Predictive close in accounting uses historical data and advanced analytics to forecast financial outcomes and accelerate period-end closing processes, enhancing accuracy and efficiency. Flash close delivers rapid financial reporting by significantly shortening the closing cycle, providing near real-time insights critical for timely decision-making. Explore the key differences and benefits of predictive close versus flash close to optimize your financial closing strategy.

Why it is important

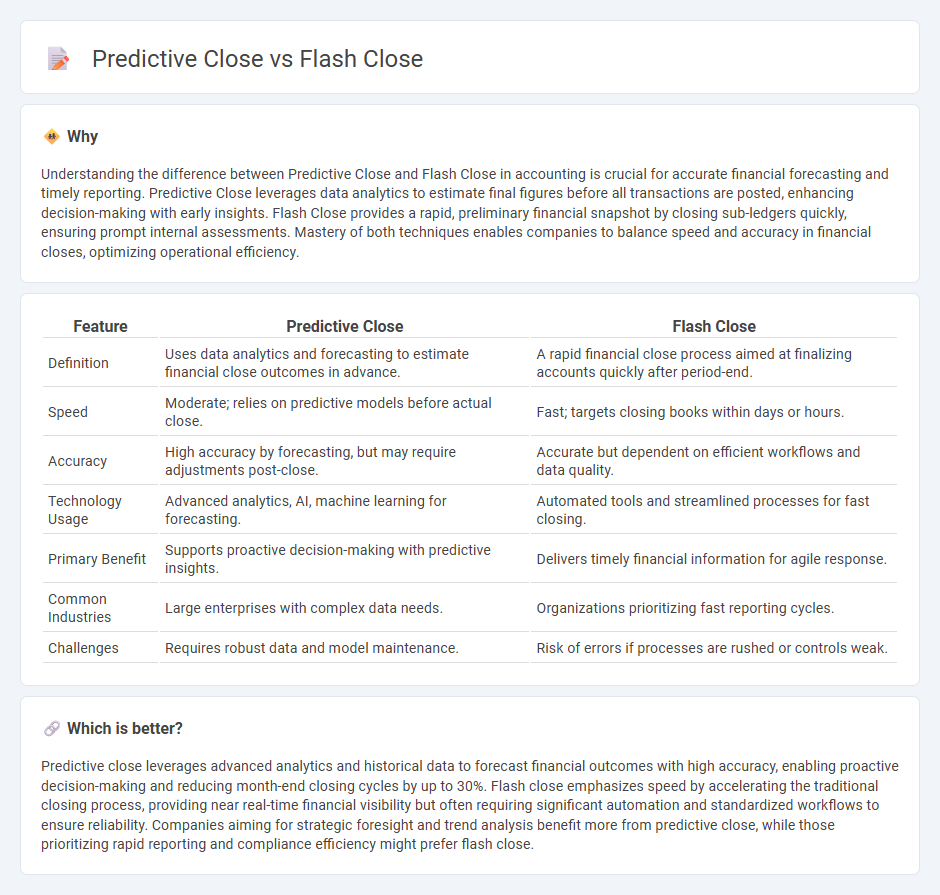

Understanding the difference between Predictive Close and Flash Close in accounting is crucial for accurate financial forecasting and timely reporting. Predictive Close leverages data analytics to estimate final figures before all transactions are posted, enhancing decision-making with early insights. Flash Close provides a rapid, preliminary financial snapshot by closing sub-ledgers quickly, ensuring prompt internal assessments. Mastery of both techniques enables companies to balance speed and accuracy in financial closes, optimizing operational efficiency.

Comparison Table

| Feature | Predictive Close | Flash Close |

|---|---|---|

| Definition | Uses data analytics and forecasting to estimate financial close outcomes in advance. | A rapid financial close process aimed at finalizing accounts quickly after period-end. |

| Speed | Moderate; relies on predictive models before actual close. | Fast; targets closing books within days or hours. |

| Accuracy | High accuracy by forecasting, but may require adjustments post-close. | Accurate but dependent on efficient workflows and data quality. |

| Technology Usage | Advanced analytics, AI, machine learning for forecasting. | Automated tools and streamlined processes for fast closing. |

| Primary Benefit | Supports proactive decision-making with predictive insights. | Delivers timely financial information for agile response. |

| Common Industries | Large enterprises with complex data needs. | Organizations prioritizing fast reporting cycles. |

| Challenges | Requires robust data and model maintenance. | Risk of errors if processes are rushed or controls weak. |

Which is better?

Predictive close leverages advanced analytics and historical data to forecast financial outcomes with high accuracy, enabling proactive decision-making and reducing month-end closing cycles by up to 30%. Flash close emphasizes speed by accelerating the traditional closing process, providing near real-time financial visibility but often requiring significant automation and standardized workflows to ensure reliability. Companies aiming for strategic foresight and trend analysis benefit more from predictive close, while those prioritizing rapid reporting and compliance efficiency might prefer flash close.

Connection

Predictive close leverages historical financial data and algorithmic forecasting to estimate end-of-period results, accelerating the accounting cycle. Flash close provides a rapid, preliminary financial statement shortly after period-end, relying on timely data inputs often generated through predictive modeling. Together, these approaches enhance the speed and accuracy of financial close processes by integrating data analytics with streamlined reporting.

Key Terms

Real-time data

Flash close accelerates the accounting close process by capturing real-time financial data, enabling faster decision-making and improved operational efficiency. Predictive close leverages advanced analytics and machine learning models to forecast financial outcomes, enhancing accuracy and proactive management of closing activities. Explore how integrating real-time data with predictive close strategies can transform your financial close process.

Forecasting algorithms

Flash Close leverages real-time data processing and machine learning algorithms to expedite financial reporting by generating near-instantaneous forecasts, minimizing the lag between period-end and financial close. Predictive Close utilizes advanced forecasting models such as time series analysis, regression techniques, and artificial intelligence to anticipate potential discrepancies and optimize the accuracy of financial statements ahead of the actual close. Explore deeper insights into these forecasting algorithms to enhance financial reporting efficiency and accuracy.

Financial reconciliation

Flash close accelerates financial reconciliation by delivering preliminary financial statements shortly after the accounting period ends, enabling quicker error detection and corrections. Predictive close leverages advanced analytics and forecasting models to estimate financial outcomes before period-end data is finalized, promoting proactive decision-making. Explore the detailed methodologies of Flash close and Predictive close for enhanced financial reconciliation.

Source and External Links

Flash Close Operation Tutorial (Web) - Flash Close helps users place orders with top 30 optimal prices based on BBO price orders to quickly close positions.

Flash Close - MEXC Exchange - Flash Close allows users to close all positions at once based on the market price, though it may not be fully filled in extreme market conditions.

Sign your closing docs in advance with FlashClose - FlashClose allows borrowers to electronically sign loan closing documents in advance, reducing time at the closing table.

dowidth.com

dowidth.com