Zero-knowledge proofs in accounting enhance data privacy by allowing verification of financial transactions without revealing sensitive information, contrasting with blockchain accounting, which prioritizes transparency and immutability through distributed ledger technology. This method reduces risks of data exposure while maintaining trust in financial reporting, offering a balanced approach to confidentiality and accountability. Explore how zero-knowledge proofs revolutionize accounting security and efficiency for deeper insights.

Why it is important

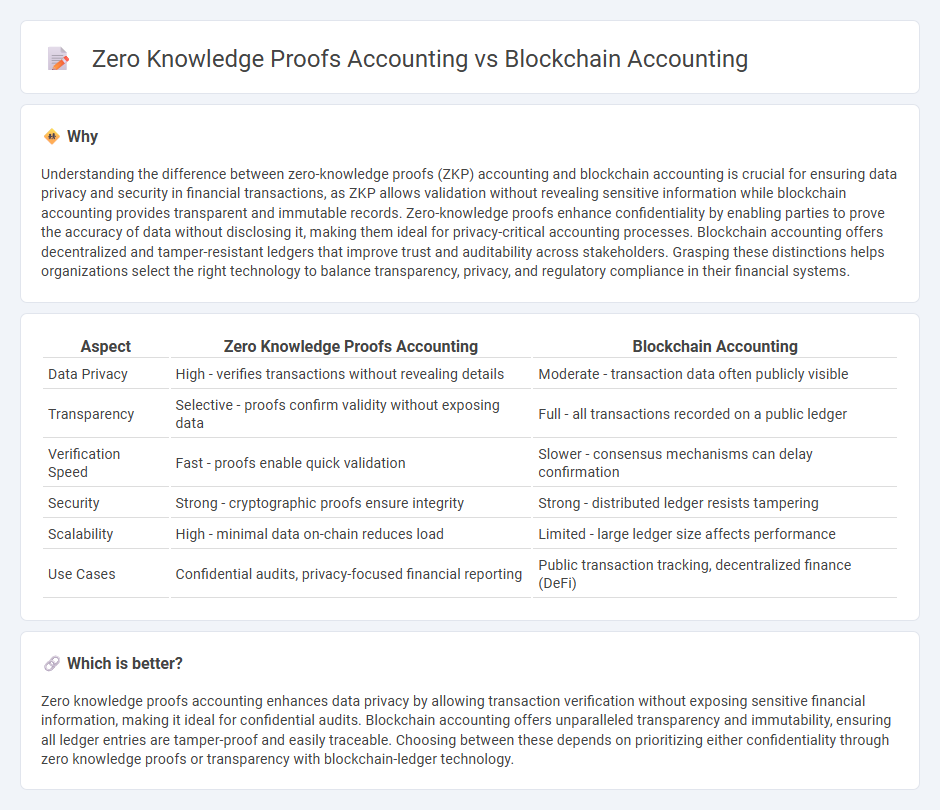

Understanding the difference between zero-knowledge proofs (ZKP) accounting and blockchain accounting is crucial for ensuring data privacy and security in financial transactions, as ZKP allows validation without revealing sensitive information while blockchain accounting provides transparent and immutable records. Zero-knowledge proofs enhance confidentiality by enabling parties to prove the accuracy of data without disclosing it, making them ideal for privacy-critical accounting processes. Blockchain accounting offers decentralized and tamper-resistant ledgers that improve trust and auditability across stakeholders. Grasping these distinctions helps organizations select the right technology to balance transparency, privacy, and regulatory compliance in their financial systems.

Comparison Table

| Aspect | Zero Knowledge Proofs Accounting | Blockchain Accounting |

|---|---|---|

| Data Privacy | High - verifies transactions without revealing details | Moderate - transaction data often publicly visible |

| Transparency | Selective - proofs confirm validity without exposing data | Full - all transactions recorded on a public ledger |

| Verification Speed | Fast - proofs enable quick validation | Slower - consensus mechanisms can delay confirmation |

| Security | Strong - cryptographic proofs ensure integrity | Strong - distributed ledger resists tampering |

| Scalability | High - minimal data on-chain reduces load | Limited - large ledger size affects performance |

| Use Cases | Confidential audits, privacy-focused financial reporting | Public transaction tracking, decentralized finance (DeFi) |

Which is better?

Zero knowledge proofs accounting enhances data privacy by allowing transaction verification without exposing sensitive financial information, making it ideal for confidential audits. Blockchain accounting offers unparalleled transparency and immutability, ensuring all ledger entries are tamper-proof and easily traceable. Choosing between these depends on prioritizing either confidentiality through zero knowledge proofs or transparency with blockchain-ledger technology.

Connection

Zero knowledge proofs enhance blockchain accounting by enabling the verification of transactions without revealing sensitive financial details, ensuring data privacy and security. This cryptographic method supports decentralized accounting systems by providing trust and transparency while maintaining confidentiality. Integrating zero knowledge proofs with blockchain accounting streamlines audit processes and prevents fraud through immutable, verifiable records.

Key Terms

Distributed Ledger

Blockchain accounting utilizes distributed ledger technology to ensure transparent, immutable financial records accessible to all network participants. Zero-knowledge proofs accounting enhances privacy by allowing verification of transactions on distributed ledgers without revealing sensitive data, maintaining confidentiality alongside transparency. Explore how these advancements redefine secure and efficient accounting in decentralized finance.

Cryptographic Validation

Blockchain accounting employs cryptographic hashes and digital signatures to ensure transaction integrity and transparency across decentralized ledgers. Zero knowledge proofs accounting enhances privacy by enabling verification of data validity without revealing the underlying information, maintaining confidentiality while supporting compliance. Explore the emerging benefits and applications of cryptographic validation in these accounting innovations.

Privacy Preservation

Blockchain accounting ensures transactional transparency through decentralized ledgers, yet transaction details remain publicly visible, potentially compromising privacy. Zero-knowledge proofs accounting enhances privacy by allowing verification of transactions without revealing sensitive data, enabling compliance with financial audits while safeguarding confidentiality. Explore how integrating these technologies revolutionizes privacy preservation in modern accounting systems.

Source and External Links

Blockchain in Accounting: Transforming Financial Practices - Blockchain offers secure, transparent, and immutable ledgers that improve transaction recording, audit trails, reconciliations, fraud detection, and automate accounting processes through smart contracts, enhancing accuracy and data security in financial practices.

What is Blockchain Accounting? - Blockchain supports accountants by verifying transactions on a shared public ledger, reducing manual audit work and paperwork, though it does not replace traditional accounting as detailed transactional context remains necessary.

Blockchain Accounting - Guide & Use Cases - Blockchain accounting uses immutable, real-time shared ledgers combined with smart contracts and AI to automate financial processes, reduce fraud, and streamline audits and reconciliations through a triple-entry accounting system.

dowidth.com

dowidth.com