Supply chain finance focuses on optimizing cash flow by financing transactions between buyers and suppliers, enhancing liquidity and reducing payment risks. Working capital management involves overseeing current assets and liabilities to ensure sufficient operational liquidity and efficient resource utilization. Explore the distinctions and their impact on business finance strategies.

Why it is important

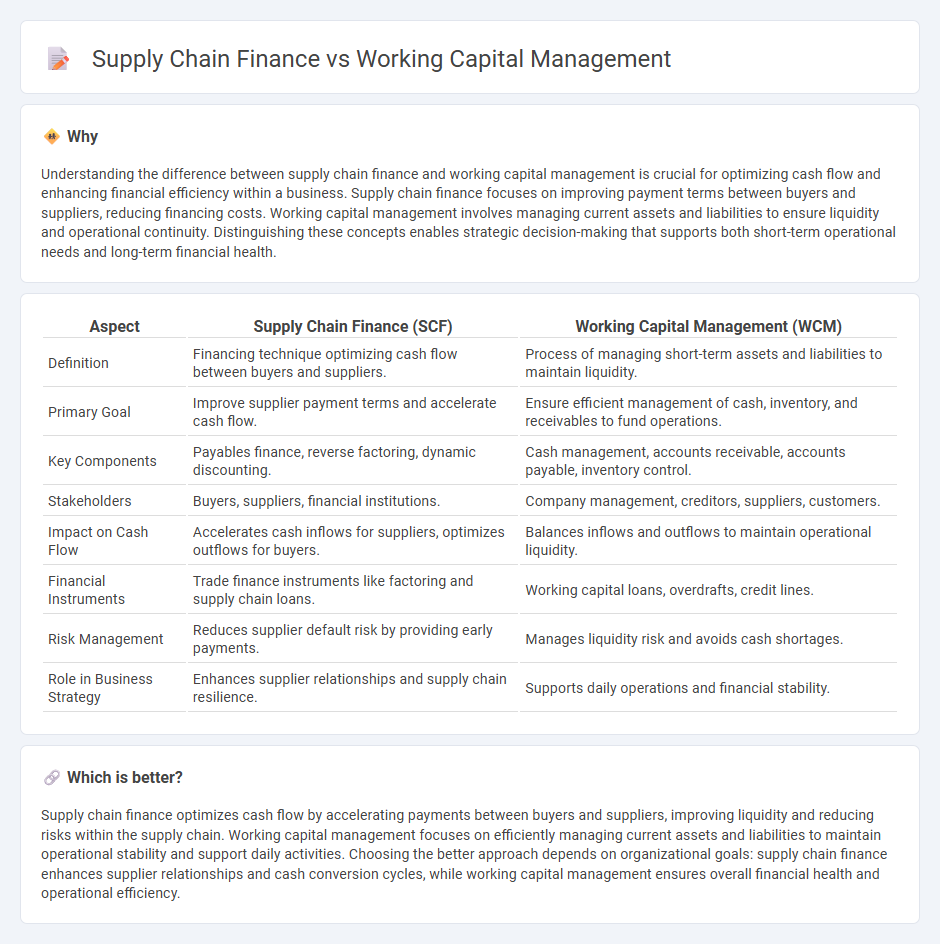

Understanding the difference between supply chain finance and working capital management is crucial for optimizing cash flow and enhancing financial efficiency within a business. Supply chain finance focuses on improving payment terms between buyers and suppliers, reducing financing costs. Working capital management involves managing current assets and liabilities to ensure liquidity and operational continuity. Distinguishing these concepts enables strategic decision-making that supports both short-term operational needs and long-term financial health.

Comparison Table

| Aspect | Supply Chain Finance (SCF) | Working Capital Management (WCM) |

|---|---|---|

| Definition | Financing technique optimizing cash flow between buyers and suppliers. | Process of managing short-term assets and liabilities to maintain liquidity. |

| Primary Goal | Improve supplier payment terms and accelerate cash flow. | Ensure efficient management of cash, inventory, and receivables to fund operations. |

| Key Components | Payables finance, reverse factoring, dynamic discounting. | Cash management, accounts receivable, accounts payable, inventory control. |

| Stakeholders | Buyers, suppliers, financial institutions. | Company management, creditors, suppliers, customers. |

| Impact on Cash Flow | Accelerates cash inflows for suppliers, optimizes outflows for buyers. | Balances inflows and outflows to maintain operational liquidity. |

| Financial Instruments | Trade finance instruments like factoring and supply chain loans. | Working capital loans, overdrafts, credit lines. |

| Risk Management | Reduces supplier default risk by providing early payments. | Manages liquidity risk and avoids cash shortages. |

| Role in Business Strategy | Enhances supplier relationships and supply chain resilience. | Supports daily operations and financial stability. |

Which is better?

Supply chain finance optimizes cash flow by accelerating payments between buyers and suppliers, improving liquidity and reducing risks within the supply chain. Working capital management focuses on efficiently managing current assets and liabilities to maintain operational stability and support daily activities. Choosing the better approach depends on organizational goals: supply chain finance enhances supplier relationships and cash conversion cycles, while working capital management ensures overall financial health and operational efficiency.

Connection

Supply chain finance optimizes cash flow by accelerating payments to suppliers, directly enhancing working capital management through improved liquidity. Efficient working capital management reduces the cash conversion cycle, enabling businesses to allocate resources more effectively across the supply chain. Integrating supply chain finance with working capital strategies strengthens financial stability and operational efficiency for companies.

Key Terms

**Working Capital Management:**

Working capital management involves optimizing current assets and liabilities to ensure a company maintains sufficient liquidity for day-to-day operations, enhancing cash flow and minimizing financial costs. It focuses on managing inventory, accounts receivable, and accounts payable efficiently to sustain operational stability and profitability. Explore more about how effective working capital management drives business growth and financial health.

Current Assets

Working capital management centers on optimizing current assets such as inventory, accounts receivable, and cash to maintain liquidity and operational efficiency. Supply chain finance leverages financial solutions like invoice factoring and dynamic discounting to accelerate cash flow and reduce working capital requirements by closely integrating suppliers' and buyers' financial processes. Explore detailed strategies and benefits of both approaches to enhance your company's financial health.

Current Liabilities

Working capital management emphasizes optimizing current liabilities such as accounts payable and short-term debt to maintain liquidity and operational efficiency. Supply chain finance specifically targets the financing of payables through solutions like reverse factoring to improve cash flow and strengthen supplier relationships. Explore how these strategies impact financial stability and supply chain resilience.

Source and External Links

Working Capital Management : Objectives, Types ... - Working capital management is crucial for ensuring a company can meet its short-term financial responsibilities by optimizing cash flow and operational efficiency.

What Is Working Capital Management? | Definition & ... - Working capital management helps companies effectively use current assets and optimize cash flow to meet short-term financial obligations while contributing to long-term objectives.

What Is Working Capital? How to Calculate and Why It's ... - Working capital management involves a financial strategy to optimize working capital for day-to-day expenses and ensure productive resource investment.

dowidth.com

dowidth.com