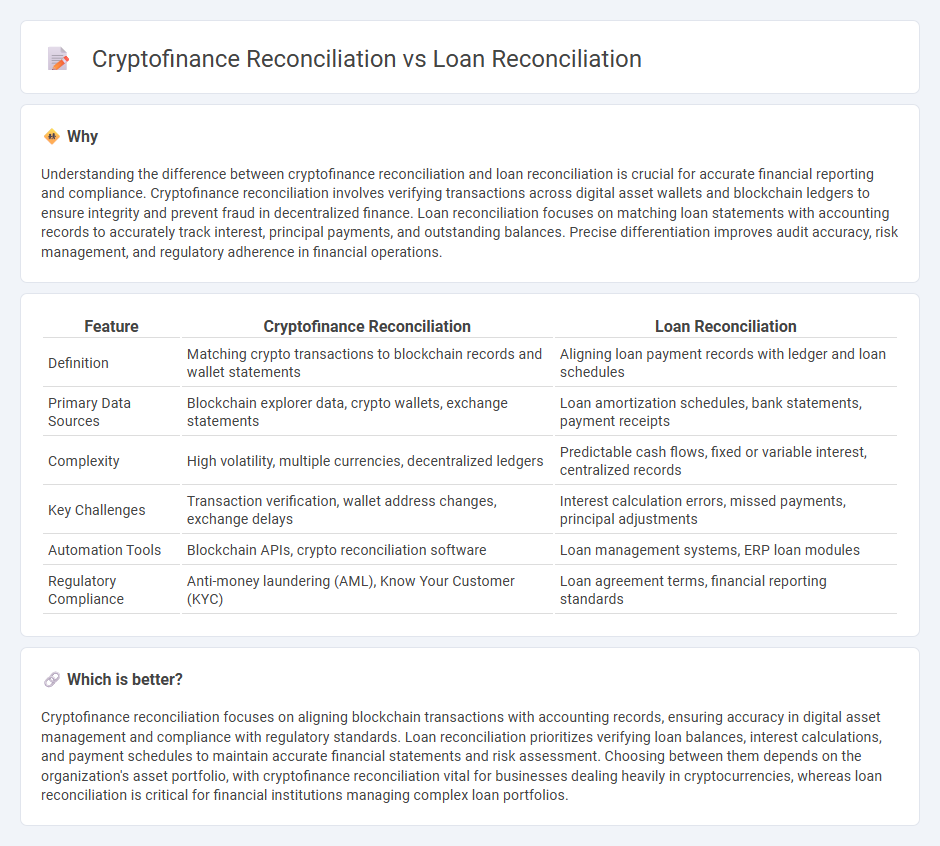

Understanding the difference between cryptofinance reconciliation and loan reconciliation is crucial for accurate financial reporting and compliance. Cryptofinance reconciliation involves verifying transactions across digital asset wallets and blockchain ledgers to ensure integrity and prevent fraud in decentralized finance. Loan reconciliation focuses on matching loan statements with accounting records to accurately track interest, principal payments, and outstanding balances. Precise differentiation improves audit accuracy, risk management, and regulatory adherence in financial operations.

Comparison Table

| Feature | Cryptofinance Reconciliation | Loan Reconciliation |

|---|---|---|

| Definition | Matching crypto transactions to blockchain records and wallet statements | Aligning loan payment records with ledger and loan schedules |

| Primary Data Sources | Blockchain explorer data, crypto wallets, exchange statements | Loan amortization schedules, bank statements, payment receipts |

| Complexity | High volatility, multiple currencies, decentralized ledgers | Predictable cash flows, fixed or variable interest, centralized records |

| Key Challenges | Transaction verification, wallet address changes, exchange delays | Interest calculation errors, missed payments, principal adjustments |

| Automation Tools | Blockchain APIs, crypto reconciliation software | Loan management systems, ERP loan modules |

| Regulatory Compliance | Anti-money laundering (AML), Know Your Customer (KYC) | Loan agreement terms, financial reporting standards |

Which is better?

Cryptofinance reconciliation focuses on aligning blockchain transactions with accounting records, ensuring accuracy in digital asset management and compliance with regulatory standards. Loan reconciliation prioritizes verifying loan balances, interest calculations, and payment schedules to maintain accurate financial statements and risk assessment. Choosing between them depends on the organization's asset portfolio, with cryptofinance reconciliation vital for businesses dealing heavily in cryptocurrencies, whereas loan reconciliation is critical for financial institutions managing complex loan portfolios.

Connection

Cryptofinance reconciliation and loan reconciliation are connected through their focus on ensuring accuracy and consistency in financial records related to digital assets and lending transactions. Both processes involve verifying transaction data, balancing accounts, and identifying discrepancies to maintain compliance and improve financial reporting. Effective integration of these reconciliations supports transparent auditing and risk management in fintech and blockchain-based loan systems.

Key Terms

**Loan reconciliation:**

Loan reconciliation involves matching loan balances, payment schedules, interest accruals, and principal repayments between internal records and external statements to ensure accuracy in financial reporting. It requires analyzing amortization schedules, verifying transaction dates, and resolving discrepancies related to loan servicing fees, penalties, or early repayments. Explore detailed methodologies and best practices for loan reconciliation to enhance financial transparency and compliance.

Principal balance

Loan reconciliation focuses on accurately aligning the principal balance by tracking repayments, interest accruals, and adjustments to ensure the loan ledger matches the actual outstanding amount. Cryptofinance reconciliation involves verifying principal balances amidst volatile asset valuations, blockchain transaction records, and smart contract terms to maintain consistency with decentralized ledgers. Discover how these critical processes differ and which strategies optimize principal balance accuracy in each domain.

Interest accrual

Loan reconciliation primarily involves matching loan transactions and interest accruals to ensure accurate financial reporting, focusing on interest payments, principal reductions, and outstanding balances. Cryptofinance reconciliation requires tracking volatile cryptocurrency valuations alongside interest accruals, often complicated by decentralized finance (DeFi) protocols that calculate interest dynamically on crypto assets. Explore detailed methods to optimize interest accrual tracking in both traditional loans and cryptofinance reconciliations.

Source and External Links

Mastering Loan Reconciliation: A Guide for Modern ... - Loan reconciliation is the process of ensuring your company's loan records align with what your lenders report by comparing internal records to lender documentation, identifying discrepancies such as errors or timing differences, and correcting them to maintain accurate financial reporting and lender relationships.

Automating the Loan Reconciliation Process - This process involves gathering internal and lender loan records, verifying starting balances, comparing interest expenses, investigating discrepancies, correcting errors with journal entries, and producing a reconciliation report often used for audits.

Markit Loan Reconciliation - In syndicated loan markets, loan reconciliation is automated via platforms like Markit Loan Reconciliation, which provides accurate loan asset ownership data, validates position information between agents and lenders, and creates detailed audit trails to resolve discrepancies efficiently.

dowidth.com

dowidth.com