Continuous auditing employs automated tools to provide real-time or near-real-time assurance on financial transactions, enhancing the timeliness and accuracy of audit findings. Statutory auditing, mandated by law, involves periodic examination of financial statements to ensure compliance with accounting standards and regulatory requirements. Explore further to understand the distinct benefits and applications of continuous and statutory auditing in modern accounting practices.

Why it is important

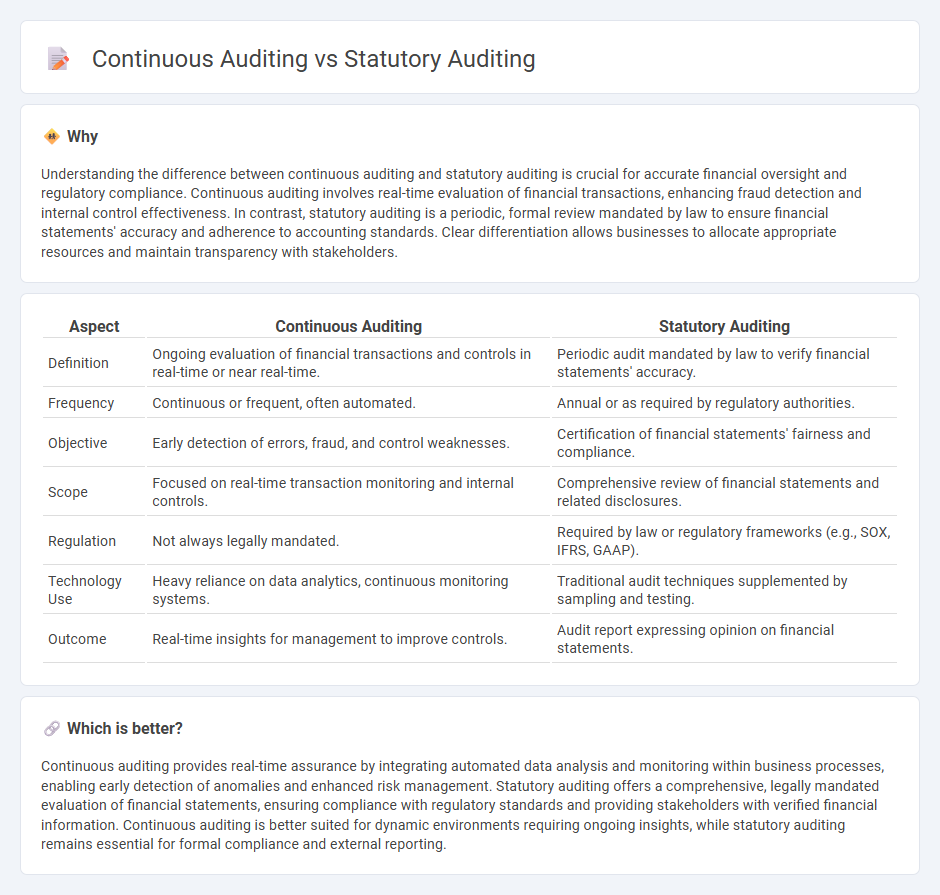

Understanding the difference between continuous auditing and statutory auditing is crucial for accurate financial oversight and regulatory compliance. Continuous auditing involves real-time evaluation of financial transactions, enhancing fraud detection and internal control effectiveness. In contrast, statutory auditing is a periodic, formal review mandated by law to ensure financial statements' accuracy and adherence to accounting standards. Clear differentiation allows businesses to allocate appropriate resources and maintain transparency with stakeholders.

Comparison Table

| Aspect | Continuous Auditing | Statutory Auditing |

|---|---|---|

| Definition | Ongoing evaluation of financial transactions and controls in real-time or near real-time. | Periodic audit mandated by law to verify financial statements' accuracy. |

| Frequency | Continuous or frequent, often automated. | Annual or as required by regulatory authorities. |

| Objective | Early detection of errors, fraud, and control weaknesses. | Certification of financial statements' fairness and compliance. |

| Scope | Focused on real-time transaction monitoring and internal controls. | Comprehensive review of financial statements and related disclosures. |

| Regulation | Not always legally mandated. | Required by law or regulatory frameworks (e.g., SOX, IFRS, GAAP). |

| Technology Use | Heavy reliance on data analytics, continuous monitoring systems. | Traditional audit techniques supplemented by sampling and testing. |

| Outcome | Real-time insights for management to improve controls. | Audit report expressing opinion on financial statements. |

Which is better?

Continuous auditing provides real-time assurance by integrating automated data analysis and monitoring within business processes, enabling early detection of anomalies and enhanced risk management. Statutory auditing offers a comprehensive, legally mandated evaluation of financial statements, ensuring compliance with regulatory standards and providing stakeholders with verified financial information. Continuous auditing is better suited for dynamic environments requiring ongoing insights, while statutory auditing remains essential for formal compliance and external reporting.

Connection

Continuous auditing enhances statutory auditing by providing real-time financial data and ongoing risk assessments, which improve the accuracy and efficiency of compliance evaluations. This integration allows statutory auditors to identify discrepancies and control weaknesses more rapidly, ensuring adherence to regulatory standards. Leveraging continuous auditing technologies supports timely intervention and strengthens overall audit quality in statutory reporting.

Key Terms

Compliance

Statutory auditing ensures compliance through periodic, formal examinations of financial statements mandated by law, verifying accuracy and adherence to regulations. Continuous auditing employs technology-enabled, real-time monitoring of transactions and controls to detect compliance issues promptly and support ongoing risk management. Explore deeper insights into how each auditing method enhances regulatory compliance and organizational governance.

Frequency

Statutory auditing typically occurs annually and involves a comprehensive review of financial statements to ensure compliance with legal and regulatory standards. Continuous auditing, on the other hand, utilizes real-time data analysis and monitoring techniques to provide ongoing assurance and immediate detection of anomalies throughout the fiscal period. Explore our detailed comparison to understand how audit frequency impacts financial oversight and risk management.

Reporting

Statutory auditing involves periodic evaluation of financial statements to ensure compliance with legal and regulatory standards, typically conducted annually. Continuous auditing employs real-time data analysis techniques to provide ongoing assessment and timely reporting of financial activities, enhancing the detection of anomalies and risks. Explore how continuous auditing transforms reporting accuracy and efficiency compared to traditional statutory audits.

Source and External Links

What is a Statutory Audit? - Vintti - This page explains that a statutory audit is a legally required review of a company's financial statements, ensuring accuracy and compliance with laws to protect stakeholders' interests.

Statutory audits demystified: what to expect & how to prepare - This article provides insights into the statutory audit process, including its benefits beyond compliance, such as enhanced credibility and improved internal controls.

Statutory vs Non-Statutory Audits: Key Differences - This article highlights the differences between statutory and non-statutory audits, focusing on legal compliance for statutory audits, especially for public companies and entities of a certain size.

dowidth.com

dowidth.com