Forensic data analytics involves examining financial records to detect fraud, errors, or compliance issues through advanced data analysis techniques. Business valuation focuses on determining a company's economic worth by analyzing assets, earnings, market conditions, and financial projections. Explore detailed insights to understand how both disciplines enhance financial decision-making and risk management.

Why it is important

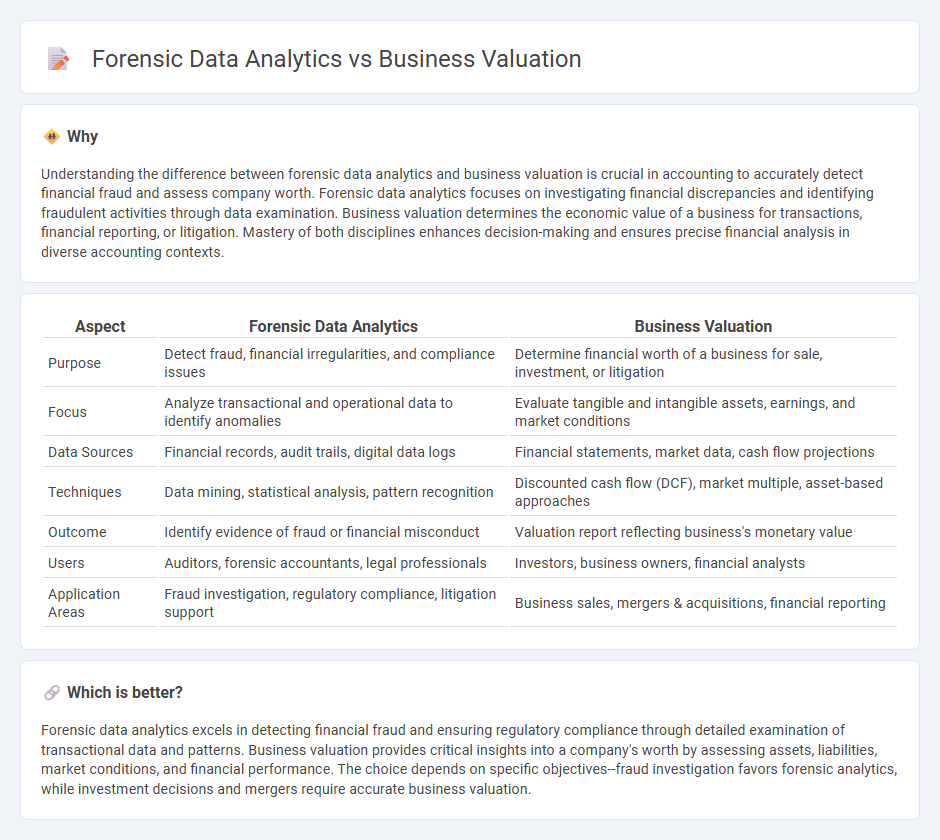

Understanding the difference between forensic data analytics and business valuation is crucial in accounting to accurately detect financial fraud and assess company worth. Forensic data analytics focuses on investigating financial discrepancies and identifying fraudulent activities through data examination. Business valuation determines the economic value of a business for transactions, financial reporting, or litigation. Mastery of both disciplines enhances decision-making and ensures precise financial analysis in diverse accounting contexts.

Comparison Table

| Aspect | Forensic Data Analytics | Business Valuation |

|---|---|---|

| Purpose | Detect fraud, financial irregularities, and compliance issues | Determine financial worth of a business for sale, investment, or litigation |

| Focus | Analyze transactional and operational data to identify anomalies | Evaluate tangible and intangible assets, earnings, and market conditions |

| Data Sources | Financial records, audit trails, digital data logs | Financial statements, market data, cash flow projections |

| Techniques | Data mining, statistical analysis, pattern recognition | Discounted cash flow (DCF), market multiple, asset-based approaches |

| Outcome | Identify evidence of fraud or financial misconduct | Valuation report reflecting business's monetary value |

| Users | Auditors, forensic accountants, legal professionals | Investors, business owners, financial analysts |

| Application Areas | Fraud investigation, regulatory compliance, litigation support | Business sales, mergers & acquisitions, financial reporting |

Which is better?

Forensic data analytics excels in detecting financial fraud and ensuring regulatory compliance through detailed examination of transactional data and patterns. Business valuation provides critical insights into a company's worth by assessing assets, liabilities, market conditions, and financial performance. The choice depends on specific objectives--fraud investigation favors forensic analytics, while investment decisions and mergers require accurate business valuation.

Connection

Forensic data analytics enhances business valuation by identifying financial discrepancies, fraud, and irregularities that can significantly impact the accuracy of a company's worth. Through detailed analysis of transactional data, forensic experts uncover hidden liabilities or asset misstatements, providing a more reliable foundation for valuation models. This integration ensures that stakeholders receive a transparent and precise assessment of the business's true economic value.

Key Terms

**Business valuation:**

Business valuation involves assessing a company's worth by analyzing financial statements, market conditions, and asset valuations to support investment decisions or mergers and acquisitions. Techniques such as discounted cash flow (DCF), comparable company analysis, and precedent transactions are commonly used for accurate valuation. Discover more about how expert business valuation drives strategic growth and informed decision-making.

Fair Market Value

Fair Market Value (FMV) is a core metric in business valuation, representing the price at which an asset would change hands between a willing buyer and seller in an open market. Forensic data analytics strengthens the accuracy of FMV assessments by scrutinizing financial records, identifying anomalies, and validating transactional data to prevent fraud and misrepresentation. Explore our comprehensive guide to understand how blending these approaches enhances precise valuation and risk mitigation.

Discounted Cash Flow (DCF)

Business valuation often relies on Discounted Cash Flow (DCF) analysis to estimate a company's intrinsic value based on projected future cash flows discounted at a risk-adjusted rate, providing investors and stakeholders with quantifiable metrics for decision-making. Forensic data analytics, while also utilizing financial data, focuses on detecting anomalies, fraud, and irregularities within cash flow streams to ensure the reliability and integrity of the financial information used in valuations. Explore how integrating forensic data analytics strengthens the accuracy and trustworthiness of DCF-based business valuations.

Source and External Links

Determining Your Business's Market Value - This article discusses various methods for determining the market value of a business, including tallying assets, using revenue and earnings multiples, and performing a discounted cash-flow analysis.

What is a Business Valuation and How Do You Calculate It - This page explains the three main methods of business valuation: asset-based, earnings value, and market value methods, highlighting their pros and cons.

Business Valuation - This Wikipedia entry provides an overview of business valuation processes and techniques used to estimate the economic value of a business, including reasons for conducting valuations.

dowidth.com

dowidth.com