Real-time expense management enables businesses to monitor and control expenditures instantly through integrated software platforms, enhancing cash flow accuracy and decision-making efficiency. Automated invoice processing streamlines data entry and approval workflows using optical character recognition (OCR) and artificial intelligence, reducing errors and accelerating payment cycles. Explore further to understand how these technologies transform financial operations and boost organizational productivity.

Why it is important

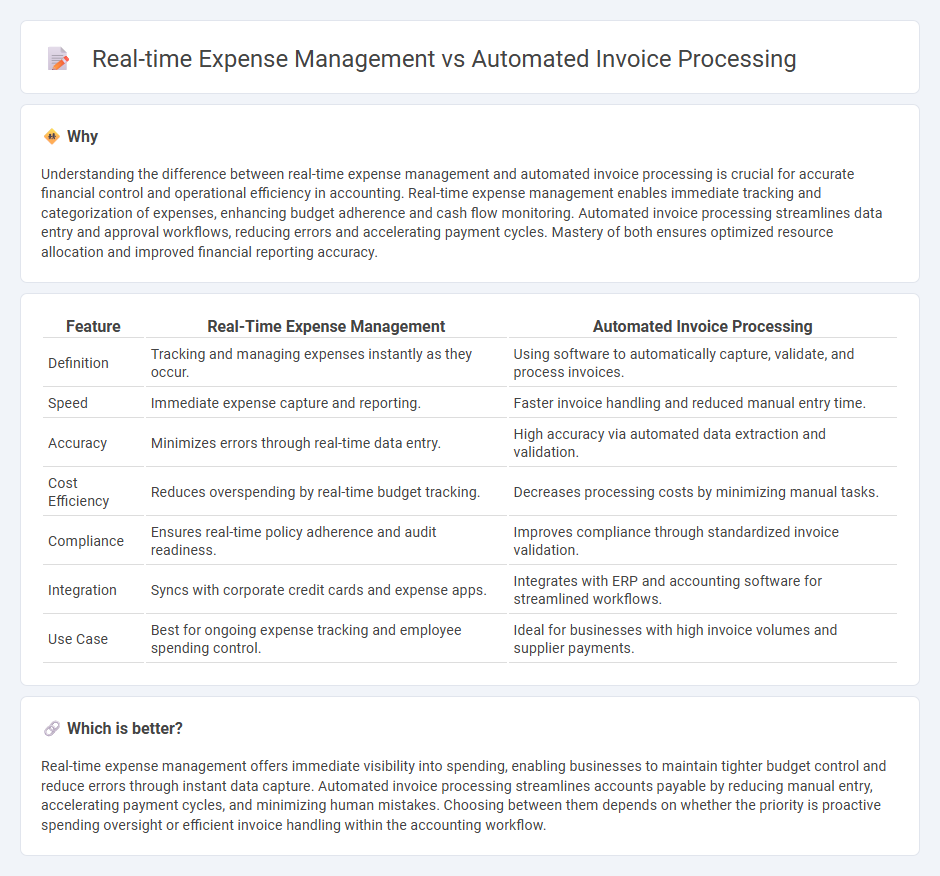

Understanding the difference between real-time expense management and automated invoice processing is crucial for accurate financial control and operational efficiency in accounting. Real-time expense management enables immediate tracking and categorization of expenses, enhancing budget adherence and cash flow monitoring. Automated invoice processing streamlines data entry and approval workflows, reducing errors and accelerating payment cycles. Mastery of both ensures optimized resource allocation and improved financial reporting accuracy.

Comparison Table

| Feature | Real-Time Expense Management | Automated Invoice Processing |

|---|---|---|

| Definition | Tracking and managing expenses instantly as they occur. | Using software to automatically capture, validate, and process invoices. |

| Speed | Immediate expense capture and reporting. | Faster invoice handling and reduced manual entry time. |

| Accuracy | Minimizes errors through real-time data entry. | High accuracy via automated data extraction and validation. |

| Cost Efficiency | Reduces overspending by real-time budget tracking. | Decreases processing costs by minimizing manual tasks. |

| Compliance | Ensures real-time policy adherence and audit readiness. | Improves compliance through standardized invoice validation. |

| Integration | Syncs with corporate credit cards and expense apps. | Integrates with ERP and accounting software for streamlined workflows. |

| Use Case | Best for ongoing expense tracking and employee spending control. | Ideal for businesses with high invoice volumes and supplier payments. |

Which is better?

Real-time expense management offers immediate visibility into spending, enabling businesses to maintain tighter budget control and reduce errors through instant data capture. Automated invoice processing streamlines accounts payable by reducing manual entry, accelerating payment cycles, and minimizing human mistakes. Choosing between them depends on whether the priority is proactive spending oversight or efficient invoice handling within the accounting workflow.

Connection

Real-time expense management enhances financial accuracy by instantly tracking spending data, which seamlessly integrates with automated invoice processing systems to reduce manual entry errors and accelerate approval workflows. Automated invoice processing uses optical character recognition (OCR) and machine learning algorithms to extract and validate expense information, supporting real-time budget monitoring and compliance. This integration streamlines financial operations, improves cash flow visibility, and enables faster decision-making in accounting departments.

Key Terms

Optical Character Recognition (OCR)

Automated invoice processing leverages Optical Character Recognition (OCR) to efficiently digitize and extract data from paper invoices, reducing manual entry errors and accelerating accounts payable workflows. Real-time expense management integrates OCR with mobile scanning and cloud platforms to capture receipts instantly, enabling faster reimbursement and precise budget tracking. Discover how OCR transforms financial operations by exploring the latest innovations in automated invoicing and expense solutions.

Workflow Automation

Automated invoice processing enhances business efficiency by minimizing manual data entry and accelerating invoice approval through intelligent workflow automation systems. Real-time expense management leverages integrated platforms that provide instant visibility into spending, enabling swift decision-making and precise budget control. Explore how advanced workflow automation transforms financial operations to boost productivity and accuracy.

Spend Analytics

Automated invoice processing streamlines the capture and validation of billing data, reducing manual errors and accelerating accounts payable cycles. Real-time expense management provides instant visibility into spending patterns, enabling timely budget adjustments and enhanced compliance monitoring. Explore how spend analytics integrates these functions to deliver actionable insights for optimizing financial performance.

Source and External Links

How Automated Invoice Processing Works: A Starter Guide - This guide outlines a step-by-step workflow for automating invoice processing, including capture, data extraction, matching, approval, and payment.

How automation works in invoice processing - This article explains how automated invoice processing uses software and digital workflows to manage invoices with minimal human intervention.

How to Successfully Automate Invoice Processing in 5 steps - This post provides a five-step approach to automating invoice processing, focusing on capturing, extracting, validating, routing, and processing payments.

dowidth.com

dowidth.com