Outsourced bookkeeping services provide businesses with expert financial record management while reducing operational costs and increasing scalability compared to in-house bookkeeping teams. Companies benefit from access to specialized professionals and advanced accounting technologies without the overhead expenses associated with full-time staff. Explore how outsourced bookkeeping can enhance your financial accuracy and efficiency.

Why it is important

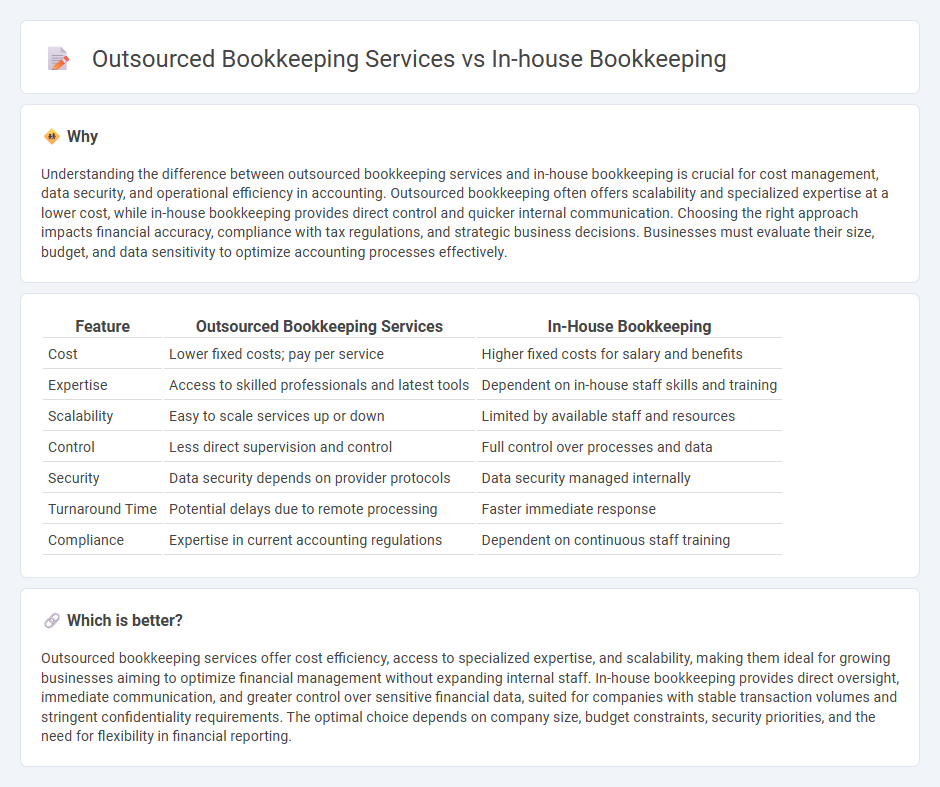

Understanding the difference between outsourced bookkeeping services and in-house bookkeeping is crucial for cost management, data security, and operational efficiency in accounting. Outsourced bookkeeping often offers scalability and specialized expertise at a lower cost, while in-house bookkeeping provides direct control and quicker internal communication. Choosing the right approach impacts financial accuracy, compliance with tax regulations, and strategic business decisions. Businesses must evaluate their size, budget, and data sensitivity to optimize accounting processes effectively.

Comparison Table

| Feature | Outsourced Bookkeeping Services | In-House Bookkeeping |

|---|---|---|

| Cost | Lower fixed costs; pay per service | Higher fixed costs for salary and benefits |

| Expertise | Access to skilled professionals and latest tools | Dependent on in-house staff skills and training |

| Scalability | Easy to scale services up or down | Limited by available staff and resources |

| Control | Less direct supervision and control | Full control over processes and data |

| Security | Data security depends on provider protocols | Data security managed internally |

| Turnaround Time | Potential delays due to remote processing | Faster immediate response |

| Compliance | Expertise in current accounting regulations | Dependent on continuous staff training |

Which is better?

Outsourced bookkeeping services offer cost efficiency, access to specialized expertise, and scalability, making them ideal for growing businesses aiming to optimize financial management without expanding internal staff. In-house bookkeeping provides direct oversight, immediate communication, and greater control over sensitive financial data, suited for companies with stable transaction volumes and stringent confidentiality requirements. The optimal choice depends on company size, budget constraints, security priorities, and the need for flexibility in financial reporting.

Connection

Outsourced bookkeeping services and in-house bookkeeping both focus on accurate financial record-keeping, ensuring compliance with accounting standards and facilitating informed business decisions. Businesses may leverage outsourced bookkeeping to access specialized expertise and cost efficiency, while maintaining oversight through in-house bookkeeping teams for day-to-day financial management. Integrating both approaches can optimize financial workflow, improve data accuracy, and enhance overall accounting performance.

Key Terms

Cost Efficiency

In-house bookkeeping requires direct expenses such as salaries, benefits, and training, often leading to higher fixed costs. Outsourced bookkeeping services offer scalable pricing models and reduced overhead, enhancing overall cost efficiency for businesses. Explore detailed comparisons to determine the best strategy for your financial management needs.

Data Security

In-house bookkeeping provides direct control over sensitive financial data, minimizing exposure risks through restricted access within the company's secure network. Outsourced bookkeeping services implement advanced encryption protocols and compliance standards such as SOC 2 and GDPR to safeguard client information across digital platforms. Explore detailed comparisons of data security measures to decide the best approach for your business needs.

Control & Oversight

In-house bookkeeping offers businesses direct control and immediate oversight of financial records, enabling real-time adjustments and personalized management aligned with company policies. Outsourced bookkeeping services provide specialized expertise and scalable solutions but require trust in third-party providers to maintain accuracy and confidentiality. Explore the advantages and challenges of both approaches to determine the best fit for your financial management needs.

Source and External Links

Internal Bookkeeping vs Outsourcing: Key Takeaways - In-house bookkeeping means employees within your company handle financial record-keeping, offering cost efficiency for straightforward operations, better financial insight, and enhanced control over tracking expenses and revenue streams.

Compare in-House vs Outsourced Bookkeeping & Accounting - In-house bookkeeping requires internal controls to reduce fraud risk, provides customized financial reports, but may suffer from limited separation of duties and multitasking that can affect accuracy and timeliness.

Outsourcing vs In-House Bookkeeping: What is better? - The key benefits of in-house bookkeeping include familiarity with business operations and direct oversight, but drawbacks are higher fixed overhead costs including salaries, benefits, and office space requirements.

dowidth.com

dowidth.com